PHOTO

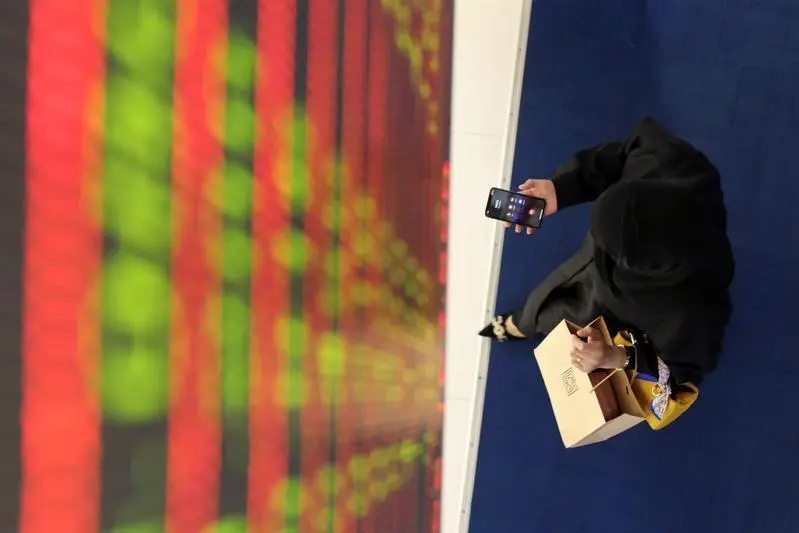

Most stock markets in the Gulf finished lower on Monday, as the growing risk of more aggressive interest rate hikes in the United States and Europe spooked investors.

Federal Reserve Chair Jerome Powell, speaking at the Jackson Hole symposium on Friday, said the Fed would raise rates as high as needed to restrict growth, and keep them there "for some time" to bring down inflation running well above its 2% target.

Most Gulf Cooperation Council countries have their currencies pegged to the U.S. dollar and broadly follow the Fed's policy moves, exposing the region to a direct impact from monetary tightening.

In Abu Dhabi, the index dropped 1.1%, dragged down by a 3% slide in the United Arab Emirates' biggest lender First Abu Dhabi Bank. Dubai's main share index closed 0.8% lower, hit by a 1% fall in blue-chip developer Emaar Properties and a 1% decline in sharia-compliant lender Dubai Islamic Bank.

European Central Bank board member Isabel Schnabel added to market jitters. On Saturday, she warned that central banks risk losing public trust and must act forcefully to curb inflation, even if that drags their economies into a recession.

Saudi Arabia's benchmark index gave up early gains to end flat. Oil edged higher to extend last week's gains as potential OPEC+ output cuts and conflict in Libya helped to offset a strong U.S. dollar and a dire outlook for U.S. growth. Saudi Arabia, top producer in the Organization of the Petroleum Exporting Countries (OPEC), last week raised the possibility of production cuts, which sources said could coincide with a boost in supply from Iran should it clinch a nuclear deal with the West.

Outside the Gulf, Egypt's blue-chip index lost 0.6%, with Madinet Nasr For Housing And Development retreating about 7%.

(Reporting by Ateeq Shariff in Bengaluru; Editing by Maju Samuel)