Emerging markets are eager to diversify away from the developed economies and looking to open up fresh avenues for trade, investment and exchange of product and services.

Nowhere is this more evident than in the rising trade between African states and the nations of Brazil, Russia, India, China and fellow African nation of South Africa - known as the BRICS nations.

They may be spread out geographically, but these countries have shown a strong desire and inclination to forge closer economic ties and create new opportunities.

When Angola started its liquefied natural gas project last year, its first export shipment was not to the gas-hungry markets of its traditional trading partner of Europe - it was Brazil.

"This is just one example of the growing importance of the relations between the two Lusophone [Portugese-speaking] countries. Brazil's engagement with Africa in general has been increasing significantly since the 2000s ....," said Victor Lopes, analyst at Standard Chartered Bank.

"Today, Africa remains high on Brazil's external policy agenda. The fact that president Dilma Rousseff travelled to Angola (as well as Mozambique and South Africa) just a few months after her election in October 2010 confirms the importance of the political relations with Angola in particular and Africa in general."

WHY TRADE WITH BRICS

Trading with BRICS is prized in Africa for a number of reasons. First, the key BRICS markets are economic powerhouses, comprising 40% of the global population, a quarter of the GDP and 50% of economic growth.

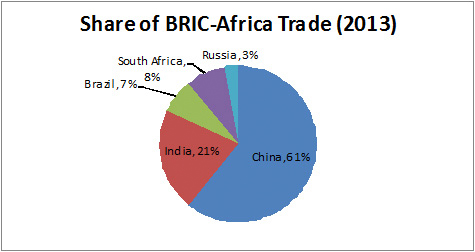

China remains unquestionably Africa's largest single trade partner, and the BRICS' cumulative trade with the continent is just 20% shy of the EU27, a larger basket of nations with far more historically entrenched platforms on the continent, noted Simon Freemantle, an analyst with Johannesburg-based Standard Bank.

"A discussion of the potential cooling of the BRICS economic momentum, as well as a slowing of the growth in interactions with Africa, should not therefore detract from an overall view of BRICS-Africa ties, which for the most part suggests long term and structural synergies."

The Centre for the Study of the Economies of Africa notes that bilateral trade between Africa and BRICS has risen tenfold to USD 350 billion over the past 10 years. The trade currently surpasses intra-BRICS trade which stands at USD 230 billion.

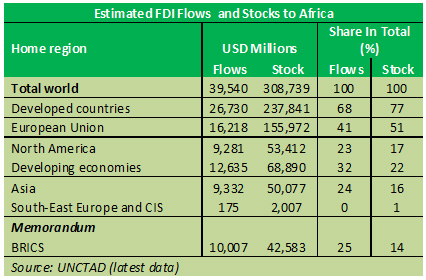

As much as 25% of all BRICS foreign direct investment was directed at Africa, with resource-rich nations such as Angola, Democratic Republic of Congo, Nigeria and Sudan the biggest beneficiaries.

Countries such as Nigeria import 42% of its machinery and transport equipment and a third of its manufacturing goods from BRICS nations. More crucially, 97% of Nigerian mineral fuels are headed for BRICS states, with India (49%), Brazil (34%), South Africa (13%) and China (4%).

Ethiopia, another country that is seeking greater ties with BRICS, exports 73% of its coffee and other soft commodities to China alone, while its leather exports are increasingly heading to Brazil to the west and India to the east.

AFRICAN DOWN UNDER

The economic group of South Africa, Botswana, Lesotho, Namibia and Swaziland, known as SACU is also pursuing a preferential trade agreement (PTA) with the MERCOSUR countries comprising Brazil, Argentina, Paraguay and Uruguay.

FRIENDS NOT FORMER MASTERS

The Africa-BRICS partnership benefits from the lack of emotional and historical baggage between the two regions.

European countries continue to have an economic and political foothold in their former colonies in Africa, and new investments from the former masters often leads to resentment from African citizens.

Similarly, United States' investments are often viewed with some suspicion, especially when Washington uses its loans and aid leverage to question African nations on their human rights issues.

For better or for worse, African dialogue with BRICS nations skirts past awkward political discussions.

This is especially true in Angola where Brazil has emerged as a competitor to Portugal's influence, which has strong cultural and historical ties with Angola.

"Brazil does not have the colonial background that can sometimes be a liability for Portugal and also has not suffered from diplomatic tensions," said Lopes. "Investigations by the Portuguese Public Prosecutor into Angolan officials' deals in Portugal have led to growing tensions. The Angolan president has even called into question the strategic partnership between the two countries."

RISING SOUTH-SOUTH TRADE

"The BRICS-Africa Trade fosters robust 'South-South' Cooperation and avenue to promote African issues in the global landscape," CSEA noted in a presentation. "Recent growth experiences of many African countries are [driving] BRICS' demand for resources (the mineral-dollar stimulus)."

Indeed, even as Africa's traditional partners European Union and North America wobbled and slowed down over the past five years, growth rates in China, India, Brazil and Russia helped many African states post stellar economic growth.

But 2013 was a subdued year for BRIC-Africa trade as many emerging market nations worked through their domestic issues.

"Where in 2009 we estimated that BRICS-Africa trade would reach USD 500 billion by 2015, we would now more comfortably suggest that volumes will rest at closer to USD 400-USD 420 billion within this time frame," Freemantle said.

This slowing export growth was partly offset in terms of overall trade volumes by a sustained lift in African imports from the BRICS economies.

"Clearly, robust demand from fast-growing African economies is wedded to industrial output from the BRICS. And, given our forecast for rising average GDP growth across Sub-Sahara Africa in 2014, this trend will likely continue."

The feature was produced by alifarabia.com exclusively for zawya.com.

Zawya.com 2014