PHOTO

Dubai: The Dubai Financial Market (DFM), Nasdaq Dubai, and Shanghai Stock Exchange (SSE) announced the signing of a Memorandum of Understanding (MoU) to further strengthen the ties between the capital markets of Dubai and China. This partnership marks a significant milestone in cross-border collaboration.

The partnership not only facilitates the exchange of knowledge, expertise, and information between DFM, Nasdaq Dubai and Shanghai Stock Exchange (SSE), but also aims to enhance efficiency and transparency in both markets. Moreover, focusing on products relevant to both markets, it will facilitate joint product development, such as Index and ETFs, as well as the creation of ESG and sustainability-linked products.

As part of the strategic alignment to meet the evolving needs of both market participants, DFM and Shanghai Stock Exchange will jointly explore to develop products, introduce companies and issuers to the advantages of each market and provide them with access to growth opportunities and services.

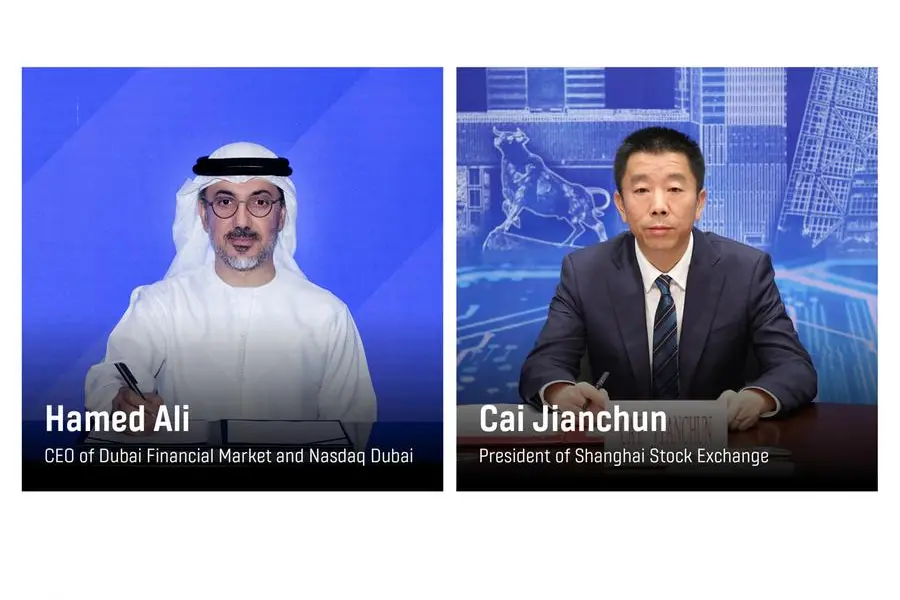

Hamed Ali, CEO of Dubai Financial Market and Nasdaq Dubai, remarked, "The partnership with the Shanghai Stock Exchange (SSE) marks a significant step in strengthening our international ties and fostering cooperation in key areas of our capital markets development. This partnership opens doors to exploring new opportunities and expanding our market reach."

He added, "In an evolving financial landscape, global collaboration is paramount. Together with Shanghai Stock Exchange, we aim to bring the best practices and expertise from both sides, unlocking new horizons for market participants and fortifying the growth of our financial ecosystems."

Cai Jianchun, President of Shanghai Stock Exchange, said, “We are pleased to establish partnership with DFM and announce our MoU signing to explore potential opportunities in corss-listing, indices, ETFs, ESG and other areas. We look forward to working closely with DFM to advance product cooperation and further strengthen the cooperation between two markets. Next, under the guidance of our regulator, China Securities Regulatory Commission, SSE will further deepen the high-standard opening-up to the world and continue to explore a diversified cooperation mechanism with stock exchanges in the Middle East region, to strengthen bilateral cooperation, explore multilateral cooperation, continuously enrich and deepen cooperation format.”

About Dubai Financial Market:

Dubai Financial Market (DFM) was established as a public institution with its own independent corporate body. DFM operates as a secondary market for the trading of securities issued by public shareholding companies, bonds issued by the Federal Government or any of the local Governments and public institutions in the country, units of investment funds and any other financial instruments, local or foreign, which are accepted by the market. The DFM commenced operations on March 26, 2000 and became the first Islamic Shari’a-compliant exchange globally since 2007. Following its initial public offering in November 2006, when DFM offered 1.6 billion shares, representing 20 per cent of its paid-up capital of AED 8 billion, DFM became a public joint stock company, and its shares were listed on 7 March 2007 with the trading symbol (DFM). Following the IPO, the Government of Dubai retained the remaining 80 per cent of DFM Company through Borse Dubai Limited. www.dfm.ae

For further information, please contact:

Noora Al Soori

Communications and Public Relations

Dubai Financial Market

E: nalsoori@dfm.ae

Shruti Choudhury Shraddha Sundar

Account Director Account Manager

Edelman Smithfield Edelman Smithfield

E: dfmedelmansmithfield@edelman.com E: dfmedelmansmithfield@edelman.com

About Nasdaq Dubai:

Nasdaq Dubai is the international financial exchange serving the region between Western Europe and East Asia. It welcomes regional as well as global issuers that seek regional and international investment. The exchange currently lists shares, derivatives, Sukuk (Islamic bonds), conventional bonds and Real Estate Investment Trusts (REITS). The majority shareholder of Nasdaq Dubai is Dubai Financial Market with a two-thirds stake. Borse Dubai owns one third of the shares. The regulator of Nasdaq Dubai is the Dubai Financial Services Authority (DFSA). Nasdaq Dubai is located in the Dubai International Financial Centre (DIFC).

About Shanghai Stock Exchange:

Under the supervision and guidance of the China Securities Regulatory Commission, Shanghai Stock Exchange (SSE) was established on November 26, 1990, and started operations on December 19 of the same year. SSE is a membership legal entity that provides venues and facilities for centralized securities trading, organizes and supervises securities trading, and implements self-discipline management. After more than 30 years of development, SSE has grown into a comprehensive, open and service-oriented exchange. With a complete market structure, SSE provides products of stocks, bonds, funds and derivatives; has trading systems and communications infrastructure which can support the efficient and stable operation of the Shanghai securities market; and has an effective self-regulatory system which can ensure the regulated and orderly operation of the Shanghai securities market. At present, SSE has become the third largest securities exchange in the world and one of the most active securities exchanges in the world. As the end of 2022, SSE ranked 3rd and 1st respectively in terms of total market capitalization and capital raised in the world.

http://english.sse.com.cn/