PHOTO

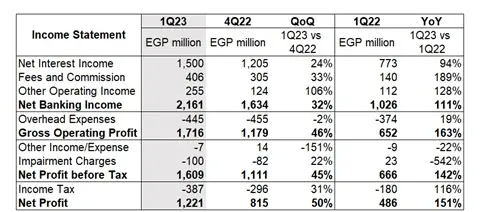

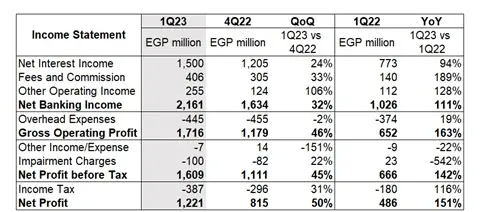

- Net Profit of EGP 1,221 million, up 151% Year-on-Year;

- Customer Deposits reached EGP 67.9 billion, up 39% Year-on-Year;

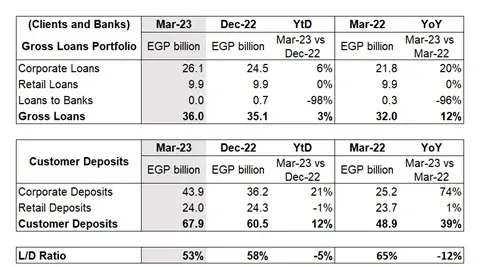

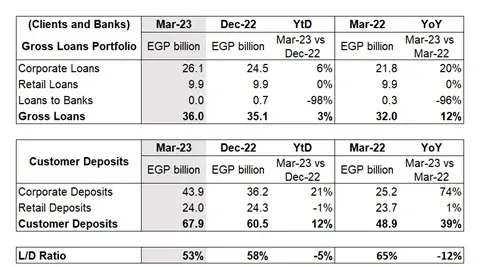

- Gross Loans reached EGP 36.0 billion, up 12% Year-on-Year;

- Current and Saving accounts to Total Deposits reached 63.7% up by 1281 bps Year-on-Year;

- Good and Resilient quality of assets, Non-performing Loans ratio at 2.8%;

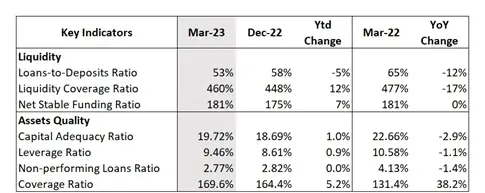

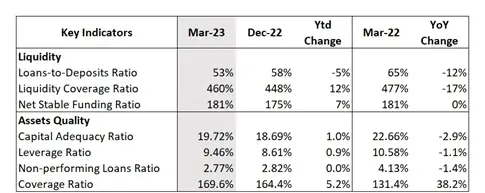

- Loans-to-Deposit Ratio at 53% down 12% Year-on-Year driven by increase in deposits and EGP devaluation;

- Resilient capital structure, Capital Adequacy ratio of 19.72%;

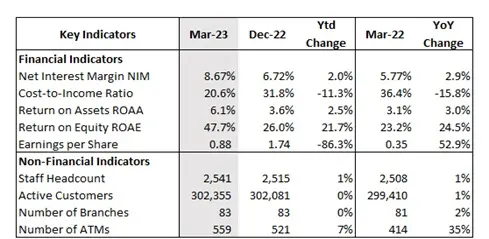

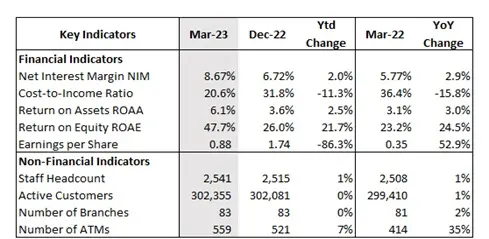

- Return on Average Assets of 6.1% and Return on Average Equity of 47.7%;

Economic Dynamics:

On the global front inflation has shown signs of slowing down from the peaks through eased international commodity prices though outlook on prices and economic growth remains uncertain due to effects of the recent financial sector evolutions, continuation of conflict between Russia/Ukraine and removal of COVID restrictions in China.

On the domestic front, inflationary pressures persist, making a historical high in February 2023 (core at 40.3%) driven by local supply chain disruptions, further depreciation of the EGP, surplus EGP liquidity and demand side pressures as evidenced by developments in real economic activity relative to potential capacity.

The CBE responded by raising key policy rates by 200 bps at the end of Q1 2023, further tightening the monetary stance with the aim of anchoring inflation expectations.

Crédit Agricole Egypt: Record performance continues despite challenging environment

Crédit Agricole Egypt (CAE) maintains its solid performance through Q1 2023, generating a Net Banking Income of EGP 2,161 million, up 111%YoY, on the back of good performance by business lines, Gross Loans outstanding reaching EGP 36billion, up 12%YoY, and Customer Deposits reaching EGP 67.9billion, up 39%YoY.

In continuation of our strategy to support local and multi-national corporates, despite current market conditions, outstanding increased by EGP 1.6billion, thereby achieving a 6% YTD growth and 20% YoY growth, with resilient and high quality of assets. Corporate Customers’ Deposits grew by EGP 7.7billion, achieving a 21% YTD growth and 74% YoY growth, with a diversified client base. CAE aims to continue strengthening its position across all corporate segments, via diversified products, service offerings, and enhance cross selling to increase engagement with our clients and secure sustainable relationship.

