PHOTO

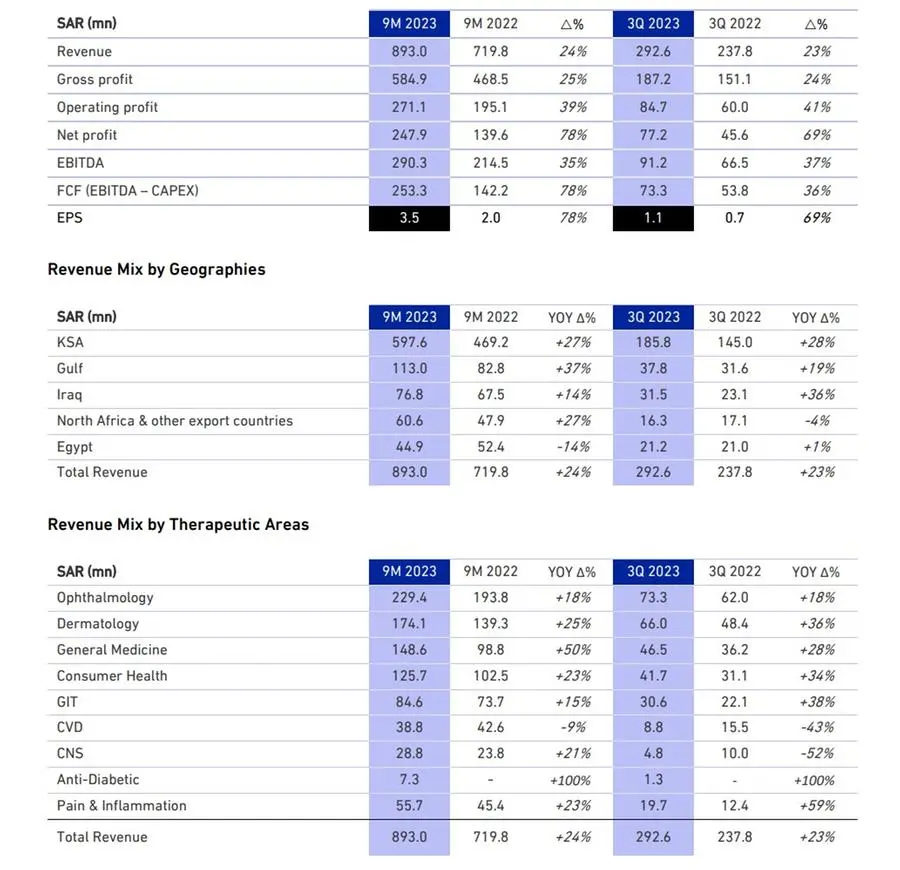

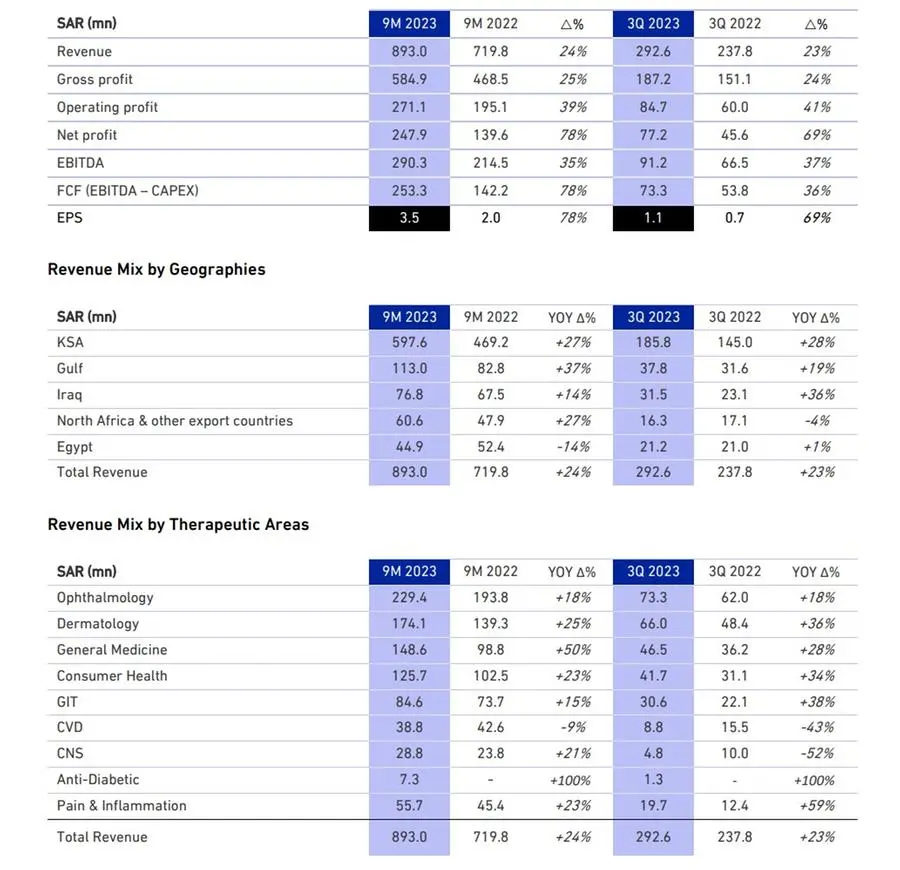

9M 2023 Financial Highlights:

- Revenue growth of 24.1% YoY to SAR 893.0 million

- Gross profit of SAR 584.9 million, with gross margins expanding 40bps YoY to 65.5%

- EBITDA margin expanded 2.7ppts YoY to 32.5% with EBITDA rising to SAR 290.3million

- Net profit grew by 77.6% to SAR 247.9 million, with net margin expanding by 8.4ppts to 27.8%

- Free cash1 flow conversion of 87.3%, with a cash position of SAR 93.2 million as at 30 September 2023

Jeddah – Jamjoom Pharma reported a strong set of results with 77.6% YoY growth in net profit to SAR 247.9 million for 9M 2023. This strong performance was driven by revenue growth of 24.1% to SAR 893.0 million and operating profit margin expansion by 3.3ppts YoY on higher efficiencies in production and operating expenses. EBITDA of SAR 290.3 million for 9M 2023 was up 35.3% YoY, while EBITDA margin improved by 2.7ppts to 32.5%. Following the conclusion of the investment cycle for two new production facilities, CAPEX in 9M 2023 reduced by 48.8% year on year to SAR 37.0 million, which resulted in 21.0ppts increase of FCF conversion ratio to 87.3% and 78.1% growth of FCF to SAR 253.3 million.

Dr. Tarek Hosni, Chief Executive Officer of Jamjoom Pharma, commented on 9M 2023 results: “Jamjoom Pharma delivered a strong performance in 9M 2023, with revenue rising 24.1% to SAR 893.0 million driven mainly by volume growth, supported by price increases and new product launches. EBITDA rose to SAR 290.3 million and our industry-leading EBITDA margin expanded further to 32.5%. While our top five brands continue to witness double-digit sales growth, we have added 10 new brands to the portfolio since the beginning of the year, including 3 brands in 3Q 2023.

Another key milestone achieved during this quarter is that the new Egypt production facility is now operational. Furthermore, we expect the launch of the Jeddah Sterile facility within the coming months.

Additionally, our recent investment in Algeria, signifies our commitment to deepen our footprint in North Africa. The acquisition of this facility from Sandoz has paved the way for introducing innovative products tailored to the Algerian market, and we are enthusiastic about the potential growth opportunities that lie ahead.

Our people continue to be the cornerstone of our achievements. Their dedication and resilience drive our progress forward. We are grateful for their commitment and their leadership.

Our strategic efforts are yielding positive results. As we witness momentum across our business areas and see our regional expansion progressing, we are confident in our capacity to bring local solutions to MEA healthcare markets and deliver consistent value to our stakeholders.”

1 Calculated as EBITDA minus CAPEX

Performance Highlights

Income Statement Summary

Revenue Trends

Revenue for 9M 2023 grew 24.1% year-on-year to SAR 893.0 million on the back of volume growth, price increases and new brand launches.

