PHOTO

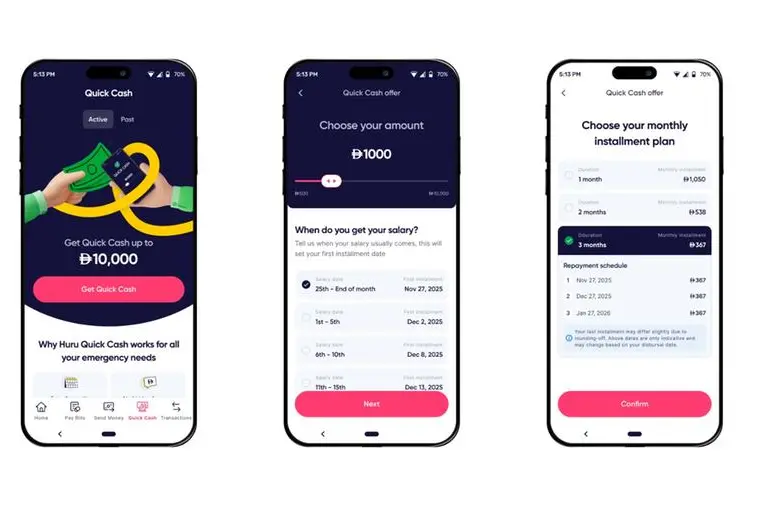

Dubai, United Arab Emirates: Huru, the UAE’s homegrown, Central Bank–licensed fintech platform dedicated to advancing financial access for unbanked and underbanked communities, has announced the launch of Quick Cash, an instant microfinance solution developed in partnership with Mawarid Finance. The new feature strengthens Huru’s mission to provide transparent, empowering, and affordable financial tools to individuals who have historically faced barriers to mainstream banking.

Since launch, Huru has focused on building a comprehensive ecosystem designed around financial inclusion, from instant zero-balance IBAN accounts and Visa ATM cards, to bill payments, in-app remittances, and Saving Pots that help communities better manage, move, and grow their money. Quick Cash now becomes the next milestone in this mission, extending Huru’s commitment to delivering essential financial tools via a trusted, homegrown platform.

The launch also comes at a timely moment for the UAE, following the Central Bank’s updated framework that broadens eligibility for personal lending. The shift enables solutions like Quick Cash to play a meaningful role in advancing the country’s financial inclusion goals by offering regulated, responsible access to short-term finance for those who have long been underserved.

Designed specifically for the day-to-day realities of unbanked and underbanked communities, Quick Cash provides immediate access to up to AED 10,000, with repayment through monthly installments at low and transparent mark up fees. Funds are disbursed instantly, and repayments are deducted automatically from users’ Huru salary accounts, supporting responsible borrowing while reducing the need for employers to process frequent salary advance requests.

“At a time when the United Arab Emirates is expanding pathways to financial access, Quick Cash offers a practical and reliable solution for individuals who have long faced barriers to credit solutions,” said Abhimanyu Girotra, Chief Executive Officer of Huru. “Our aim is to provide transparent and empowering financial tools that strengthen resilience and create opportunity for individuals who contribute meaningfully to the country’s progress.”

Quick Cash is powered by Huru’s data-driven eligibility model, which reviews self-declared information, salary inflows, spending patterns, and alternative data inputs. These insights feed into Huru’s machine-learning underwriting engine, enabling accurate, responsible, and inclusive microfinance decisions that prioritise long-term financial wellbeing.

Through its partnership with Mawarid Finance, a leading provider of Sharia-compliant financial services, Quick Cash is delivered with full regulatory alignment and strong ethical finance standards.

“At Mawarid Finance, we are committed to offering fair and accessible financial solutions,” said Rashid Al Qubaisi, Chief Executive Officer of Mawarid Finance. “Collaborating with Huru allows us to combine innovation with financial integrity and introduce a responsible microfinance model that reflects the vision of the United Arab Emirates for a more inclusive financial environment.”

Beyond supporting individuals, Quick Cash offers meaningful advantages for employers. By reducing the need for salary advances, the solution eases administrative pressure while strengthening employee financial security, morale, and retention, key contributors to organisational stability.

The launch of Quick Cash underscores the shared commitment of Huru and Mawarid Finance to close financial accessibility gaps through technology, ethical finance, and user-centred design, ensuring that every individual, regardless of income level, credit history, or traditional banking access, can participate confidently in the UAE’s evolving financial ecosystem.

For more information, please visit https://www.huru.co/

About Huru:

Huru is a homegrown UAE fintech company licensed by the Central Bank of the UAE. Founded in 2022, Huru serves as a one-stop money management app for the country’s unbanked and underbanked communities. The platform provides innovative features such as instant zero-balance IBAN accounts, a free digital and physical Visa ATM card, in-app remittances, bill payments, and saving tools that enable users to retain and grow more of their earnings. Now expanding into tailored credit products, Huru is committed to building transparent, accessible, and impactful financial solutions for those who form the backbone of the UAE’s workforce.

About Mawarid Finance:

Mawarid Finance, regulated by the Central Bank of the UAE, has evolved into a leading catalyst for fintech-driven, Shariah-compliant financial innovation in the region. Building on its core strengths in financing and cards, Mawarid combines responsible finance with cutting-edge digital solutions, offering ethical, transparent, and accessible products that power individuals, SMEs, and fintech ecosystems. By embedding its services into partner platforms and enabling new digital business models, Mawarid is turning its core business into a launchpad for the next generation of financial experiences.

For more information, please visit https://www.mawarid.ae/en/