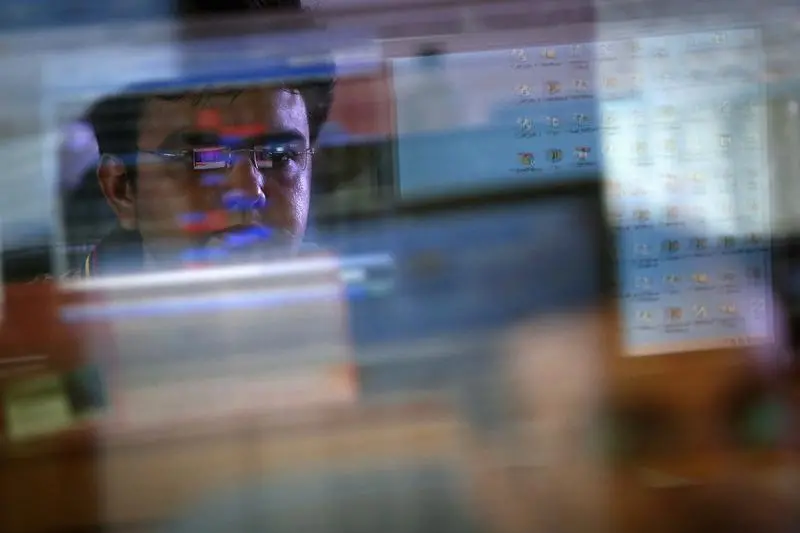

PHOTO

BENGALURU - India's main indexes ended lower on Wednesday, dragged down by energy and metals sectors, with investors eyeing the U.S. Federal Reserve's rate hike decision later in the day.

The NSE Nifty 50 index closed down 0.25% at 15,692.15, while the BSE index ended 0.3% lower at 52,541.39.

Analysts largely expect a 50-basis-point hike at the Fed's meeting, but the possibility of a 75-bp raise has also grown after Friday's higher-than-expected consumer price index (CPI) data for May.

The spotlight on the U.S. central bank's decision comes after the Reserve Bank of India last week raised its key interest rate by 50 basis points as widely expected, in a bid to cool high inflation in Asia's third-largest economy.

The country's wholesale inflation for May surged 15.88% in May, while retail inflation eased to 7.04%, data showed earlier this week.

Among individual sectors and shares, the Nifty energy index dropped 1.2%, with Oil and Natural Gas Corp down about 3% while NTPC Ltd shed 2.2%.

"People are exiting their profitable trades and with oil prices already moving up, the energy sector stocks are down today due to profit-booking," said Siddharth Khemka, head of retail research, Motilal Oswal.

The Nifty metal index dropped 0.7%, pulled lower by a 3.7% drop in Tata Steel.

Network18 Media and Investments rose 2.4% after Viacom18, in which Network 18 owns a majority stake, won digital streaming rights for the Indian cricket league IPL from 2023 to 2027.

Shares of One97 Communications were up 1.8% after the company's average monthly users on its Paytm super app rose 48% for two months ending May.

(Reporting by Tanvi Mehta in Bengaluru; Editing by Uttaresh.V and Anil D'Silva)