PHOTO

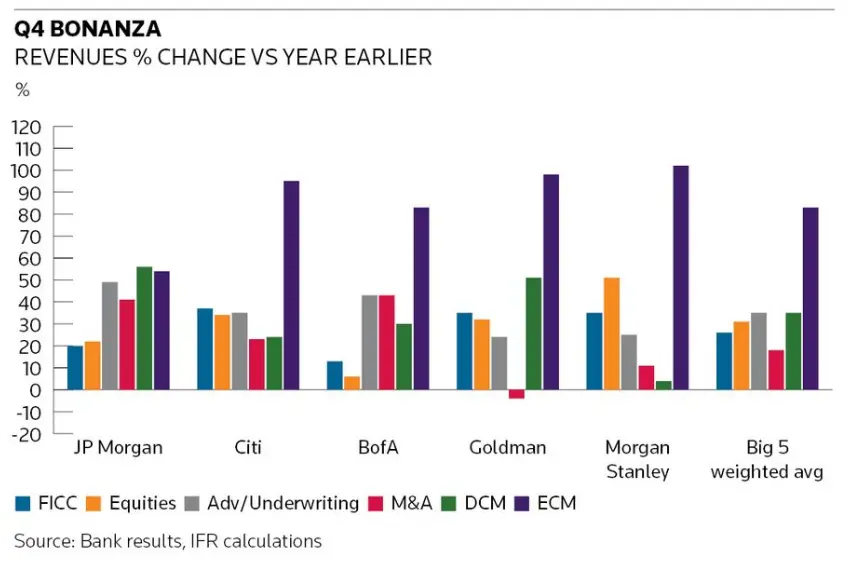

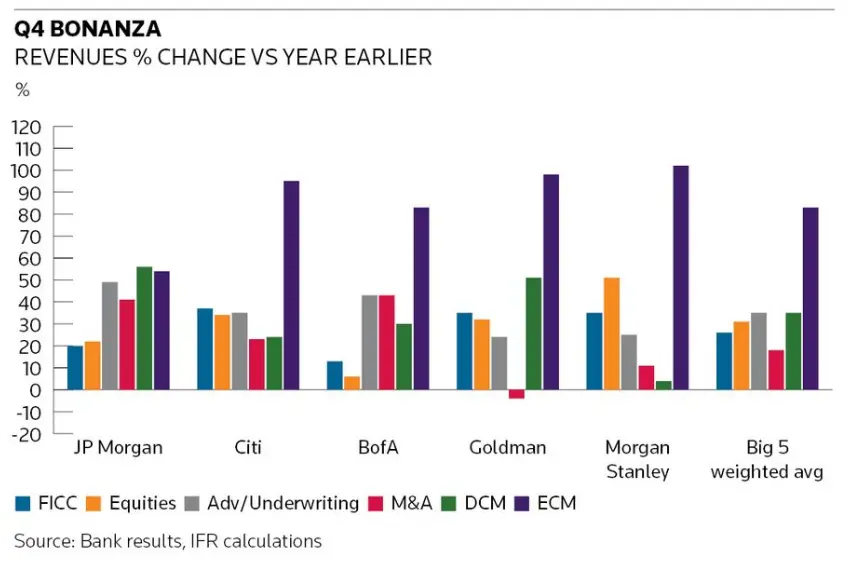

Banking and trading revenue soared in the fourth quarter as the election of US president Donald Trump unleashed euphoria about taxes and deregulation impacting M&A, debt and equity underwriting and markets. And banks expect the performance to continue in 2025.

Business bosses are more confident than they have been in a while, said leaders at all top five US banks, and they are in the mood to do deals.

Investment banking revenue in the fourth quarter jumped 35% from a year earlier to US$8.8bn across the five US banks of JP Morgan, Goldman Sachs, Bank of America, Morgan Stanley and Citigroup.

“While no one has a crystal ball, there are a number of catalysts that we believe will continue to drive activity,” Goldman chief executive David Solomon told analysts. “There has been a meaningful shift in CEO confidence, particularly following the results of the US election.”

Morgan Stanley CEO Ted Pick described the changing environment in rates and geopolitical uncertainty as “paradigm shifts juxtaposed against renewed investor and corporate confidence”, which he said present significant opportunities.

