PHOTO

- Egypt’s first integrated solar and battery storage plant will deliver dispatchable clean energy, enhance grid stability and manage peak demand

- BII’s financing includes a returnable grant to lower the cost of the project

- The project is expected to generate approximately 3,000 GWh of clean energy and avoid up to 1.4 million metric tonnes of emissions per year, supporting Egypt’s decarbonisation goals

Cairo,: British International Investment (BII), the UK’s development finance institution and impact investor, the African Development Bank (AfDB) and European Bank for Reconstruction and Development (EBRD) are providing a total of US$ 479.1 million to Obelisk Solar Power SAE, a special-purpose vehicle incorporated in and owned by Scatec ASA. This financing will support the development of a 1.1 GW solar photovoltaic (PV) power plant integrated with a 200 MWh battery energy storage system (BESS) in the country’s Nagaa Hammadi region.

The AfDB’s financing package of US$ 184.1 million includes US$ 125.5 million of ordinary resources, as well as concessional funding from AfDB-managed special funds the Sustainable Energy Fund for Africa worth US$ 20 million, and US$ 18.6 million from the Canada-African Development Bank Climate Fund, a partnership between the AfDB and the government of Canada. A further US$ 20 million will be channelled from the CIF’s Clean Technology Fund through the AfDB.

The EBRD will provide a financing package of up to US$ 173.5 million, of which US$ 101.9 million will benefit from a European Fund for Sustainable Development (EFSD+) first-loss cover guarantee for the first 18 years, in addition to a US$ 6.5 million grant from the EBRD Shareholder Special Fund.

BII financing includes a US$ 100 million concessional loan and a US$ 15 million returnable grant that helps lower the overall cost of the BESS part of the project, making it more financially viable and affordable, while attracting private sector participation and creating models for future investments. BII’s financing is subject to drawdown conditions.

The project’s blended financing of US$ 479.1 million corresponds to approximately 80 per cent of the total estimated capital expenditure of US$ 590 million.

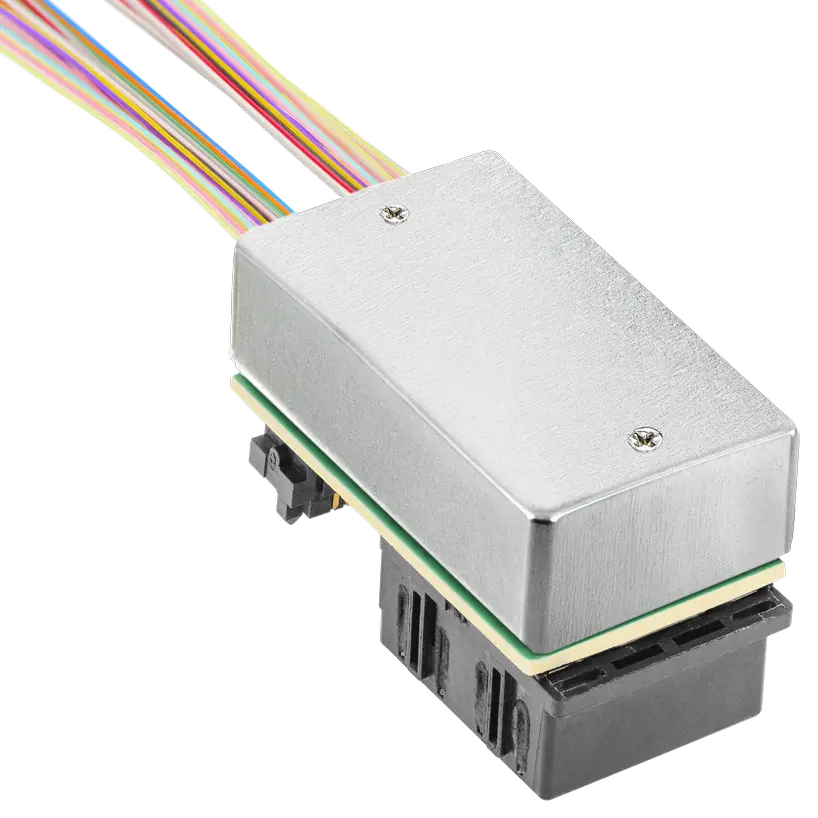

The integrated power plant will be developed by Scatec, a leading renewable energy solutions provider, and built in two phases. The first phase, with 561 MW of solar and 100 MW/200 MWh of battery storage, aims to start operations in the first half of 2026. The second phase, with 564 MW of solar, aims to start operations in the second half of 2026. The energy will be sold under a US dollar-denominated 25-year power purchase agreement with the Egyptian Electricity Transmission Company, backed by a sovereign guarantee.

