PHOTO

The GCC is likely to be one of the few regions in the world that will see higher growth in 2022 compared to last year due to the strong rebound in the oil sector and the public sector driving the non-oil economy, said Scott Livermore, the Chief Economist, Oxford Economics Middle East.

In a webinar held on Monday, titled "Middle East: Regional trends in an inflationary world," he said that for countries other than the oil exporters there are downside risks to the outlook as they are more vulnerable to the impact of inflation, the impact of potential risk-off scenarios and having to prop up their current accounts.

Livermore said the Middle East’s exposure to higher energy and food prices showed a mixed pattern.

Watch the Zawya video here:

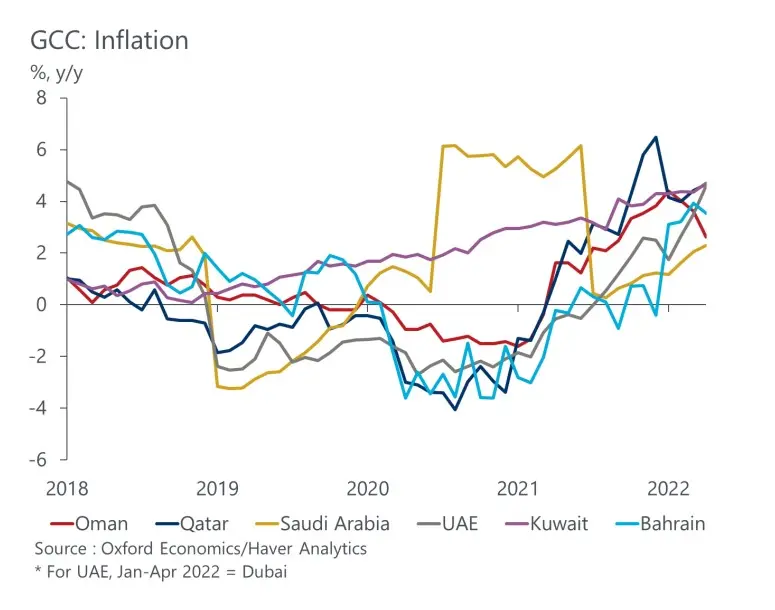

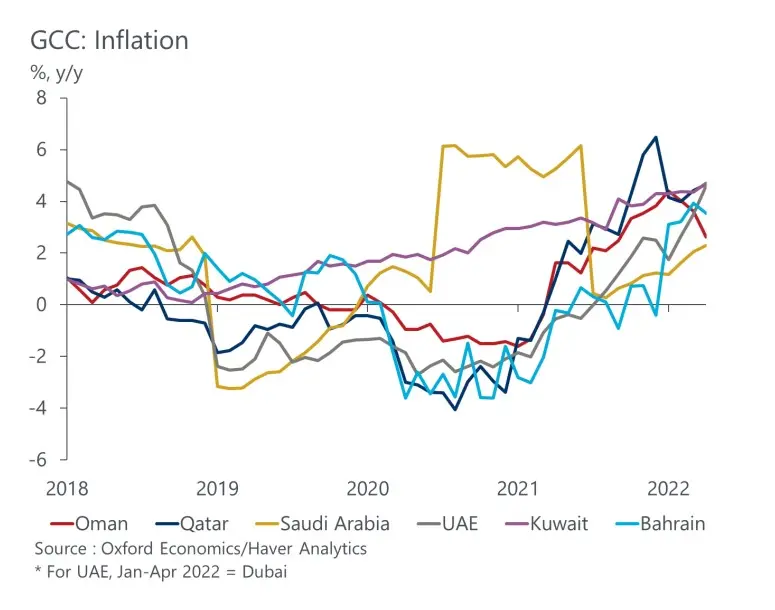

Bahrain, Qatar, Saudi Arabia all have under 20 percent share of the CPI basket accounted for by food and energy. Countries such as Oman, UAE and Turkey are slightly higher, a close to a third of consumer spending goes on these items.

While inflation is trending up in the GCC, it is still lower there than elsewhere. It has risen to around 5 percent in Qatar and Kuwait and is just over 2 percent in Saudi Arabia, “with the other countries somewhere in between”.

However, in the UAE and Saudi Arabia, factors like Expo 2020 and reforms to attract expatriates have led to stronger pick up in housing demand, which is feeding through to the headline inflation, said Livermore.

The economist also said he expected the Gulf countries to stay committed to fiscal discipline despite the windfall from oil, unlike in the past when spending tracked revenue quite closely. “I think the financially strong Gulf countries such as Saudi Arabia and UAE, were not that financially constrained anyway, prior to the crisis, with access to capital markets. So far, there's been little sign that the oil windfall is being recycled into additional spending," he said.

The oil windfall also eases pressure on the more fiscally constrained economies, such as Oman and Bahrain. And so far, they're staying committed to the fiscal plans that they have laid out to move them back to more budget balance over the medium term, he said.

(Reporting by Brinda Darasha; editing by Seban Scaria)