Overall flat portfolio growth on YTD and YoY basis for Retail. Cash loans had a modest growth (11% YoY), slower auto loans due to market conditions (-26% YoY), but record mortgage loans achieved in terms of volume during Q1 2023 (mortgage outstanding portfolio increased by 140%YoY). Furthermore, highest booking achieved in banc-assurance i.e. life, accompanied by a strong performance in banc-assurance non-life.

New products launched during the quarter i.e. SMART Online Daily Account, Diamond Floating CDs, Revamped Fixed Rate CDs, Cash Loans program for engineers and High-End compound unit owners, etc. along with variety of campaigns/offers to existing and new to bank customers related to acquisition/activation and financial inclusion.

CAE aims to provide the highest level of services and attaining customers’ satisfaction, through cross-selling activities, improving customer equipment ratio and credit cards utilization. Targeted campaigns relating to Mother’s day, International Women’s day and Ramadan also launched during Q1 2023.

Dynamic Commercial Activity and Solid Balance Sheet Structure

Commercial activity growth continues to be good with limited impact due to the evolution of the CDs and FX market thereby providing both Corporate and Individual customers with adequate financial solutions and increasing the active customer base. Gross Loans portfolio (including Loans to Banks) increased +3% YTD and +12%YoY, to reach EGP 36billion, while Customer Deposits increased +12%YTD and +39%YoY, to reach EGP 67.9billion.

Profitability Performance

Net Banking Income (NBI) increased +111% YoY, reaching EGP 2,161 million, where Net Interest Income increased +94% YoY, reaffirming the bank’s commercial activity and efficient control on the cost of funding. Operating Expenses increased +19% YoY driven by efficient controls on costs despite higher inflation and pressure through EGP devaluation of ~25% (at the end of March). Accordingly, Cost to Income Ratio (C/I) reduced significantly to 20.6% from 36.4% and Gross Operating Income (GOI) increased +163% YoY to reach EGP 1,716million.

Normal cost of risk at EGP -100 million, compared to a net recovery of EGP 23 million in the same period last year (specific recoveries in 1Q22) driven by prudent risk management including additional provisions on specific sectors and counterparties during the period.

Net Profit reached EGP 1,221million +151% YoY in Q1 2023 driven by higher NBI with effective control on cost of funds and operating expenses ably complemented by prudent risk management.

QoQ sequentially, NBI and GOI grew by +32% and +46% respectively, where NII increased by +24% on the back of higher yields on earning assets, volumes increase and exercised control on cost of funding, complemented with good momentum on commissions +33% driven by trade finance, banc-assurance and cards in addition to control on operating expenses.

High Quality of Assets, Strong Solvency and Liquidity

CAE NPL ratio of 2.8% remains notably one of the lowest within the banking sector, coupled with a decent coverage buffer, demonstrating vigilant risk management practices in place.

The bank’s strong liquidity and capital positions, well above regulatory requirements, provides adequate safeguard to absorb shocks, if any, and provide the ability to pursue healthy organic growth in the loans portfolio.

Key Financial and Business Indicators

Digital Development

Another successful quarter for CAE digital channels banki Mobile, showing very competitive positive achievements.

For Retail, banki Mobile proving itself as an essential banking tool for customers with the average login per customer close to 8 times/month, and the app rating steadily staying at 4.3 (average on app stores) up from 3.7 in 2021. Our channels have witnessed more than 2.1M logins during Q1 2023, with 643K digital transactions executed on our banki Mobile/Online and banki Wallet, with a remarkable 96% of domestic transfers done online. banki Wallet usage and transactions reached a new record of +200K transactions in Q1 2023, with an increase of +13% compared to Q4 2022, accentuating the contribution of the bank towards financial inclusion in light of the CBE continuous efforts.

As for Corporate and SME, more than 97% of customers have subscribed to banki Business, compared to 95% in Q1 2022, with almost half of the domestic transfers being digitally processed through the platform, more than 300 customers on-boarded/reactivated, and increase in governmental payment transactions.

As for e-commerce, by end of Q1 2023 CAE continued its momentum in the digital payment acceptance field with the successful launch of banki Commerce in 2022, payment gateway. As e-commerce continues to grow, CAE also contributes to the CBE efforts towards a "less cash society". By the end of Q1 2023, banki Commerce had generated a total of EGP 36M payment inflows, with 30K e-commerce transactions processed through the new gateway. CAE concisely remains committed to its ambitious vision in the payment acceptance field, and its unique journey continues to make it easy for all customers to onboard.

Corporate Social Responsibility and Foundation activities

In order to support the critical and under-served needs of the community in the health sector, Credit Agricole Egypt Foundation signed a memorandum of understanding (MOU) in January 2023 with Ahl Misr Foundation to provide the Central Sanitization Unit (CSU) at Ahl Misr Burns Hospital. The hospital is the first to specialize in advanced treatment of burn victims free of charge. The CSU is responsible for sanitizing all medical equipment, beddings and outfits used by doctors and patients thereby ensuring hygiene and better protection against infection.

Conclusion

Credit Agricole Egypt continues to leverage on its digital infrastructure, diversified expertise, solid balance sheet structure, prudent risk management, strong liquidity position and adequate capital buffer allowing the bank to pursue its strategic profitable growth by serving its customers as well as the economy.