PHOTO

Artificial Intelligence (AI) technologies, such as machine learning (ML), computer vision and data analytics, are already transforming the nature and future of work for humans. There are now ample examples of innovative use cases showing how AI technologies lead to increased productivity, reduced costs and greater accuracy and efficiency in various processes.

However, AI may also restrict human potential to some extent by making people more dependent on technology than ever. The ubiquitous nature of technology also raises privacy concerns for individuals, societal concerns around the spread of consumerism and ‘affluenza’, as well as perhaps the greatest concern for many: the automation of existing jobs, especially if it exceeds job creation efforts and leads to a net unemployment effect globally.

Consequently, discussions around solutions such as a universal basic income are becoming more widespread as well.

OIC countries vary widely in readiness for automation

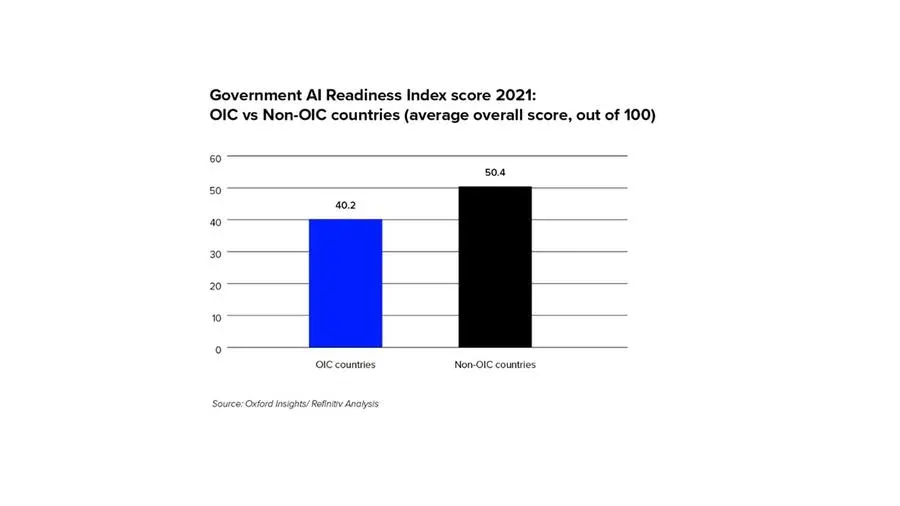

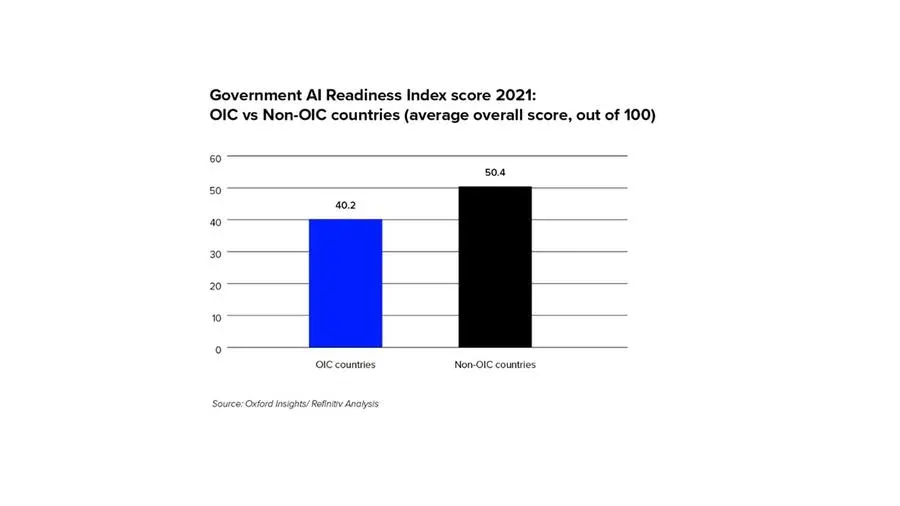

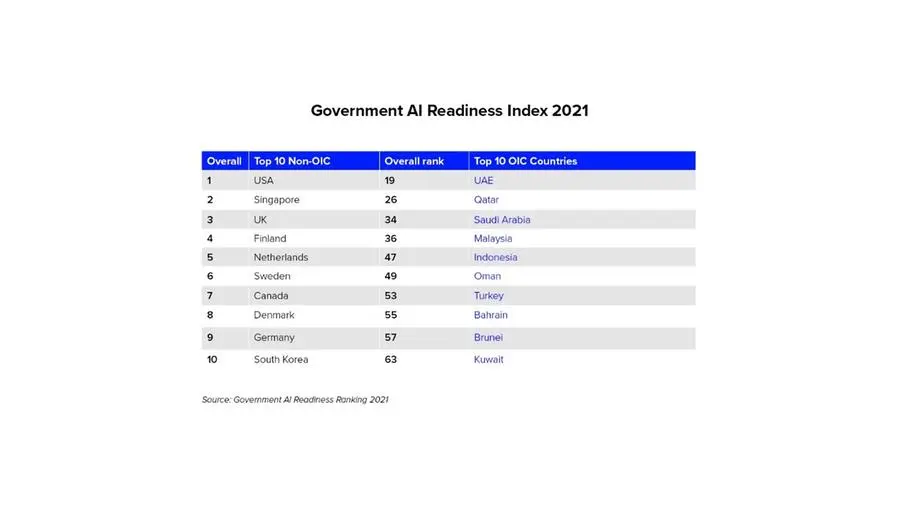

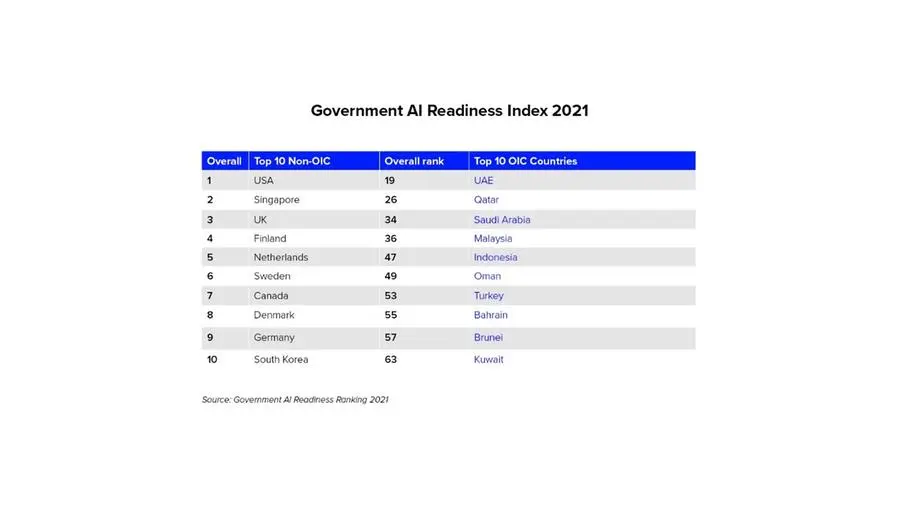

As the Global AI Readiness Index 2021 shows, OIC markets vary widely in their readiness for automation. OIC countries UAE and Qatar are in the Top 30 globally but other OIC countries rank at 34 and below. Moreover, the average scores for OIC countries are significantly lower than that for non-OIC countries.

One of the potential solutions to this situation is increased intra-OIC cooperation between the leading OIC nations and the late adopters. Countries such as UAE, Qatar, Saudi Arabia, and Malaysia can help bridge the gap in AI readiness for other OIC countries. Another solution is to engage in knowledge transfers and exchanges with leading non-OIC hubs and countries to help narrow the gap.

