The Gulf's petrochemicals sector's revenues came tantalizing close to USD 100 billion, reaching USD 97.3 billion last year, despite strong headwinds, according to IHS CERA, an energy consultancy. The region earned USD 52.7 billion in export revenues last year.

Listed petrochemicals companies in the Gulf saw capacity rise to 130 million tons per year, with Saudi Arabia petrochemical production estimated to have crossed 87.5 million tons while that of Qatar is expected to have crossed 17.5 million tons, according to Global Investment House.

The sector's fourth quarter earnings rise 7.2% quarter-on-quarter and 18.4% year-on-year. Revenues of listed petrochemical companies stood just over USD 3 billion, compared to USD 2.85 billion in the previous quarter and USD 2.58 billion in the same quarter last year, Global noted.

"Fourth quarter performance of petrochemical companies was mixed as prices of petrochemical products rose while within the segment the price of fertilizer products went down significantly. Global Research Universe companies are highly dependent on fertilizers as SABIC [Saudi Arabia Basic Industries Corporation], IQ [Industries Qatar] and SAFCO [Saudi Arabian Fertilizer Company] make significant income from fertilizer operations and the prices of their product went down by double digits."

GLOBAL PERSPECTIVE

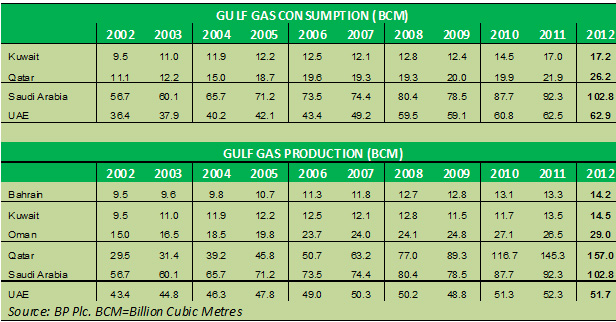

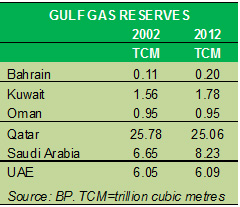

Natural gas is a key feedstock for petrochemicals and the availability and abundance of natural gas in the Middle East has transformed the regional industry into a powerhouse.

But that dominance is under threat as the global petrochemicals industry has been shaken by the arrival of cheap US shale production. The availability and abundance of cheap feedstock has revived the industry in North America and helped it emerge as a new challenger to Mideast dominance in the global markets.

Still, the American Chemistry Council expects MENA petrochemicals sector to grow just under 5% each year till at least 2017.

The challenge from North America is coupled with the shortage of natural gas production.

"Mideast producers are placing more emphasis on adding value to basic petrochemicals because of a shortage of advantaged feedstocks," noted IHS CERA in a recent report on global petrochemicals outlook.

Companies such as Sabic are looking to invest in North America to gain a foothold in the fast developing American market, while also keeping an eye out for opportunities to invest in Asia.

Gulf petrochemical producers have also fallen behind United States and European players and there are fears that the West's technical prowess could make Gulf producers uncompetitive.

"In the Middle East we are much behind in innovation. We have to do more; go after startups, globalize our innovation capability," Sabic CEO Mohamed al-Mady told reporters on the sidelines of a conference in Dubai on March 13.

GAS SHORTAGES

Among Gulf states, only Qatar and Bahrain have adequate gas supplies to meet current gas demand, and generate a surplus.

"The remaining GCC members are either struggling to meet demand with current supply or have already been forced to turn to pipeline gas or LNG imports, or use crude and refined products to supplement gas as feedstock to generate electricity," wrote Amy Myers Jaffe, executive director of Energy and Sustainability, Graduate School of Management and the Institute of Transportation Studies at the University of California.

"The projected rise in natural gas demand forecast for the GCC states for the next decade will exacerbate the supply situation in all of the Gulf nations except Qatar, particularly if politics and economics continue to delay anticipated tight gas development projects."

While petrochemicals sector requires more natural gas, the Gulf states have also embarked on a massive investment spree running into hundreds of billions of dollar, which demand greater natural gas use for electricity.

"Regional trade has served to alleviate some of these pressures but geopolitical variables and commercial factors, including subsidized domestic energy prices, has prevented the efficient development of reserves and regional transport infrastructure," Jaffe noted.

In Oman, BP is looking to produce 1 billion cubic feet per day (bcfd) of gas and 25,000 bbl/day of gas condensate from the Khazzan field, equivalent to about one-third of Oman's current production.

Saudi Arabia is developing 1.2 billion bcfd Arabiyah gas field and the 1.3 bcfd of gas from the Hasbah field within the next four years.

"A major expansion of natural gas and natural gas liquids processing capacity from 9.3 Bcf/d to 12.5 Bcf/d is underway at Khursaniyah, Hawiyah, Ju'aymah, Yanbu, and Khurais to process increases in production," said the US Department of Energy.

"Saudi Arabia is also building a 2.5 Bcf/d Wasit Gas Plant, which will be one of the largest gas plants Saudi Aramco has ever built. It has a target completion date set at mid-2014. This plant will receive gas from the Arabiyah and Hasbah fields."

"Feedstock shortages have also led Mideast governments to increasingly favor subsidiaries or joint ventures of national energy groups for feedstock allocations, leaving independent chemical companies scrambling for raw materials," IHS noted.

To cut costs, scale up and diversify their petrochemical offerings, a number of companies have chosen to merge their businesses. Sipchem is expected to merge with Sahara Petrochemicals and other companies are expected to follow suit.

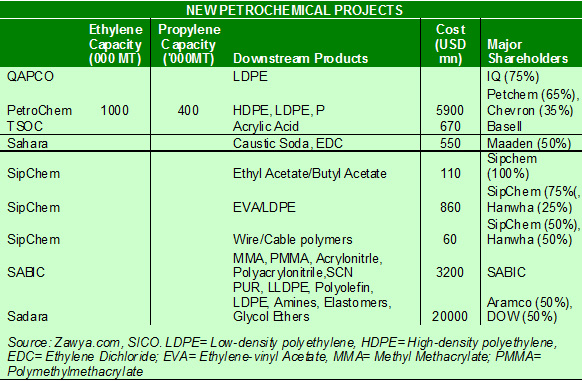

NEW PETCHEM PRODUCTION

Additional natural gas production is acutely needed as the region embarks on a new wave of investment in the petrochemicals sector.

Saudi Aramco and Dow Chemical are building a USD 20 billion Sadara joint venture project, while another Aramco joint venture Petro Rabigh will see its capacity double.

SipChem also announced that its Polybutylene Terephthalate (PBT) project was 77% complete and would start operations by the fourth quarter. The plant would produce 63,000 tons of polybutylene terephthalate (PBT) resin, used for manufacturing compounds in the automotive, electrical, electronics and IT material industries.

The company is also developing a USD 230 million Cable Insulation Polymers Plant in partnership with Hanwha Chemicals Company of South Korea.

Qatar, meanwhile, is looking to invest USD 25 billion over the next five years to extend its natural gas dominance and expand its petrochemicals sector.

The massive investment in petrochemicals needs to be backed by an equally determined effort to develop natural gas resources, and invest in international companies. The strategy is not new to Gulf companies - but it needs to be accelerated.

The feature was produced by alifarabia.com exclusively for zawya.com.

Zawya 2014