PHOTO

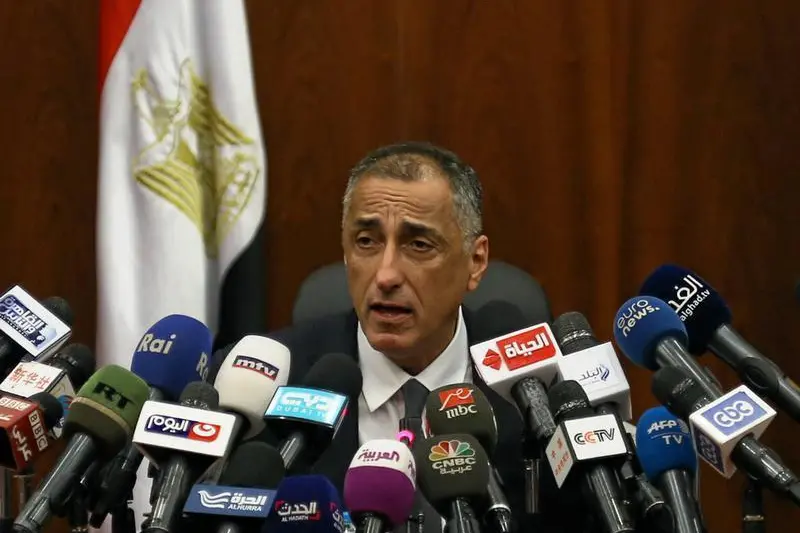

CAIRO - Egyptian President Abdel Fattah al-Sisi accepted the resignation of central bank governor Tarek Amer, more than a year before the completion of his second term, and appointed him as a presidential adviser, Sisi's office said on Wednesday.

Egypt's government bonds suffered a sell-off on international debt markets after the news of the unexpected resignation, with falls between 0.6 and 1.7 cents on the dollar and larger moves by many of the country's longer-dated bonds.

State TV said Amer had stepped down "to allow others to complete the successful development process under the leadership of the president". It gave no further details.

The change came ahead of a monetary policy committee meeting on Thursday evening where analysts polled by Reuters expect the overnight deposit rate to be raised by 50 basis points (bps) in order to keep inflation in check.

Egypt is also in the midst of negotiations for fresh financing from the International Monetary Fund.

Last month the IMF said Egypt needed to make "decisive progress" on fiscal and structural reform, and that greater exchange rate variability could have helped avoid a buildup of external imbalances and smooth adjustment to economic shocks.

Egyptian Finance Minister Mohamed Maait said late last month that the talks had made "very good progress."

On March 21, the central bank allowed the currency to weaken to about 18.45 to the dollar from its previous level of 15.70. On Wednesday, the pound was trading at about 19.12 pounds to the dollar.

After emerging from the worst of the coronavirus-induced slowdown, Egypt's economy suffered a new blow arising from Russia's invasion of Ukraine, as investors pulled billions of dollars out of its treasury market and commodity prices surged.

Annual urban consumer inflation accelerated to a higher-than expected 13.6% year-on-year in July from 13.2% in June, a three-year high.

Deputy central bank governor Gamal Negm said on Saturday that Egypt's foreign currency gap had narrowed due to central bank decisions on import regulations, and ruled out any considerable devaluation soon.

Amer, whose background was in banking, rose to vice chairman of Egypt's state-owned largest lender, National Bank of Egypt, before being appointed deputy central bank governor in 2003.

He later left the central bank to be chairman of NBE before returning as central bank governor. Amer was appointed to a four-year term in November 2015 and reappointed for another four years in November 2019. The post has a two-term limit.

(Reporting by Mohamed Hendawy, Enas Alashray, and Patrick Werr; additional reporting by Marc Jones; Writing by Nafisa Eltahir and Lina Najem; Editing by Mark Heinrich)