PHOTO

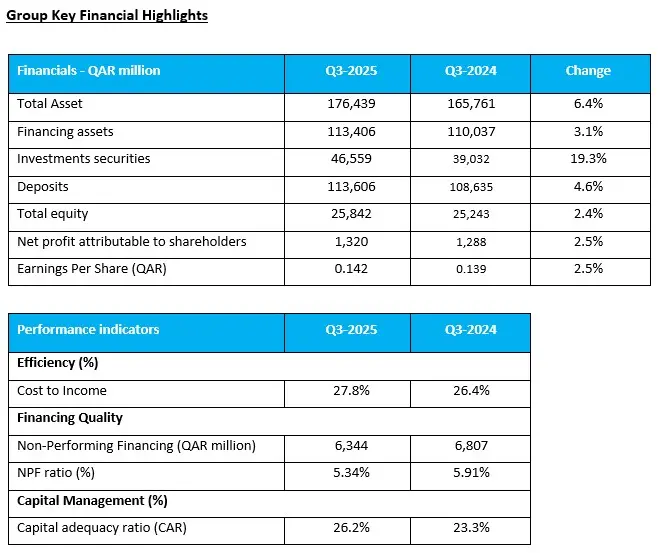

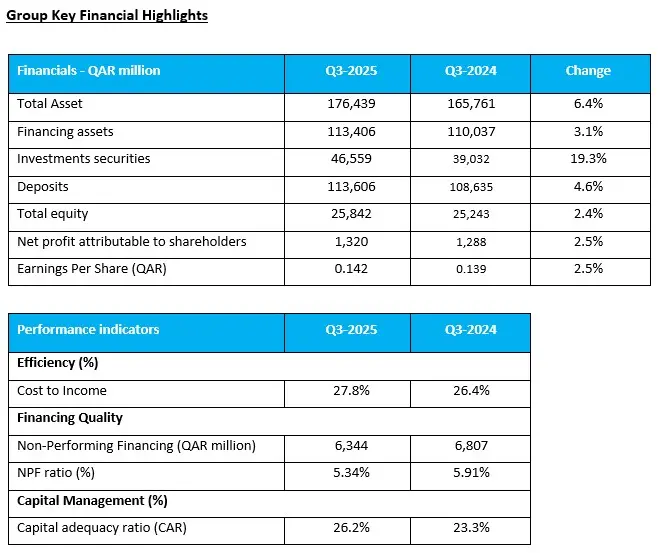

- Net financing assets closed at QAR 113.4 billion and Deposits at QAR 113.6 billion representing a YOY increase of 3.1% and 4.6% respectively

- Cost to Income (efficiency) ratio 27.8%

- The Capital Adequacy ratio stood at 26.2%

Doha: Al Rayan Bank QPSC released today its consolidated financial statements for the nine-month period ended 30 September 2025 with Net Profit attributable to the equity holders of the bank of QAR 1,320 million.

His Excellency Sheikh Mohammed Bin Hamad Bin Qassim Al Thani, Chairman of the Board commented:

“Our continued strong performance across Qatar and international markets reflects the strength of our strategy and the trust of our clients. As of 30 September 2025, the Group’s total assets surged to QAR 176 billion, up 6.4% year-on-year, driven by robust growth in investment securities (+19.3%) and financing assets (+3.1%). In Q3, our fully owned subsidiary, AlRayan Investment, was named the Best Equity Manager at the 2025 MENA Banking Excellence Awards organized by MEED. In addition, the Bank also launched a new trade finance digital platform which allows full automation of all customer trade transactions. These achievements not only reinforce our leadership in the financial sector but also highlight our firm commitment to innovation, digital transformation, and delivering Sharia-compliant banking solutions that put our customers first”.

Commenting on Q3 financial performance, Fahad Bin Abdulla Al Khalifa, Group Chief Executive Officer said:

“I am pleased to announce that the Group recorded a net profit of QAR 1,320 million for the nine-month period ended 30 September 2025, representing a 2.5% increase compared to the same period last year. This strong performance is a testament to our sound fundamentals and unwavering commitment to sustainable growth. AlRayan became the first Islamic Bank in Qatar to launch Visa Commercial Pay, a payment proposition to enhance the experience of corporate clients. The Bank also launched a merchant e-commerce gateway to enable corporate and SME clients to seamlessly accept e-commerce transactions. Our continued focus on cost discipline and operational efficiency has enabled us to maintain a strong efficiency ratio of 27.8%, while driving innovation across the Bank through enhanced digital capabilities, streamlined processes, and customer-focused solutions.”

For further information please visit our investor relations page on our website https://www.alrayan.com or contact our Investor Relations team at IR@alrayan.com