PHOTO

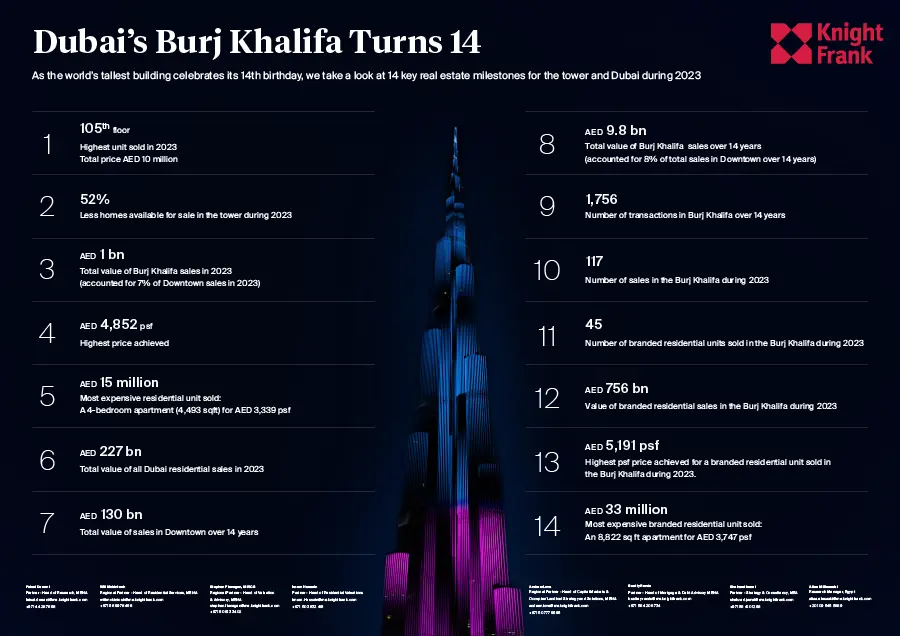

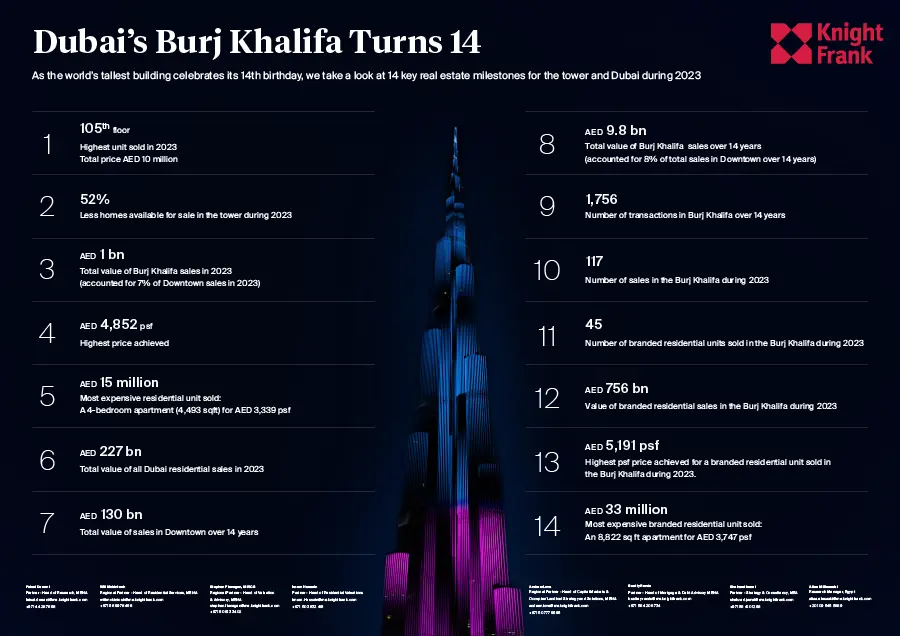

DUBAI: The total number of homes available for sale in Dubai’s Burj Khalifa declined by 52% during 2023, reflecting the growing number of long term investors and genuine end users, according to analysis carried out by global property consultant Knight Frank to mark the 14th anniversary of the world’s tallest building.

Despite the fall in the number of homes available for sale, the total number of deals in the tower during 2023 rose by 22% to 117 sales. Knight Frank says the world’s tallest building continues to enjoy robust demand, mirroring the rest of Dubai. Indeed, with 117 apartment and branded residence sales in 2023, totalling over AED 1.06 billion, the Burj Khalifa accounted for 7% of all sales in Downtown, which amounted to AED 14.6 billion.