Islamic fintech and AI technologies will be crucial for OIC governments and industry

For OIC governments, AI and automation have deep implications for citizens, for example, impact on employment prospects and privacy implications. As such, it is critical for OIC governments to articulate their national AI strategies so that there is clarity on what OIC countries’ citizens expect from AI and what they are willing to give up in return, such as certain privacy rights. Moreover, the picture for citizens’ relationship with AI and automation is more nuanced than just accepting or rejecting such technologies. Involving citizens at the earlier stages of an AI technology’s development would help ensure the application of such a technology is acceptable to the public.

Some OIC governments have adopted national AI strategies and initiatives, but it remains to be seen how well these will be implemented and how far the strategies’ targets will be achieved.

For industry, AI-rich platforms are providing novel solutions to existing problems. For instance, market intermediaries and asset managers are using AI and ML techniques to optimise portfolios, suggest investment recommendations and improve internal back-office functions. Moreover, AI is helping to generate alternative data that can be used for credit scoring, such as data from mobile phones, social networks, utilities and telecoms payments, rental payments, facial recognition and satellites.

Considering these developments, Islamic fintech and the application of AI technologies in Islamic finance will have a crucial role to play in navigating governments’ concerns, whilst providing novel solutions to existing problems across industries in a Shariah-compliant manner.

For more insights and key findings, read the report.

(Reporting by Redha Al Ansari; editing by Seban Scaria)