PHOTO

Manama, Kingdom of Bahrain – The Central Bank of Bahrain’s (CBB) Board of Directors held its fifth meeting for the year 2025, chaired by Mr. Hassan Khalifa Al Jalahma on Sunday, 14 December 2025.

The Chairman commenced the meeting by congratulating His Majesty King Hamad bin Isa Al Khalifa and His Royal Highness Prince Salman bin Hamad Al Khalifa, Crown Prince and Prime Minister and the people of Bahrain on the occasion of the Kingdom of Bahrain's celebration of its national holidays and the anniversary of the accession of His Majesty the King to the throne and the accompanying national events.

During the meeting, the Board was presented with the items on the agenda. The Board also reviewed and approved CBB’s budget for 2026, which generally focuses on leveraging technology through several projects including the payment systems modernization project and supervision technology (SupTech) projects. On another note, CBB will continue investing in human capital by providing specialized training programs to enhance the competencies of employees, with a particular focus on programs related to digital transformation and artificial intelligence (AI).

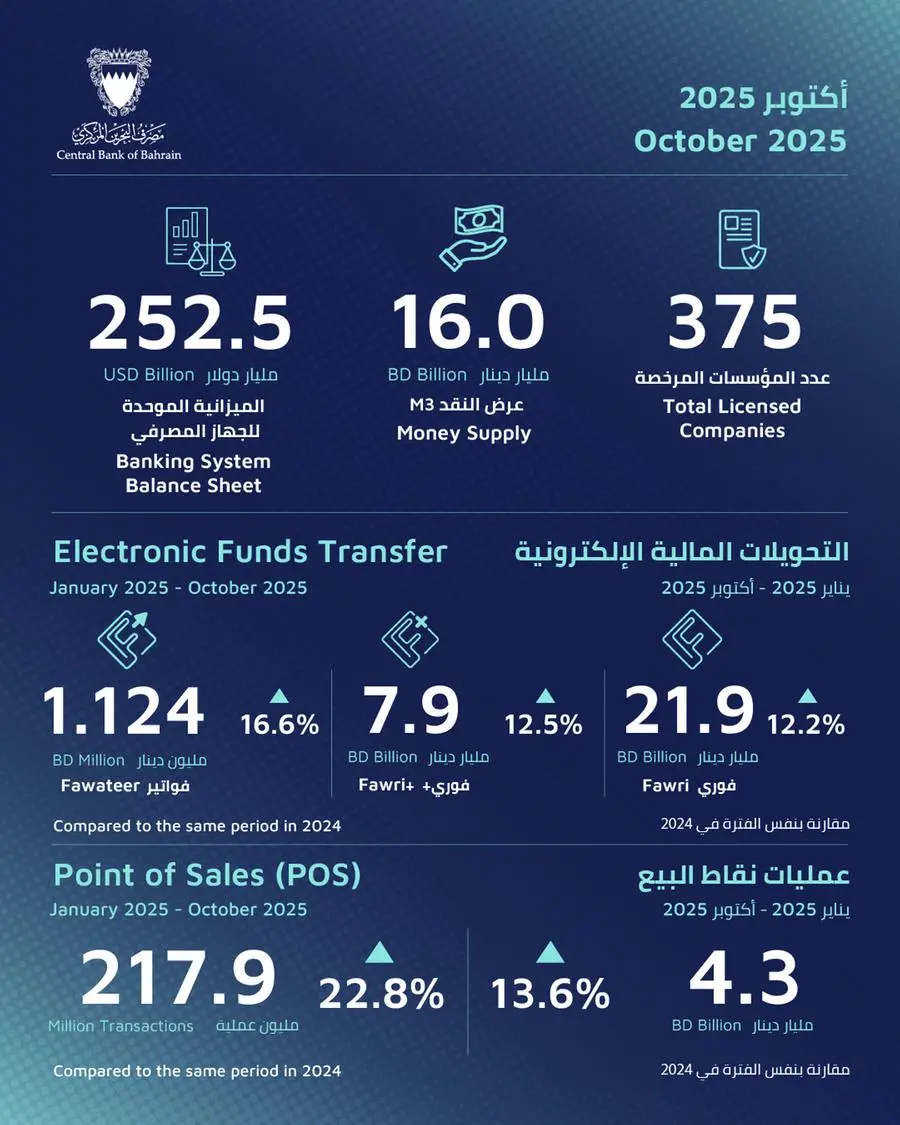

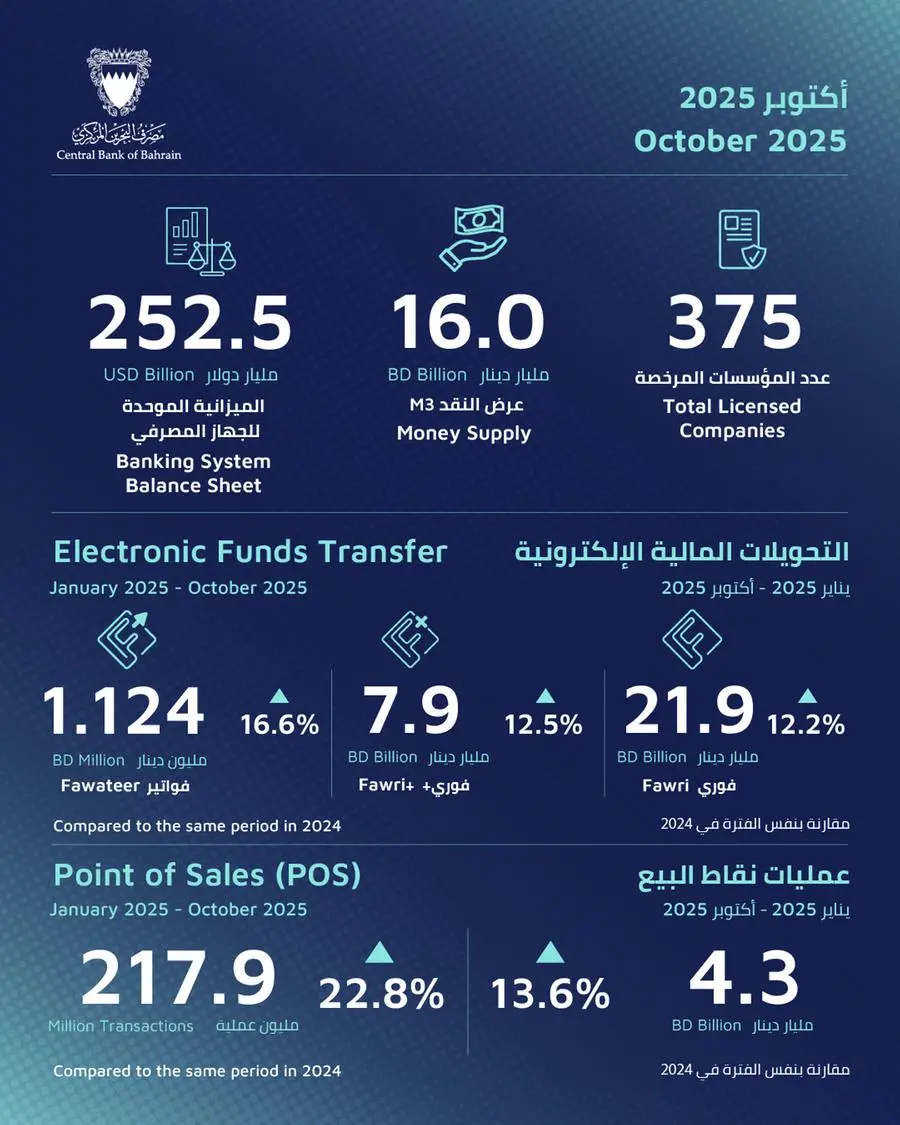

The Board also reviewed key monetary and banking indicators for the period up to October 2025 including the money supply, which decreased by BD 0.5 billion to reach BD 16.0 billion at the end of October 2025, compared to the same period in 2024. As for retail banks, total private deposits increased to reach BD 13.6 billion at the end of October 2025, an increase of 0.8% compared to the end of October 2024. The outstanding balance of total loans and credit facilities extended to resident economic sectors increased to BD 12.8 billion at the end of October 2025, an