PHOTO

Saudi Arabia’s market regulator has approved three IPOs, two of which will list on the NOMU Parallel Market, while the third remains to be announced.

Property developer AlRamz Real Estate Company will float 12,857,143 shares, representing 30% of its share capital. This is the firm’s second attempt at a NOMU IPO, following a 2022 announcement to float a 10% stake, which was scrapped a month later upon consultation with its financial advisor ANB Capital, the company said at the time.

The Saudi CMA has also approved the NOMU IPO of Abdulaziz Ahmad Altwijri Trading Company, which plans to list 1 million shares, representing 20% of its share capital.

The company, which deals in the sale of cosmetics to medical supplies and general commodity goods, had earlier announced a NOMU float in June 2023, which included a 600,000-share offering.

However, later that month, financial advisor and lead manager Yaqeen Capital announced the incompletion of the offering.

A third company that has received a nod of approval from the CMA is the Saudi-based Consolidated Gruenenfelder Saady Holding Company (CGS), which has registered an offering of 30 million shares, representing 30% of its share capital.

CGS, a Swiss-Saudi joint venture, also known as the Coldstores Group of Saudi Arabia, operates in industrial and commercial refrigeration transporting and storage solutions.

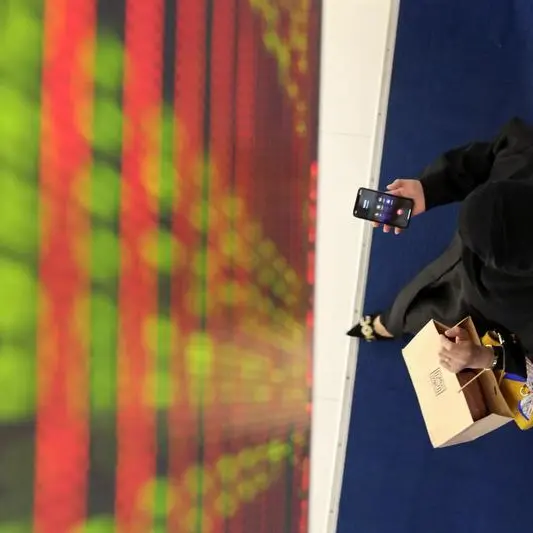

Saudi has seen a surge in listings on its Parallel Market in the first half of 2025 with close to 20 IPOs, according to Tadawul data.

(Writing by Bindu Rai, editing by Seban Scaria)