KSA revenues increased by 27.4% YoY principally driven by sales volume growth and price increases. In exports, revenues in the Gulf region showed the highest growth by 36.5%, while exports to North Africa recorded a 26.5% increase. Egypt revenues declined by 14.3% to SAR 44.9 million for 9M 2023, driven by the devaluation of the Egyptian pound despite an 18.5% increase in the number of units sold in Egypt. We expect to see a continued recovery in the region during the coming quarters, as we ramp up production in the new Egypt facility.

In 3Q 2023, Jamjoom Pharma added three new brands to the portfolio to take the total number of brands to 131. 9M 2023 Revenue growth was driven by Jamjoom Pharma’s solid growth in its Dermatology, General Medicine, and Consumer Health therapeutic categories. The company enjoys leadership positions in Ophthalmology (#1) and Dermatology (#2), which allows Jamjoom Pharma to gain additional production efficiencies and generate favorable margins. Anti-Diabetic brands - launched at the beginning of 2023 generated SAR 7.3 million of revenue.

Jamjoom Pharma’s top 5 brands contributed SAR 254.0 million (27.7% of total revenue) to the top line during 9M 2023. New launches added SAR 19.7 million to revenue. Meanwhile, price increases obtained on several products in the first nine months of the year increased revenue by SAR 34.7 million (20.1% contribution to revenue growth).

Cost Trends and Margins

9M 2023 cost of sales increased by 22.6% against 24.1% revenue growth, resulting in a 40bps expansion of gross profit margin to 65.5%. This was achieved despite raw material expenses increasing by 26.6% for the period on the back of increased production. Cost discipline along with a high-capacity utilization ratio resulted in a lower cost per unit.

Non-production operating expenses (which include R&D, Selling and Distribution (S&D) and General and Administrative (G&A)) increased by 12.9% YoY in 9M 2023, which is visibly below revenue growth. This was achieved due to decent cost discipline and the focus on optimizing operations and work force. S&D expenses increased by a modest 12.1% YoY due to the removal of distributor’s commission for a key distributor at the end of 2022.

Finance costs declined by 94.6% year-on-year in 9M 2023 to a marginal SAR 2.3 million. The decline was mainly due to the absence of a one-off, non-cash EGP devaluation impact from last year after conversion of the Company’s loan to its Egyptian subsidiary to an equity instrument in 4Q 2022. This contributed to an improvement in net profit after zakat and income tax for 9M 2023 of 77.6% year-on-year to SAR 247.9 million.

CAPEX and Cash Flows

With the completion of the investment cycles for the upcoming Egypt main facility and Jeddah sterile facility, capital expenditures in 9M 2023 of SAR 37.0 million was 48.8% below spending in 9M 2022.

The CAPEX reduction boosted the FCF2 which increased by 78.1% YoY to SAR 253.3 million thereby bringing the FCF conversion to 87.3% for 9M 2023

Working capital increased by 25% YoY in 9M 2023, driven by revenue expansion. The LTM (last twelve months) cash conversion cycle was broadly flat YoY at 271 days. Optimization of the cash conversion cycle remains an area of focus.

As at the end of 9M 2023, Jamjoom Pharma’s cash position reduced to SAR 93.2 million due to dividends payout and investment in its Algerian joint venture.

