PHOTO

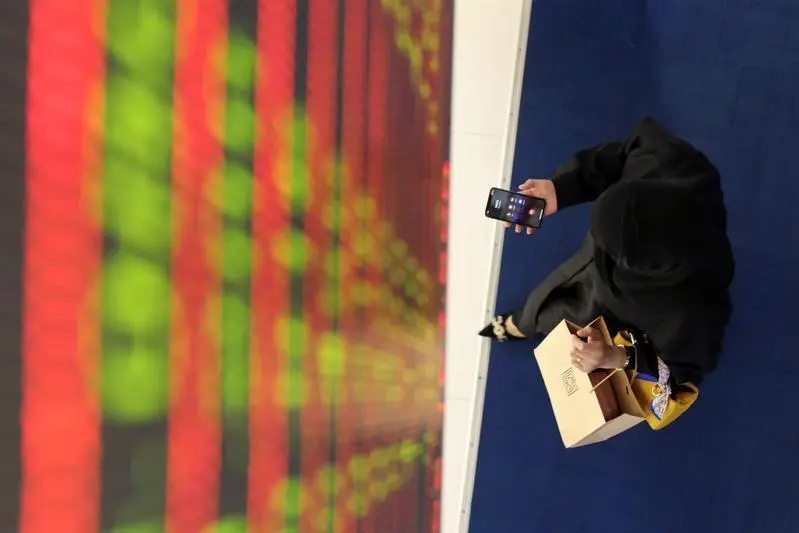

Most stock markets in the Gulf ended lower on Wednesday, with the Dubai index falling most, hit by concern over a possible global recession.

Dubai's main share index lost 1.9%, dragged down by a 2.8% fall for blue-chip developer Emaar Properties and a 2.7% decline for sharia-compliant lender Dubai Islamic Bank. Separately, Dubai road-toll operator Salik has appointed Ibrahim Al Haddad as chief executive, it said on Wednesday, in a move that showed the company was moving closer to its planned flotation.

In Abu Dhabi, equities eased by 0.2%, hit by a 0.4% fall in conglomerate International Holding.

The United Arab Emirates is boosting state spending on social welfare by billions of dollars as it seeks to shield its citizens from rising living costs. The UAE is doubling the financial support it provides to low-income Emirati families to 28 billion dirhams ($7.6 billion) to help them contend with soaring inflation in the Gulf state.

The Qatari benchmark finished 1.7% down, with petrochemicals company Industries Qatar retreating 3.9%.

Saudi Arabia's benchmark index reversed early losses to close 0.6% up, ending four sessions of losses, with Al Rajhi Bank rising 2% and Riyad Bank advancing 2.8%.

Oil prices, a key catalyst for the Gulf's financial markets, rose on Wednesday, clawing back some of the previous day's heavy losses as supply concerns returned to the fore and outweighed lingering global recession fears. Advanced Petrochemical Co slid 3.6%, however, after a steep fall in quarterly profit.

Outside the Gulf, Egypt's blue-chip index edged 0.2% higher, helped by a 0.6% gain for Commercial International Bank.

The Egyptian stock market was volatile and remained exposed to the downside as inflation and risk aversion weighed on investor sentiment, said CAPEX.com analyst Fadi Reyad. The market could find some relief if talks to bring a resumption in grain exports from Ukraine prove successful, Reyad added.

(Reporting by Ateeq Shariff in Bengaluru, Editing by David Goodman )