Faisal Durrani, Partner - Head of Middle East Research, MENA, explained: “Dubai’s emergence as a second homes hub and crowning as the world’s busiest US$ 10 million plus homes market has fuelled a relentless wave of international buyers, many of whom have been targeting the emirate’s most expensive homes in the city’s most desirable neighbourhoods. This extraordinary level of demand has been the catalyst behind the 38% increase in average city-wide prices since March 2021. The Burj Khalifa has outperformed the rest of the city, with prices growing by 55.4% over the same period.

“Dubai’s property market is very much in an emergent phase and identifying signs of maturity can be challenging. That said, the 52% fall in the number of homes available for sale in the tower underscores Dubai’s repositioning as a hub for second home buyers and genuine end users. Owners are clearly deciding to hold on to their homes for longer, with inventory levels falling sharply, signalling the longer-term residency mindset now bedding in. Unsurprisingly, this behaviour has helped to sustain price growth in the tower, with the most expensive home sold this year trading for 140% more than 2022.”

Knight Frank’s analysis has shown that the most expensive apartment sold this year at the Burj Khalifa was priced at AED 4,852 per square foot, 20% more than 2022’s priciest sale of AED 4,044 per square foot.

The magnetic attraction of the world’s tallest building to potential buyers is best reflected in the fact that since opening 14 years ago, the tower has accounted for AED 9.8 billion of home sales, or 8% of the value of all sales in Downtown since 2010.

Away from the Burj Khalifa, prime residential values in Dubai, which encompass the neighbourhoods of the Palm Jumeirah, Emirates Hills and Jumeirah Bay Island, have experienced record growth during 2023, albeit this has been from a low base, Knight Frank says. Furthermore, Knight Frank’s 2024 global prime residential markets forecast positions Dubai in third place at 5%. This comes hot on the heels of an estimated 16% rise in prime residential prices in 2023.

Despite this, prime prices stand at approximately AED 3,740 per square foot, or around US$ 1,020 per square foot, making Dubai one of the world’s most ‘affordable’ luxury homes markets.

While Downtown Dubai is not classed as prime neighbourhood by Knight Frank, the submarket registered 4 home sales above the exclusive US$ 10 million+ mark, two of which were in Emaar’s The Address Residence Sky Views.

In reference to the enduring appeal of Downtown Dubai, Will McKintosh, Regional Partner – Head of Residential, MENA, said: “Downtown Dubai sits at the heart of the city’s most desirable submarkets and our research shows that it is in fact the most sought-after location for residential real estate in Dubai by international high-net-worth-individuals.

“With the main city-core now encompassing Downtown, Business Bay and the wider-DIFC, we are seeing developers move to capitalise on the high level of demand for homes in this area. Branded residential operators are clustering in Business Bay, offering one-of-a-kind homes, under the management of new-to-the-region brands, which is helping to cement Dubai’s status as the city with the highest concentration of branded residential operators. Pockets of Business Bay, stretching from Marasi Drive to Safa Park, are becoming a particular hotspot. The DIFC too, with its recently launched DIFC Living project, is experiencing record levels of demand. Indeed, the 164 homes launched at DIFC Living sold-out in a matter of minutes.”

About Knight Frank:

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, the Knight Frank network has 487 offices across 53 territories and more than 20,000 people The Group advises clients ranging from individual owners and buyers to major developers, investors, and corporate tenants. For further information about the Firm, please visit www.knightfrank.com.

In the MENA region, we have strategically positioned offices in key countries such as the United Arab Emirates, Saudi Arabia, Bahrain, Qatar, and Egypt. For the past 13 years, we have been offering integrated residential and commercial real estate services, including transactional support, consultancy, and management.

Understanding the unique intricacies of local markets is at the core of what we do, we blend this understanding with our global resources to provide you with tailored solutions that meet your specific needs. At Knight Frank, excellence, innovation, and a genuine focus on our clients drive everything we do. We are not just consultants; we are trusted partners in property ready to support you on your real estate journey, no matter the scale of your endeavour.

For all Media and PR inquiries, please contact:

Roksar Kamal, Press Manager

Roksar.kamal@me.knightfrank.com

Let's connect socially - find us on LinkedIn, Instagram, and Twitter. For more information and to explore how we can be your partners in property, please visit our website at https://www.knightfrank.ae