PHOTO

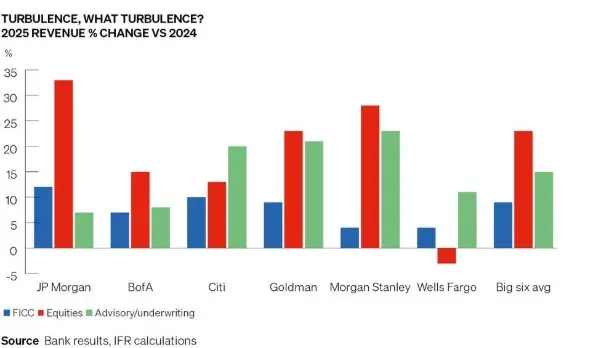

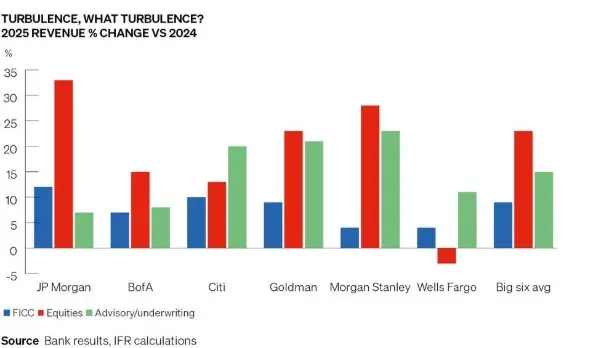

It’s back on! The top investment banks are entering 2026 with the same swagger and enthusiasm they had entering 2025, confident that a multi-year boom cycle in investment banking is underway – and hopeful that not even US president Donald Trump can blow it off course.

Across the top six US banks, fees from investment banking hit US$10.78bn in the fourth quarter, up 16% from the previous year. That was despite a fumble in the quarter by JP Morgan. Wells Fargo, which is hoping to break into the top five Wall Street firms and gained significant ground in recent years, also missed a step.

But while investment banking fees fell 5% at JP Morgan and 7% at Wells, rivals found a world of opportunity in the October-December quarter to seal a bumper year.

“Capital market revenues in 2025 beat the prior record in 2021 by 10% and should continue higher with strong backlogs, pent-up IB demand, good liquidity, and high stocks,” said Wells Fargo bank analyst Mike Mayo in a note. “The five large banks seem upbeat.”

Citigroup’s bet on investment banking paid off in the fourth quarter as fee revenue from M&A surged 84% to US$649m – a record for the quarter.

“Citi had a role in 15 out of the 25 largest investment banking transactions of the year,” chief executive Jane Fraser said on the bank’s earnings call.

Citi hired Viswas Raghavan away from JP Morgan in 2024 and he set about hiring a gang of JP Morgan employees to revitalise his new firm's investment bank.

Investment banking fees at Citi rose 35% year on year in the fourth quarter to US$1.29bn, driven by momentum in advisory across several sectors and continued market share gains, the bank said. Its revenue from debt underwriting rose 19% to US$458m, driven by investment-grade and leveraged finance debt, partially offset by lower participation in loans.

Fraser said the performance in the quarter was a direct result of the strategy to revamp the banking arm over the past two years. That restructuring is 80% complete and the bank is “decidedly on the front foot", she said.

Citi's investment banking fees for the year hit US$4.62bn, up 20% from 2024, driven by a record year in advisory, where revenue soared 53%.

“All the investments we have made translated to growth and robust market share gains,” Fraser said.

Despite the success, she said it is too early for the bank to take any victory laps.

"Kicking off a flywheel"

Goldman Sachs did take a victory lap after 23 years as the top shop in M&A advisory. Its investment banking fees in the fourth quarter were US$2.58bn, up 25%, with improvement across every segment.

Fees from debt underwriting rose 18% to US$700m and equity underwriting revenue rose 4% to US$521m. Advisory fees swelled 41% to US$1.36bn.

“M&A transactions often kick off a flywheel of activity across our entire franchise,” Goldman CEO David Solomon said.

“Whether it's acquisition financing, hedging activity, secondary market making, or investing opportunities for AWM [asset and wealth management] clients, it is unquestionable that there is a significant multiplier effect,” he told analysts on a conference call.

The increased levels of engagement across investment banking are reflected in the bank’s backlog, which Solomon said stands at its highest level in four years.

“The world is set up at the moment to be incredibly constructive in 2026 for M&A and capital markets activity,” he said.

For the year, Goldman's investment banking revenue surged 21% to US$9.34bn. Advisory fees rose 34%, while revenue from DCM and ECM rose 12% and 6%, respectively.

Boom time

Heading into 2025 banks were also optimistic, but it proved to be a turbulent year. In April, a sudden trade war launched by Trump scuttled hopes for a full-year surge in dealmaking, although it was a temporary setback and by the summer the boom was back on track, especially in M&A.

M&A fees across the five biggest banks in the fourth quarter were up 28% from a year ago, despite a 3% decline at JP Morgan.

Morgan Stanley's fourth-quarter M&A advisory fees surged 45% to US$1.13bn, the bank’s second-best quarter ever, thanks to higher completed transactions across all regions, including strong sponsor activity. Its fees from debt underwriting rose a whopping 93% year on year to a record US$785m as companies leaned into constructive financing conditions to fund strategic priorities, the bank said.

Bank of America reported a more subdued quarter in investment banking, with fee revenue up 1% at US$1.7bn. For the year, revenue from investment banking rose 8% to US$6.85bn.

Despite JP Morgan's weak fourth quarter, its annual investment banking fees reached US$9.74bn, up 7% from 2024.

Source: IFR