PHOTO

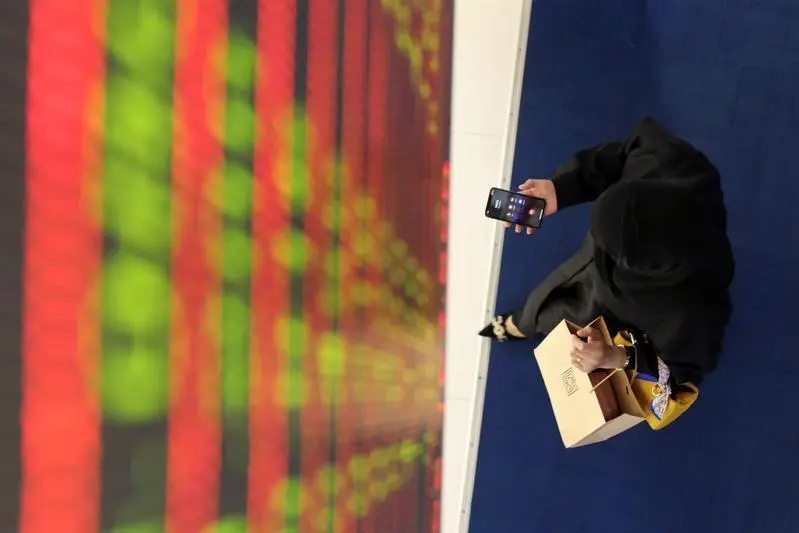

Takaful Emarat (TE) is to be merged into Arab Islamic Insurance (Salama) with Salama to be the surviving entity.

In a disclosure to Dubai Financial Market (DFM), Salama said the proposed merger, expected to be completed in the second half of next year, will be a cashless transaction effected by way of a statutory merger, with all assets and liabilities of TE will be merged into Salama.

TE shareholders will be issued new shares in Salama, the company said, with KPMG appointed as joint valuer for purposes of determining an appropriate ratio swap.

The value of the transaction is still subject to finalisation of the terms between the two parties.

The statement said: “The merger presents an opportunity to realise business synergies and improve overall business performance of Salama (as the surviving entity following the completion of the merger) and enhance its capacity to capture a larger market share in the future.”

It is anticipated that the merger will allow Salama to gain access to more customer segments and that a larger customer base is expected to allow Salama to extent its coverage in terms of network and service providers, the statement added.

Salama’s Participating Insurer (PI) licence will help to retain and grow the legacy PI business of TE, the company

AMAN disclosure

In a further statement regarding another transaction with another Islamic insurer, AMAN PJSC, Salama today disclosed that its chairman, Jassim Mohamed Rafi Alseddiqi Alansaari, is the chairman of the board of directors of Salama as well as a 10.79% shareholder of Aman, and “he may or may not benefit directly from the transaction.”

AMAN disclosed earlier this week that the proposed acquisition by Salama of its general takaful and group family takaful insurance portfolios would see AMAN exit the insurance business and become a holding company.

(Writing by Imogen Lillywhite; editing by Daniel Luiz)