PHOTO

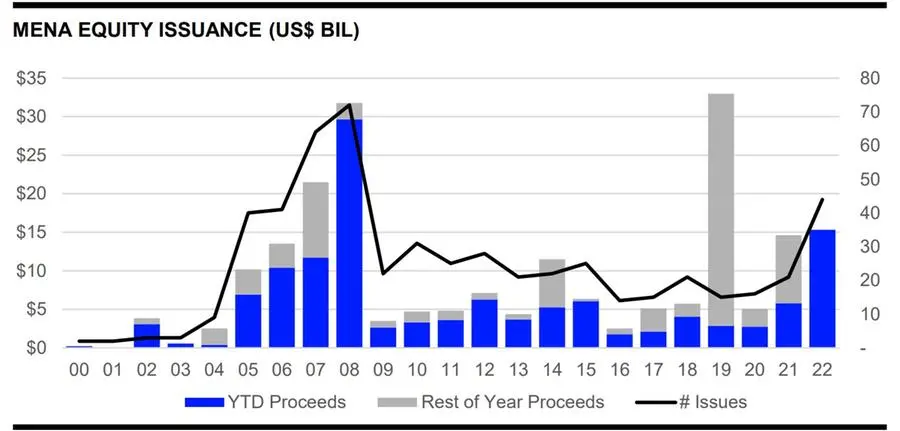

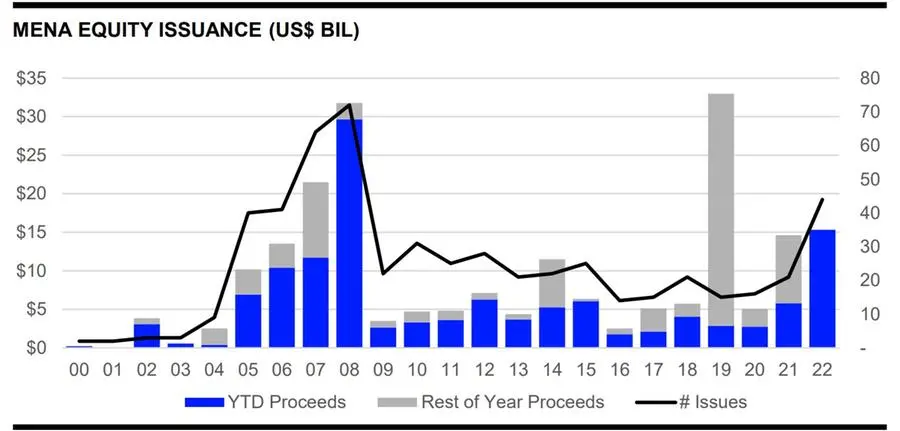

MENA equity and equity-related issuance totalled $15.3 billion year-to-date (YTD) in 2022, the highest first nine-month total since 2008, Refinitiv data showed.

Proceeds raised by companies in the region increased 166% compared to the first nine months of 2021, while the number of issues increased 110%.

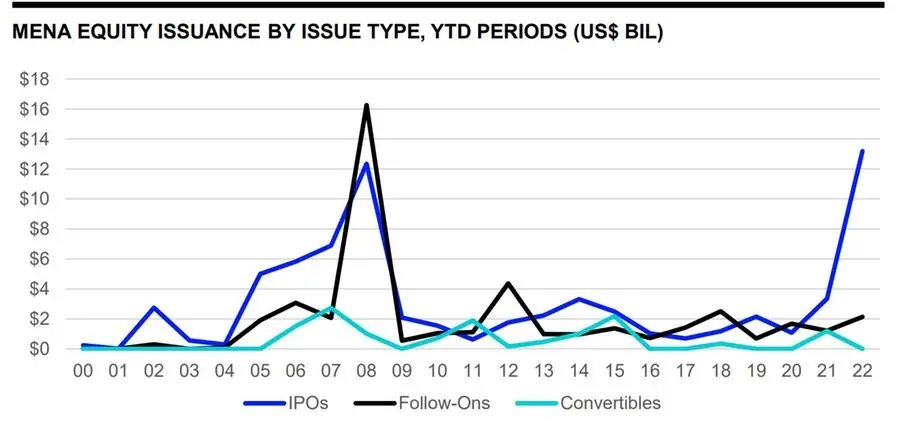

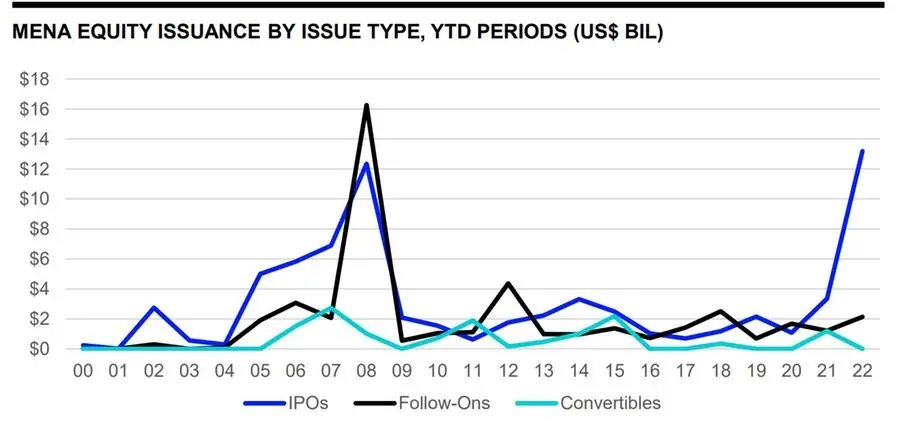

Initial public offerings accounted for 86% of activity during the first nine months of 2022, while follow-on issuance accounted for 14%.

A total of 29 initial public offerings were recorded during the first nine months of 2022, 21 more than last year at this time and the highest level since 2008. They raised a combined $13.2 billion, setting a first nine-month record in the region.

Dubai Electricity & Water Authority raised $6.1 billion in its stock market debut in April. The state utility’s initial public offering is the third largest IPO globally so far this year and the second largest MENA IPO of all time.

The UAE was the most active country in equity capital market (ECM) activity with $9.56 billion in proceeds raised. More than half of this came from the DEWA IPO.

Saudi Arabia accounted for the rest of the issuances. Rabigh Refining & Petrochem was the only follow-on issuance, raising $2.16 billion.

HSBC took first place in the MENA ECM underwriting league table during the first nine months of 2022 with an 18.5% market share, followed by Saudi National Bank SJSC

The region has been a bright spot in the IPO scene supported by elevated oil prices and foreign investor inflows, even as global issuances nearly halved.

(Reporting by Brinda Darasha; editing by Seban Scaria)

(brinda.darasha@lseg.com)