PHOTO

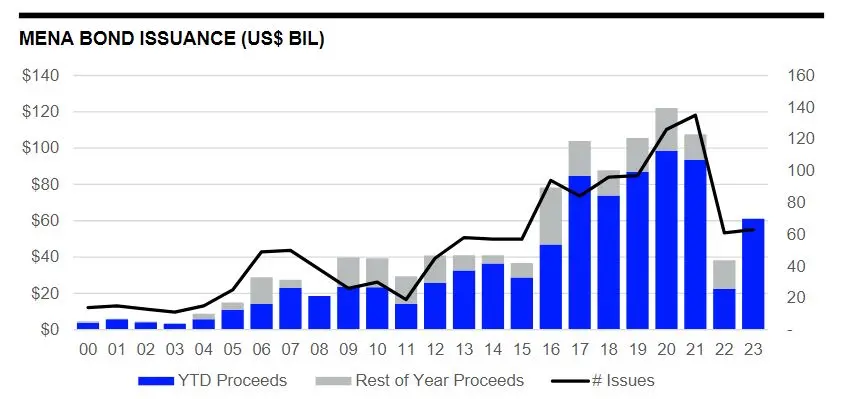

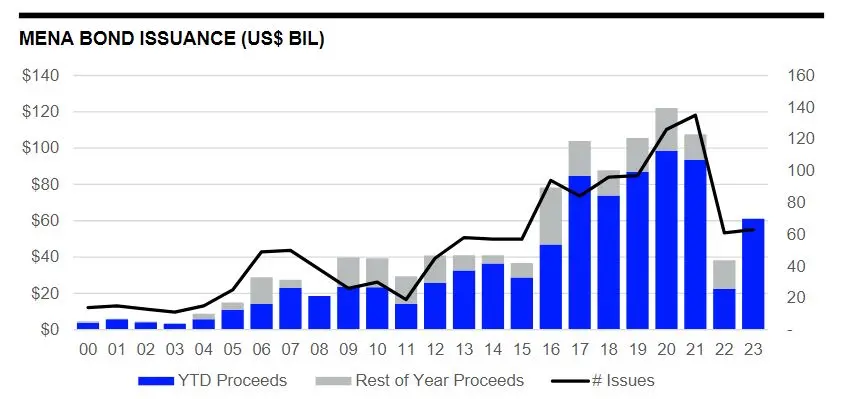

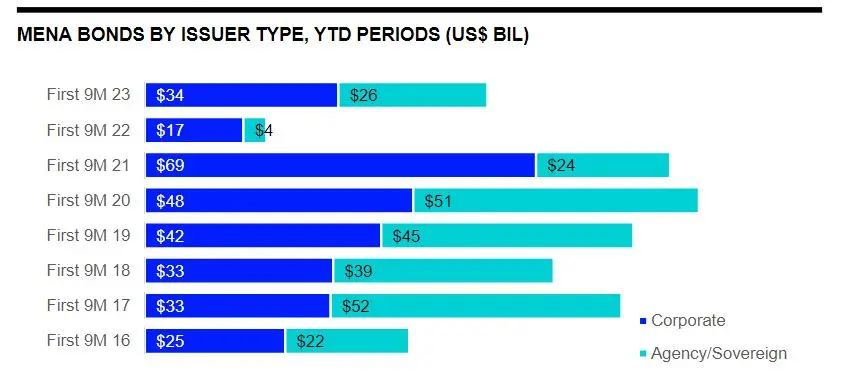

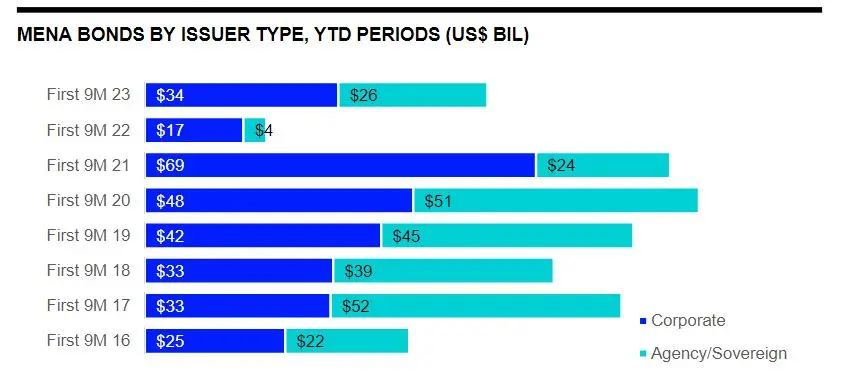

MENA debt issuances nearly tripled in value year-on-year (YoY) during the first nine months of 2023 to $61.1 billion, according to data from the London Stock Exchange Group’s (LSEG) Deals Intelligence. However, this was below the value recorded for the previous five years.

The number of issues declined 3% over the same period.

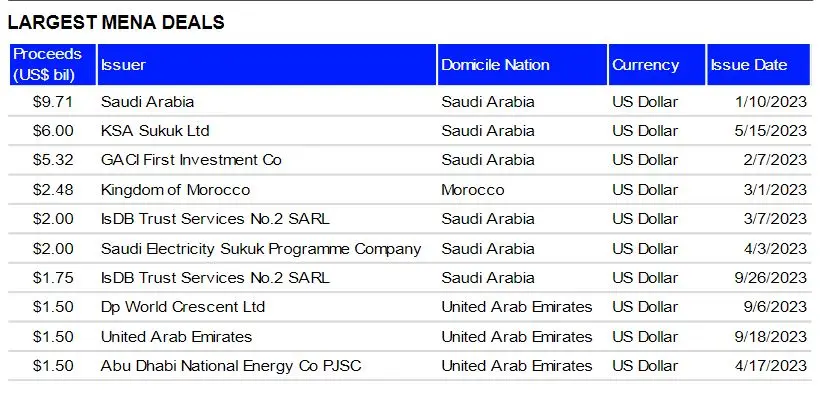

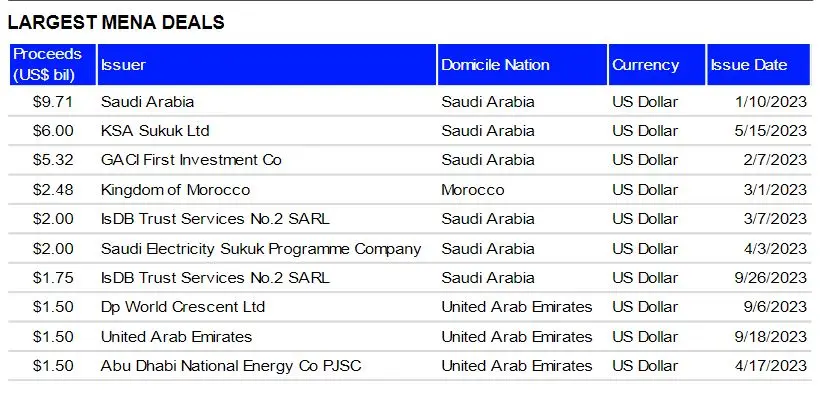

Saudi Arabia was the most active issuer nation during the first nine months of 2023 accounting for 50% of total bond proceeds, followed by the United Arab Emirates (32%), and Bahrain (7%).

Financial issuers accounted for 44% of proceeds raised during the first nine months of 2023, while Government & Agencies accounted for 43%.

Islamic bonds in the region raised $26.1 billion during the first nine months of 2023, a first nine-month record. Sukuk account for 43% of total bond proceeds raised in the region, compared to 38% last year.

Citi took the top spot in the MENA bond bookrunner ranking during the first nine months of 2023 with $7.8 billion of related proceeds, or a 13% market share. Standard Chartered led in the MENA Islamic bonds table with $3.03 billion in related proceeds.

(Writing by Brinda Darasha; editing by Seban Scaria)