On completion, it will be the first integrated solar photovoltaic and battery storage project of this scale in Egypt, and a significant milestone in the country’s energy transition. Egypt aims to reach 42 per cent of renewables in its power mix by 2030. The solar power plant is expected to generate approximately 3,000 GWh per year of additional renewable power, which will enhance grid stability and manage peak demand. It will also reduce carbon dioxide emissions by up to 1.4 million metric tonnes annually.

The facility will support the diversification of Egypt’s energy mix and increase the share of renewable energy, which will contribute to reducing greenhouse gas emissions and advancing the country's decarbonisation goals.

Sherine Shohdy, Head of Egypt Office and Coverage Director, BII, said: "Our financing in this landmark project reflects BII’s commitment to pioneering the next generation of renewable energy infrastructure to power Egypt’s sustainable future. By powering local businesses with clean, reliable energy, we are supporting economic growth and job creation at the heart of communities. This builds on our $190 million agreement to finance the 1.1 GW Gulf of Suez Wind Farm, highlighting our pivotal role in driving the energy transition in Egypt and North Africa.”

Wale Shonibare, the AfDB’s Director of Energy Financial Solutions, Policy and Regulations, noted: “This project exemplifies the scale of renewable energy potential across Africa and demonstrates how strong partnerships and innovative solutions can advance the energy transition and foster sustainable economic development. It has a high demonstration and replication potential for similar initiatives across the continent.”

Harry Boyd-Carpenter, EBRD Managing Director for Sustainable Infrastructure, said: “We are delighted to work with our longstanding partners Scatec, the AfDB and BII to support this transformative

project. It takes Egypt’s green energy transition to another level by harnessing the power of the sun, not just during the day but also at night, thanks to the combination of solar and battery storage. The project addresses the growing demand for electricity and reduces the need to import expensive fossil fuels. It contributes to the goals of Egypt’s flagship Nexus on Water, Food and Energy that was launched at COP27 in Sharm el-Sheikh, and for which the EBRD is Egypt’s leading partner on the energy pillar.”

Terje Pilskog, CEO of Scatec, commented: “This project marks a major milestone for Scatec. It proves our ability to deliver large-scale hybrid projects. We are proud to partner with leading development finance institutions to support Egypt’s clean energy ambitions, and we look forward to delivering this important project together with our partners.”

Stefano Sannino, Director-General of the Directorate-General for the Middle East, North Africa and the Gulf at the European Commission, said: “Today, the European Union (EU) launches the EU-Egypt Investment Guarantee for Development Mechanism, a strategic platform designed to fast-track a significant pipeline of investment projects to deliver large-scale financing solutions in Egypt. This is a major milestone in the implementation of the EU-Egypt Strategic Partnership. This particular project is a concrete example of a fruitful collaboration between the EU and the EBRD for supporting green transition in the country, through a large-scale investment. The EU guarantee allows the EBRD to provide a loan alongside other financiers to finance an innovative integrated solution which can attract private investors.”

About British International Investment

British International Investment is the UK’s development finance institution and impact investor. As a trusted investment partner to businesses in Africa, Asia and the Caribbean, BII invests to create productive, sustainable and inclusive economies in our markets. Between 2022-2026, at least 30 per cent of BII’s total new commitments by value will be in climate finance. BII is also a founding member of the 2X Challenge which has raised over US$ 33.6 billion to empower women’s economic development. The company has investments in over 1,580 businesses across 65 countries and total net assets of £8.5 billion. For more information, visit: www.bii.co.uk | watch here. Follow British International Investment on LinkedIn and X.

About the African Development Bank

The African Development Bank Group’s mission is to help reduce poverty, improve living conditions for Africans and mobilise resources for the continent’s economic and social development. The institution aims at assisting African

countries – individually and collectively – in their efforts to achieve sustainable economic development and social progress.

About the European Bank for Reconstruction and Development

The EBRD is a multilateral bank that promotes the development of the private sector and entrepreneurial initiative in 36 economies across three continents. The Bank is owned by 75 countries as well as the EU and the European Investment Bank. EBRD investments are aimed at making the economies in its regions competitive, well governed, green, inclusive, resilient and integrated. Follow us on the web, Facebook, LinkedIn, Instagram, X and YouTube.

About Scatec

Scatec is a leading renewable energy solutions provider, accelerating access to reliable and affordable clean energy emerging markets. As a long-term player, we develop, build, own and operate renewable energy plants, with 6.2 GW in operation and under construction across five continents today. We are committed to grow our renewable energy capacity, delivered by our passionate employees and partners who are driven by a common vision of ‘Improving our Future’. Scatec is headquartered in Oslo, Norway and listed on the Oslo Stock Exchange under the ticker symbol ‘SCATC’. To learn more, visit www.scatec.com or connect with us on LinkedIn.