Pick said Morgan Stanley is positioned to take advantage and its M&A pipeline is perhaps the strongest it's been in five to 10 years. “I think as we move through the year, if we continue to have reasonably constructive markets and reasonably predictable interest rates and reasonable sort of geopolitical backdrop, we are going to see increasing activity as the year goes on.”

For investment banking, covering advisory and underwriting, JP Morgan was once again at the top in the fourth quarter with revenues of US$2.48bn, up 49% from a year earlier. It was followed by Goldman, whose revenue rose 24% to US$2.05bn. BofA just edged out Morgan Stanley for third, with investment banking revenues rising 44% to US$1.65bn and 25% to US$1.64bn, respectively. Citi was some way behind with revenues of US$951m, up 35% on the year.

Tip of the spear

M&A is often described as the tip of the spear in investment banking as it can lead to debt and equity underwriting deals, lending and trading opportunities. Goldman remains the champ, although it lost a little ground in the last quarter.

JP Morgan pushed past Goldman in the fourth quarter to record the highest M&A revenues of US$1.06bn, up 41% compared with a year earlier, as it benefited from large deals and share growth in a number of key sectors. Goldman's advisory revenue dipped 4% to US$960m. Goldman still finished the year as the top M&A house, but the stage is set for a battle in 2025.

“There is a significant backlog from sponsors and an overall increased appetite to dealmaking supported by an improving regulatory backdrop,” Solomon said. “There's been a meaningful pickup in large-cap M&A dialogue and enquiries; there’s been a meaningful pickup in sponsor dialogue.”

Pick called M&A the “top of the waterfall, the highest margin product”, and Morgan Stanley's advisory revenue rose 11% to US$779m in the quarter.

BofA's advisory revenue rose 43% to US$556m and at Citi it rose 23% to US$353m. Across the five banks, M&A fees were up 18% in aggregate to US$3.7bn, despite the dip at Goldman.

“The fourth quarter saw strong momentum as the election results provided a lifted sentiment for a more pro-business climate and expectations for more deals to be completed,” said BofA CFO Alastair Borthwick.

While bank analysts were encouraged by the quarter, some were not sure if the release of so-called animal spirits will be sustained or could be fleeting.

“There were some extraordinary circumstances that all came into play in the third and fourth quarters,” said Chris Whalen, chairman of Whalen Global Advisors.

“In the third quarter we were expecting a recession, then the narrative changed – then: 'nah no recession'. The underwriting numbers were great for everybody across the board – it was pretty extraordinary," Whalen said. “I just don’t know that banks are going to be able to repeat that.”

Can you repeat that?

The turnaround in equity underwriting was the most dramatic feature of the quarter. ECM fees in aggregate hit US$2bn for the five banks, up 83% as strong equity markets supported robust issuance activity. ECM revenue suffered the steepest declines during the deals rout of the last two years.

Goldman's ECM revenue rose 98% to US$499m in the quarter to edge just US$1m past JP Morgan, where ECM revenue rose 54%. At Morgan Stanley, ECM revenue doubled to US$455m, at BofA it rose 83% to US$364m and Citi's ECM fees were up 95% to US$214m.

Revenue from debt underwriting rose 35% in aggregate across the five banks to US$3.1bn, spurred by higher leveraged finance activity. JP Morgan's DCM revenue rose 56% to US$921m and BofA's increased 30% to US$765m. At Goldman, DCM revenue rose 51% to US$595m amid higher leveraged finance activity, given the strengthening financing conditions post-election. Morgan Stanley's DCM fees increased 4% to US$407m and at Citi they rose 24% to US$384m on continued strength in investment-grade issuance.

Only time will tell what 2025 holds, but bank bosses are expressing high levels of optimism for advisory and underwriting.

“I think you're going to see it throughout 2025,” Solomon said. “I don't want to speculate where it'll land versus 10-year averages, but it's certainly setting up to be much more constructive and robust.”

Trading revenues across all five banks also increased strongly from elevated levels the year before. In aggregate, the five banks pulled in US$15.6bn from fixed-income, currency and commodities trading in the fourth quarter, up 26% from a year earlier, while equity trading revenues hit US$11.6bn, up 31%.

Source: IFR