PHOTO

14 February 2017

By Gerard Aoun and Nada Al Rifai

Gulf bourses put in mixed performances in January with Kuwait outperforming the region in a bull run ahead of the government unveiling economic development plans, while the UAE remained the top pick within the regional equities portfolio due to its diversified economy and more attractive valuations.

Last month also saw the introduction of new measures aimed at deepening markets, including approval of short selling on the Dubai Financial Market and a new trade settlement cycle on the Saudi stock exchange that would facilitate its inclusion in the MSCI Emerging Markets index.

Global markets and commodities movements continue to influence regional trends, particularly the strengthening of oil prices after OPEC and non-OPEC producers trimmed production under a pact that went into effect in January to shore up oil markets.

Global and emerging markets dipped after U.S. President Donald Trumps move to impose travel bans on seven Muslim majority countries within one week of taking office hit sentiment towards equities globally. There is also uncertainty about the potential impact of U.S. protectionist measures on global trade.

I think Trumpanomics is the theme of the month," Chiradeep Ghosh, Lead - Financial Institution Research at Securities and Investment Company (SICO) Bahrain, told the Trading Middle East (TME) online forum last week. Obviously the impact of policies on oil and money flow to emerging markets are the main factors that will guide investors.

The U.S. dollar had been trading in an upward trend since the U.S. elections, but lack of clarity over Trumps promised fiscal stimulus has pushed it on sharp reversal since the start of the year.

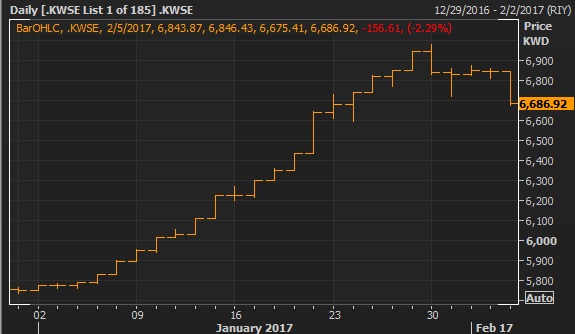

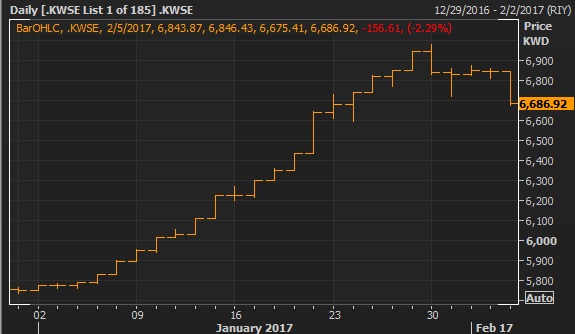

Data from Thomson Reuters Eikon

The U.S. Federal Reserve held its first meeting after Trump took office without announcing any new interest rate hikes or hinting at when it will carry out the first of its projected three rate hikes of the year. The currencies of Gulf states, with the exception of Kuwait, are pegged to the dollar, which reduces emerging market exchange rate risk. Most Gulf central banks often follow the U.S. Federal Reserve interest rate moves.

Kuwait bull run

Kuwait was the strongest performing Gulf market in January, with the index surging 18.86 percent that month on increased fund flows.

Kuwait bourse has never seen such an uptrend since the financial crisis of 2008. This positive momentum in the market is expected to last for at least three to five more months, the local Arabic-language Al Qabas newspaper quoted economic expert Amar Marafie as saying.

Data from Thomson Reuters Eikon

The surge is partly driven by the fact that Pakistan will leave MSCI's frontier market index in May, increasing Kuwait's weighting, according to a Reuters report.

Kuwait also released its 2017/2018 budget projecting a much lower deficit than the previous fiscal year and higher government spending. It allocated $100 billion for its five-year development plan to 2021, $15 billion of which would be spent between 2017 and 2018 to diversify the economy away from oil revenues.

A monthly Reuters poll of Middle East fund managers, published on January 31, found them split on Kuwait, with 38 percent expecting to raise their allocations there in the next three months and 38 percent expecting to reduce them.

