Kuwait – Kuwait Financial Centre “Markaz” released its research report titled “Initial Public Offerings (IPO) in the GCC markets”, which raised total proceeds of USD 3.5 billion through 12 offerings during the first three months of 2023, marking a year-on-year decline in value by 25% compared to the first quarter of 2022, where issuers raised USD 4.6 billion through 13 offerings.

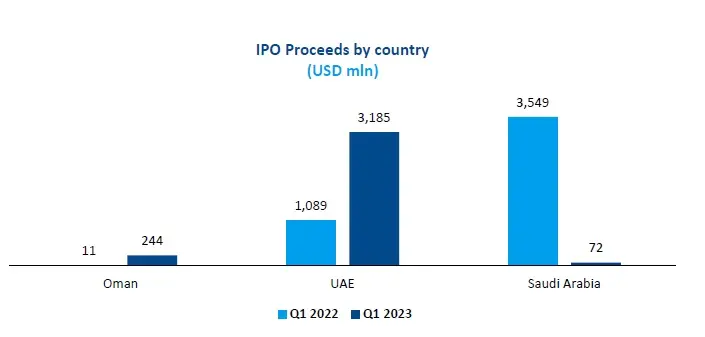

Geographical Allocation:

Markaz’s report stated that the UAE led the region in terms of IPO proceeds in Q1-2023, raising a total of USD 3.2 billion from 3 offerings and recording an increase of 192% in value compared to Q1-2022. UAE offerings constituted 91% of total GCC IPO proceeds in Q1-2023. Abu Dhabi Securities Exchange (ADX) witnessed the highest proceeds with USD 3.0 billion through the offerings of ADNOC Gas and Presight AI. UAE offerings that were listed on the Dubai Financial Market (DFM) raised a total of USD 0.2 billion from one IPO, which is Al Ansari Financial Services. Muscat Securities Market (MSM) witnessed 1 IPO with total proceeds of 244 million, constituting 7% of total GCC IPO proceeds raised during the first three months of 2023. The Saudi Exchange (Tadawul) witnessed 8 initial public offerings in Q1-2023 that generated total proceeds of USD 72 million, constituting 2% of total GCC IPO proceeds. This represents a drop of 98% year-on-year in value when compared to proceeds raised by Saudi IPOs in Q1-2022.

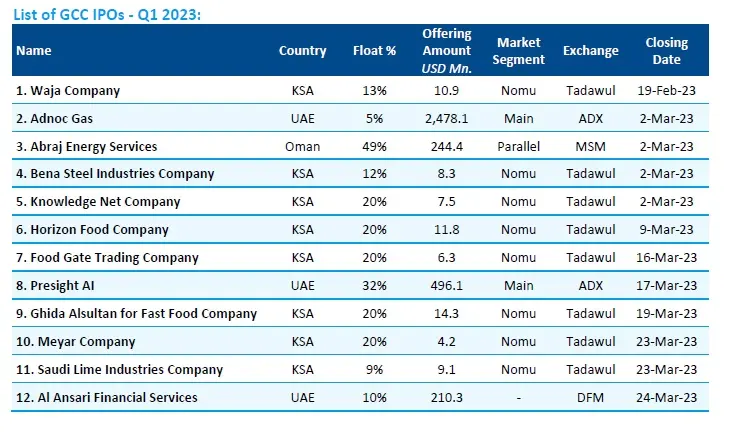

Top 5 GCC IPOs by Proceeds during Q1-2023:

Markaz’s report highlights the top 5 GCC IPOS by proceeds during Q1-2023. Abu Dhabi National Oil Company gas business, ADNOC Gas, has raised USD 2.5 billion in proceeds marking the largest IPO on ADX and surpassing Borouge, which raised USD 2.0 billion in June 2022. ADNOC Gas offered 3.84 billion shares, or 5% stake, which was covered more than 50 times. ADNOC Gas IPO proceeds constituted 71% of total GCC IPO proceeds in Q1-2023.

Presight AI IPO raised a total of USD 496 million in proceeds through the sale of 1.35 billion shares, or 32% stake, with total demand of investors which reached 136 times. Presight IPO constituted 14% of total GCC IPO proceeds during Q1-2023.

Oman’s state energy company OQ raised a total of USD 244 million from the IPO of its oil-drilling unit, Abraj Energy Services, pulling off Muscat’s largest listing in more than a decade. The company floated 377.4 million shares, or 49% stake, with a coverage ratio of 8.7 times. Abraj Energy Services IPO proceeds constituted 7% of total GCC IPO proceeds in Q1-2023.

UAE-based exchange house Al Ansari Financial Services raised a total of USD 210 million in its IPO which offered 750 million shares, or 10% stake, with a coverage ratio of 44 times. Al Ansari Financial Services IPO proceeds constituted 6% of total GCC IPO proceeds in Q1-2023.

Ghida Al-Sultan for Fast Food Company raised a total of USD 14.3 million through offering 640 thousand shares, or 20% of its capital, on Nomu with demand that covered the offering 1.1 times. Ghida Al-Sultan IPO proceeds constituted 0.4% of total GCC IPO proceeds in Q1-2023.

GCC IPO Pipeline:

Tadawul received 100 listing applications until mid-February 2023 and 23 firms obtained final approval for listing. Saudi Arabia’s First Mills Company is planning to float 16.65 million shares, or 30% of its share capital, in an IPO that could value the company at as much as USD 1 billion. Al Mawarid Manpower Company intends to offer 4.5 million shares, or 30% of its capital, on Tadawul in May. Lumi Rental Company obtained CMA approval to offer and list 16.5 million shares, or 30% of its share capital, on Tadawul. The UAE is also expecting 11 IPOs in 2023 with ADNOC planning to float its marine and logistics subsidiary in the coming months. Oman’s OQ Gas Network is preparing for a public share sale that could take place as early as June. OQ could raise more than USD 500 million.

-Ends-

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.154 billion as of 31 December 2022 (USD 3.77 billion). Markaz was listed on the Boursa Kuwait in 1997. Over the years, Markaz has pioneered innovation through the creation of new investment channels. These channels enjoy unique characteristics, and helped Markaz widen investors’ horizons. Examples include Mumtaz (the first domestic mutual fund), MREF (the first real estate investment fund) and Forsa Financial Fund (the first and only options market maker in the GCC since 2005), all conceptualized, established and managed by Markaz.

For further information, please contact:

Sondos S. Saad

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: ssaad@markaz.com