increase of 6.0% compared October 2024, with the Business Sector accounting for 40.6% and the Personal Sector at 48.2% of total loans and credit facilities. The balance sheet of the banking system (retail banks and wholesale sector banks) increased to $252.5 billion at the end of October 2025, an increase of 1.8% compared to the end October of 2024.

Point of Sales (POS) data for the period January 2025 to October 2025 totaled 217.9 million transactions (77.8% of which were contactless), an increase of 22.8% compared to the same period in 2024. The total value of POS transactions for the period January 2025 to October 2025 totaled BD 4.3 billion (51.8% of which were contactless), an increase of 13.1% compared to the same period in 2024.

The banking sector capital adequacy ratio reached 20.9% in Q3 2025 compared with 20.5% in Q3 2024. The capital adequacy ratio for the various banking sectors was 29.7% for conventional retail banks, 16.6% for conventional wholesale banks, 25.2% for Islamic retail banks, and 20.0% for Islamic wholesale banks in Q3 2025.

The total number of registered Collective Investment Undertakings (CIUs) as of September 2025 stood at 1750 CIUs, compared to 1723 CIUs as of September 2024. The net asset value (NAV) of the CIUs decreased from US $11.232 billion in Q3 2024 to US $11.139 billion in Q3 2025, reflecting a decrease of 0.83%. The NAV of Shari’a-compliant CIUs increased from US $1.904 billion in Q3 2024 to US $2.185 billion in Q3 2025, reflecting an increase of 14.76%. The NAV of Bahrain domiciled CIUs increases from US $4.349 billion in Q3 2024 to US $4.425 billion in Q3 2025, reflecting a increase of 1.75%. Additionally, the NAV of overseas domiciled CIUs decreased from US $6.883 billion in Q3 2024 to US $6.713 billion in Q3 2025, reflecting a decrease of 2.47%.