PHOTO

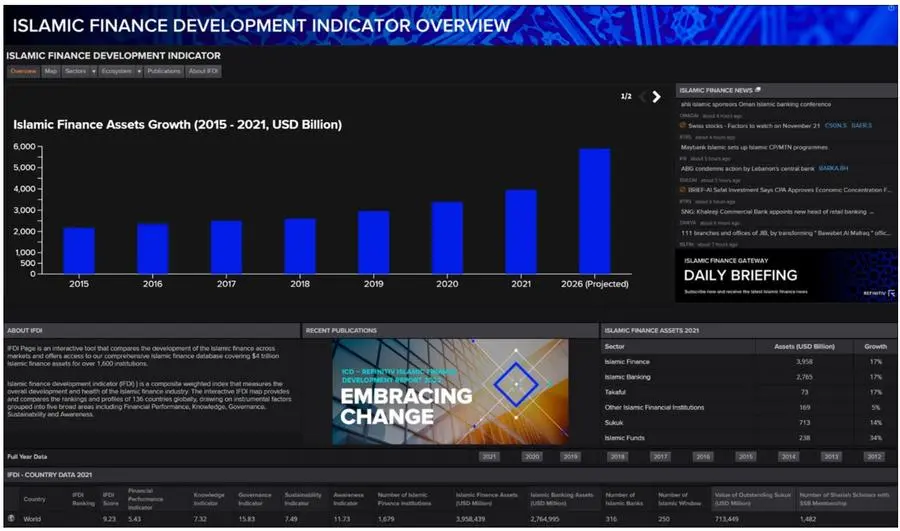

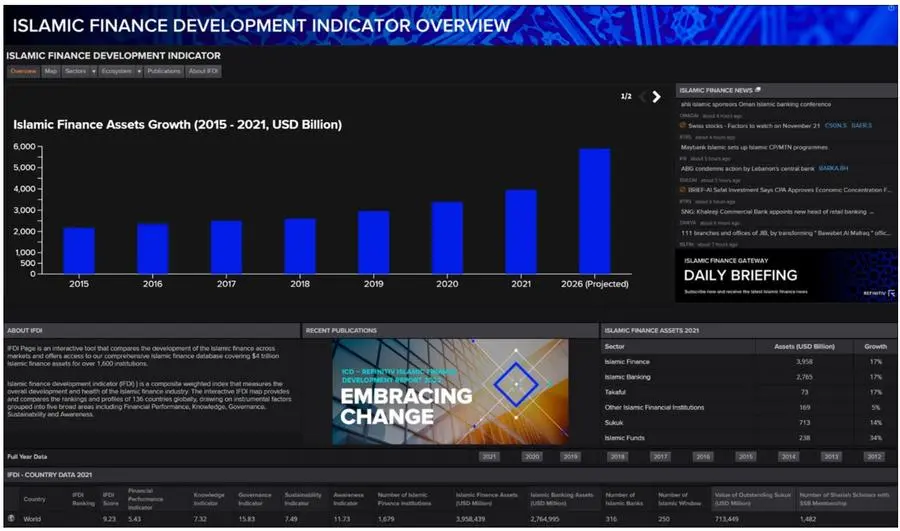

According to the Islamic Finance Development Indicator (IFDI), the Islamic finance industry reached almost US$4.0 trillion in total assets in 2021 on a growth of 17% from 2020. The total global net income reported by Islamic financial institutions in 2021 also increased three times from 2020, signaling improved outcomes, especially for Islamic banks.

The Islamic Finance Development Report investigates the reasons behind the growth and looks into the underlying sectors and countries that contributed towards this. The report not only investigates the different asset classes of the industry, but it also looks into the industry’s overall ecosystem as well such as regulations and awareness.

The report is based on the enhanced underlying IFDI model which is based on five indicators that are the main drivers of development in the industry. These are: Financial Performance, Knowledge, Governance, Sustainability, and Awareness. Other enhancements were also incorporated.

The report is launched in partnership with the Islamic Corporation for the Development of Private Sector (ICD) of the Islamic Development Bank Group.

Access the full report to find out more about:

- Up-to-date statistics on the global Islamic finance industry and its projected growth

- Key changes made to the underlying IFDI model and how it impacted the country rankings

- Main markets and trends impacting the Islamic finance industry

A new milestone

The Islamic finance industry reached almost US$4.0 trillion in total assets in 2021

A global overview

The IFDI investigates the Islamic finance industry performance and its underlying ecosystem for 136 countries globally

New metrics introduced

The enhanced IFDI incorporates Islamic FinTech and sustainability which is outlined in the report

Get the IFDI raw data on Eikon / Workspace

Eikon / Workspace user can access the underlying data for the Islamic Finance Development Indicator app. The database is comprehensive and can be downloaded in Excel sheet format with the details of every Islamic institution that discloses its financials with a dollar-by-dollar breakdown of the industry.

The data includes over 1,600 Islamic financial institutions including Islamic banks and takaful operators along with sukuk, Islamic funds and Shariah scholar for different countries around the globe. This includes the newly introduced metrics for IFDI such as ESG sukuk and Islamic funds along with Islamic FinTechs.

Click here to access the IFDI page and the global Islamic finance database in Eikon.