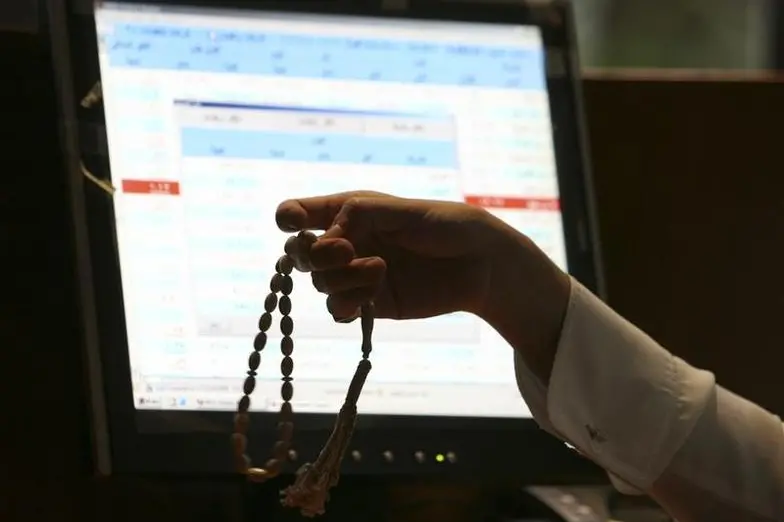

PHOTO

By Lulwa Shalhoub

MANAMA: With the growing demand for Islamic finance around the world, including non-Muslim countries, the need for specially-educated professionals in the field becomes crucial. Islamic finance is estimated to have been growing globally at an annual rate of more than 10 percent.

“This growth suggested that Shariah-compliant banking has more to offer than simply being a way to serve the need of the 1.5 billion Muslims around the globe,” said Ahmed Alkholifey, chairman of Saudi Arabian Monetary Authority (SAMA), in his keynote speech on the second day of the 23rd World Islamic Banking Conference.

He noted that the Islamic banking industry has grown significantly across the globe over the past two decades.

According to him, this Shariah-compliant banking showed a far higher level of resilience than conventional banking during the international financial crisis.

Non-Muslim countries such as China and Russia are increasingly becoming interested in adopting the system in order to develop their economy, the official added.

In March this year, the Russian city of Kazan became home to the first Islamic bank in Russia. As the demand increases internationally, a great need arises for hands-on educational and training programs.

“The fast-growing Islamic banking industry requires qualified and well trained people in many disciplines and at various levels. We urgently need to focus on that. More efforts need to be coordinated among regulators and banks in order to specify the areas where there is scarcity of human capital,” Alkholifey said.

As an attempt to tackle the lack of human capital in Islamic banking industry, the Bahrain Institute of Banking and Finance (BIBF) attempts to educate and train individuals on the field providing degrees that combine theory and practice.

These degrees are accustomed to what the market requires.

“We have seen a spike in international students, especially from the GCC region, but our plans are to promote it internationally beyond the GCC in the next year as a distance-learning program. Currently it is a classroom training,” Mujtaba Khalid, head of the Islamic Finance Center at the BIBF, told Arab News.

Saudi bankers are among clients of the BIBF’s main training programs in addition to banks across the Gulf region.

“We provide training to most of the top banks in Saudi Arabia, such as NCB (the National Commercial Bank) and AlBilad Bank. They trust the quality of our training. Our non-profit body focuses on quality education,” Ahmed A. Hameed Al-Shaikh, deputy director of BIBF, told the Arab News.

Education provided at BIBF is tailored to cater to each group of students as needed. Students and trainees from non-Muslim countries that are interested in adopting Islamic finance in their financial system are initially taught basic facts about Islamic finance and the concept of Shariah-compliant banking services.

One of the most popular courses is Advanced Diploma in Islamic Finance (ADIF), which gives a general yet intensive overview of Islamic finance.

“We have an assessment center where we do training need analysis and see what the client wants and what the expected outcome is. Based on that, we come up with a proposal. So it depends on what your background is. If you have a prior background then we give you an advanced course. If you do not have any background, we start teaching you from scratch,” Al-Shaikh added.

© Arab News 2016