PHOTO

ABU DHABI — Klickl, a regulated Web3 financial services provider based in the UAE, has signed a landmark tripartite Memorandum of Understanding (MOU) with Mainland China’s leading digital bank, WeBank, and Hong Kong’s innovation conglomerate, Goldford Group. The collaboration aims to establish a cross-regional fintech innovation alliance spanning Mainland China, Hong Kong, and the Middle East—ushering in a new phase of digital economic cooperation.

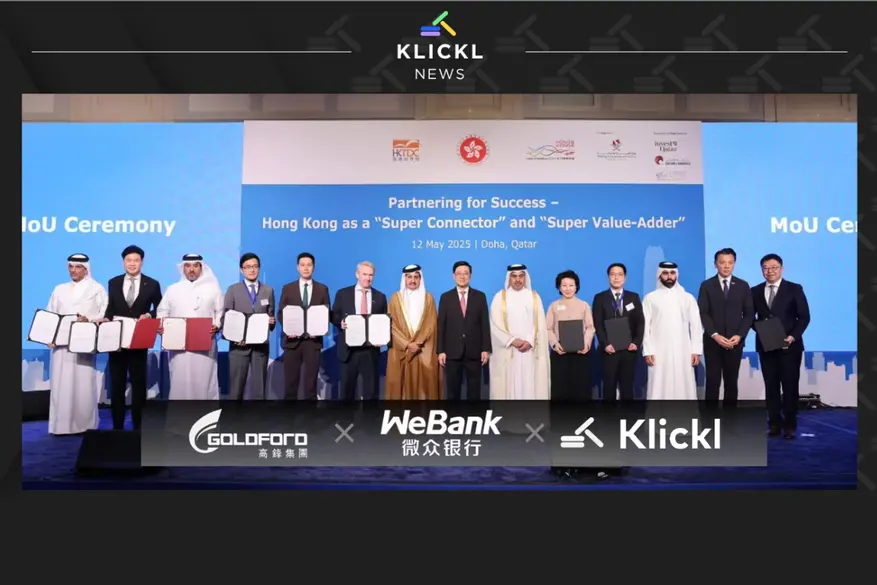

The signing took place as part of a broader economic dialogue catalyzed by the official visit of a high-level delegation from Hong Kong and Mainland China to Qatar, led by Hong Kong Chief Executive John Lee. The mission included top officials such as the Financial Secretary and senior representatives from the Financial Services and Treasury Bureau, alongside more than 30 enterprise delegates, reflecting a shared interest in advancing strategic cooperation in digital finance, AI, and infrastructure development across the Gulf region.

At the ceremony, Klickl UAE CEO Dermot Mayes, Goldford Group representative and Legislative Council member Dr. Duncan Chiu, and senior executives from WeBank formally sealed the agreement—positioning the three parties to co-develop financial infrastructure across blockchain, AI, and quantum technologies.

A Strategic Tri-Regional Collaboration Framework

With growing regional momentum toward digital transformation, this partnership represents the first structured initiative of its kind to link fintech ecosystems across the Greater Bay Area and the Middle East. Klickl brings its compliance-first Web3 financial capabilities and deep understanding of the Gulf regulatory landscape; WeBank contributes leading financial technology from Mainland China; and Goldford Group offers integration strength across Hong Kong’s tech innovation ecosystem.

The alliance will jointly pursue six core areas of cooperation:

- Blockchain & AI Incubation Platform

- Startup Acceleration Across Asia–MENA

- Next-Gen Financial Services for Cross-Border Use Cases

- Digital Transformation for Legacy Financial Institutions

- Localized Fintech Deployment for Gulf Markets

- Quantum Technology Exploration in Financial Applications

Klickl’s Institutional Role: Bridging Regulation, Markets, and Innovation

“This partnership is more than symbolic—it is strategic,” said Michael Zhao, Founder and CEO of Klickl. “As the only homegrown Web3 financial services provider in the region, we are proud to help bridge capital, compliance, and technology across three economic hubs. This alliance reflects not only our infrastructure readiness, but also the trust we’ve built with institutions across Asia and the Middle East.”

Klickl’s institutional credibility is backed by its status as a policy-aligned fintech entity, having participated in recent sovereign economic missions to Malaysia, Poland, and Japan. Its regulatory licensing through ADGM (FSP) and VASP registration in the European Union positions Klickl to operate across key financial jurisdictions, providing end-to-end Web3-native solutions including digital wallets (Klickl4U), institutional accounts (KlicklONE), payment rails (KlicklPay), stablecoin services, asset custody, and trading infrastructure.

Outlook: A New Financial Corridor Connecting East and Gulf

As Hong Kong amplifies its engagement in the Middle East and the UAE accelerates its digital economy agenda, Klickl stands uniquely positioned to anchor multi-regional collaboration. The signing of this MOU is a pivotal step in its international growth, and a signal of the convergence between policy, fintech, and decentralized infrastructure.

The company remains committed to co-building the next generation of global Web3 financial infrastructure—designed for compliance, optimized for interoperability, and aligned with institutional-grade trust.

For more information, visit: www.klickl.com

Contact:

Ivy Bak

Chief of Marketing and Operations

marketing@klickl.com