UAE top pick

The UAE remained the top pick, according to the Reuters poll, with many fund managers citing the fact that the countrys economy was less reliant on oil and attractive valuations compared to Gulf peers.

Dubais stock index rose 3.17 percent in January, starting the year on a strong note after breaking the resistance level of 3,659 points in December.

Data from Thomson Reuters Eikon

December witnessed a great movement triggered by the retail stocks which dragged into 2017, Marie Salem, Director Capital Makets at FFA Dubai Limited, told TME last week.

New highs and higher volumes on the exchange due to positive sentiment among investors pushed the index as high as 3,738 before witnessing a correction accompanied by profit taking. We still await blue chips to follow the rally we saw on the retail equities, she added.

Abu Dhabis index was little moved, edging up 0.05% in January. At the end of 2016, Abu Dhabis stock market announced plans to introduce covered short-selling in the first quarter of 2017, a move that could increase trading liquidity.

Data from Thomson Reuters Eikon

Dubai Financial Market also said early January that it plans to introduce covered short-selling in the next few months.

Saudi looks to non-oil sector activity

The Saudi index dropped 1.51 percent in January, weighed down by weak fourth quarter corporate earnings, but saw an uptrend later in the month on expectations that non-oil private sector activity would improve, including the construction sector, as the government moves to slow austerity measures that have helped the state trim a record budget deficit.

Sideways trading is what we have witnessed post the correction that followed the earnings season where the index dropped 300 points to reach 6,757.25 before making it back to the 7000 levels, Salem said. The banking sector has been strong despite the earnings announced. Volatility remains high with slightly lower volumes into the beginning of February.

Data from Thomson Reuters Eikon

Petrochemical shares have been buoyed by the recovery in oil prices. A Reuters poll covering 29 economists and analysts showed that oil prices are expected rise to $60 per barrel by the end of 2017, with further upside capped by a strong dollar, a likely recovery in U.S. oil output and possible non-compliance by OPEC with agreed cuts.

In a move to boost its chances of including the Saudi stocks in the widely tracked MSCI Emerging Markets index, Tadawul announced introducing T+2 settlement cycle in the second quarter of 2017- which allows settlement of trade within two working days

"The removal of the existing T+0 settlement cycle is the last requirement standing between Saudi Arabia and entry into the MSCI Emerging Markets index," said Fahd Iqbal, head of Credit Suisses Middle East Research in a research note.

The Saudi stock exchange also announced plans to introduce Nomu-Parallel Market on February 26 -- a market with less listing requirements than the traditional bourse in terms of market value, number of shareholders, and offered share percentages. This will in turn open up new investment possibilities for small- to medium-sized businesses.

Gerard Aoun is the editor for Trading Middle East. To join the Trading Middle East community please click here.

Zawya 2017

By Gerard Aoun and Nada Al Rifai

Gulf bourses put in mixed performances in January with Kuwait outperforming the region in a bull run ahead of the government unveiling economic development plans, while the UAE remained the top pick within the regional equities portfolio due to its diversified economy and more attractive valuations.

Last month also saw the introduction of new measures aimed at deepening markets, including approval of short selling on the Dubai Financial Market and a new trade settlement cycle on the Saudi stock exchange that would facilitate its inclusion in the MSCI Emerging Markets index.

Global markets and commodities movements continue to influence regional trends, particularly the strengthening of oil prices after OPEC and non-OPEC producers trimmed production under a pact that went into effect in January to shore up oil markets.

Global and emerging markets dipped after U.S. President Donald Trumps move to impose travel bans on seven Muslim majority countries within one week of taking office hit sentiment towards equities globally. There is also uncertainty about the potential impact of U.S. protectionist measures on global trade.

I think Trumpanomics is the theme of the month," Chiradeep Ghosh, Lead - Financial Institution Research at Securities and Investment Company (SICO) Bahrain, told the Trading Middle East (TME) online forum last week. Obviously the impact of policies on oil and money flow to emerging markets are the main factors that will guide investors.

The U.S. dollar had been trading in an upward trend since the U.S. elections, but lack of clarity over Trumps promised fiscal stimulus has pushed it on sharp reversal since the start of the year.