2 Calculated as EBITDA-CAPEX

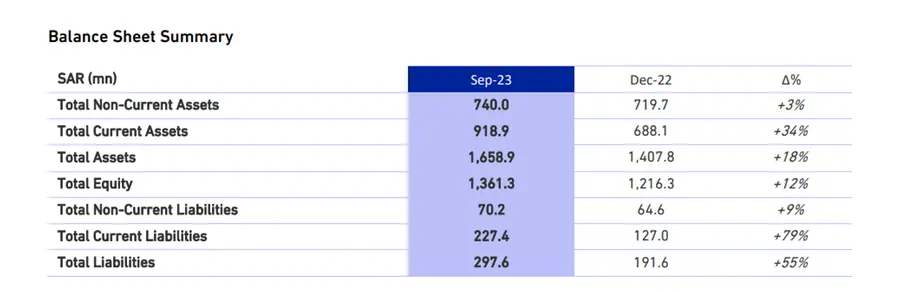

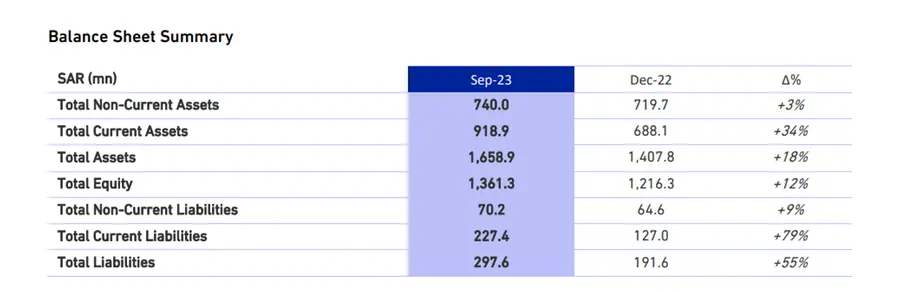

Non-current assets increased by 2.8% due to the investment in the company’s Algerian joint venture.

Current assets increased by 33.5% during 9M 2023 mainly due to increase in receivables and inventory due to revenue growth and increase in capacity utilization.

Shareholders’ equity went up 11.9% due to the net profit for the nine months, which was offset by the foreign currency translation reserve and interim dividends paid during the year 2023.

Current liabilities increased by 79.1% during the 9M 2023, resulting from an increase in trade and other payables in line with business growth as well as an increase in the Zakat provision for the period.

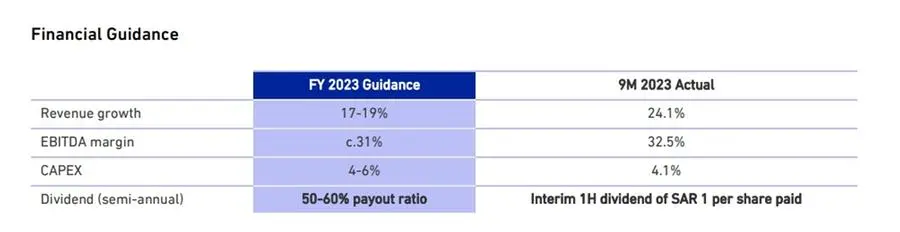

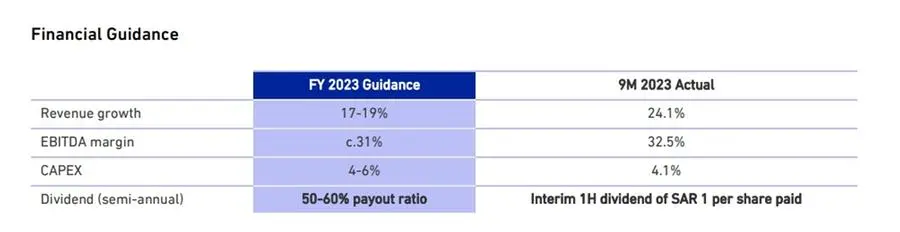

Outlook and Guidance

Jamjoom Pharma is a leading Middle East Africa (MEA) pharmaceutical manufacturer operating in a large and expanding market. The company’s management remains confident in the near-term outlook for the company and reiterate their previously upgraded guidance as detailed below:

Dividend (semi-annual) 50-60% payout ratio Interim 1H dividend of SAR 1 per share paid

In the longer term the company intends to continue to expand within the MEA region and aims to enter selected additional markets in the coming years, in line with its vision to become a leading MEA organization by 2026 through consistently providing affordable, high-quality healthcare solutions.

Additional Information

The 9M 2023 financial statements, earnings release, earnings presentation and financial data supplement will be made available on the website of Jamjoom Pharma at: investors.jamjoompharma.com Please contact the company at:

Jamjoom Pharmaceuticals Factory Company

Al-Hamra Dist, Corniche Road

P.O. Box: 6267 | Jeddah 21442, Saudi Arabia

Website: www.jamjoompharma.com

E-mail: jpharma@jamjoompharma.com

Investor Relations Contact

Muhammad Bin Khalid | Head of Investor Relations

IR@jamjoompharma.com