Data from Thomson Reuters Eikon

The U.S. Federal Reserve held its first meeting after Trump took office without announcing any new interest rate hikes or hinting at when it will carry out the first of its projected three rate hikes of the year. The currencies of Gulf states, with the exception of Kuwait, are pegged to the dollar, which reduces emerging market exchange rate risk. Most Gulf central banks often follow the U.S. Federal Reserve interest rate moves.

Kuwait bull run

Kuwait was the strongest performing Gulf market in January, with the index surging 18.86 percent that month on increased fund flows.

Kuwait bourse has never seen such an uptrend since the financial crisis of 2008. This positive momentum in the market is expected to last for at least three to five more months, the local Arabic-language Al Qabas newspaper quoted economic expert Amar Marafie as saying.

Data from Thomson Reuters Eikon

The surge is partly driven by the fact that Pakistan will leave MSCI's frontier market index in May, increasing Kuwait's weighting, according to a Reuters report.

Kuwait also released its 2017/2018 budget projecting a much lower deficit than the previous fiscal year and higher government spending. It allocated $100 billion for its five-year development plan to 2021, $15 billion of which would be spent between 2017 and 2018 to diversify the economy away from oil revenues.

A monthly Reuters poll of Middle East fund managers, published on January 31, found them split on Kuwait, with 38 percent expecting to raise their allocations there in the next three months and 38 percent expecting to reduce them.

UAE top pick

The UAE remained the top pick, according to the Reuters poll, with many fund managers citing the fact that the countrys economy was less reliant on oil and attractive valuations compared to Gulf peers.

Dubais stock index rose 3.17 percent in January, starting the year on a strong note after breaking the resistance level of 3,659 points in December.

Data from Thomson Reuters Eikon

December witnessed a great movement triggered by the retail stocks which dragged into 2017, Marie Salem, Director Capital Makets at FFA Dubai Limited, told TME last week.

New highs and higher volumes on the exchange due to positive sentiment among investors pushed the index as high as 3,738 before witnessing a correction accompanied by profit taking. We still await blue chips to follow the rally we saw on the retail equities, she added.

Abu Dhabis index was little moved, edging up 0.05% in January. At the end of 2016, Abu Dhabis stock market announced plans to introduce covered short-selling in the first quarter of 2017, a move that could increase trading liquidity.

Data from Thomson Reuters Eikon

Dubai Financial Market also said early January that it plans to introduce covered short-selling in the next few months.

Saudi looks to non-oil sector activity

The Saudi index dropped 1.51 percent in January, weighed down by weak fourth quarter corporate earnings, but saw an uptrend later in the month on expectations that non-oil private sector activity would improve, including the construction sector, as the government moves to slow austerity measures that have helped the state trim a record budget deficit.

Sideways trading is what we have witnessed post the correction that followed the earnings season where the index dropped 300 points to reach 6,757.25 before making it back to the 7000 levels, Salem said. The banking sector has been strong despite the earnings announced. Volatility remains high with slightly lower volumes into the beginning of February.

Data from Thomson Reuters Eikon

Petrochemical shares have been buoyed by the recovery in oil prices. A Reuters poll covering 29 economists and analysts showed that oil prices are expected rise to $60 per barrel by the end of 2017, with further upside capped by a strong dollar, a likely recovery in U.S. oil output and possible non-compliance by OPEC with agreed cuts.

In a move to boost its chances of including the Saudi stocks in the widely tracked MSCI Emerging Markets index, Tadawul announced introducing T+2 settlement cycle in the second quarter of 2017- which allows settlement of trade within two working days

"The removal of the existing T+0 settlement cycle is the last requirement standing between Saudi Arabia and entry into the MSCI Emerging Markets index," said Fahd Iqbal, head of Credit Suisses Middle East Research in a research note.

The Saudi stock exchange also announced plans to introduce Nomu-Parallel Market on February 26 -- a market with less listing requirements than the traditional bourse in terms of market value, number of shareholders, and offered share percentages. This will in turn open up new investment possibilities for small- to medium-sized businesses.

Gerard Aoun is the editor for Trading Middle East. To join the Trading Middle East community please click here.

Zawya 2017