PHOTO

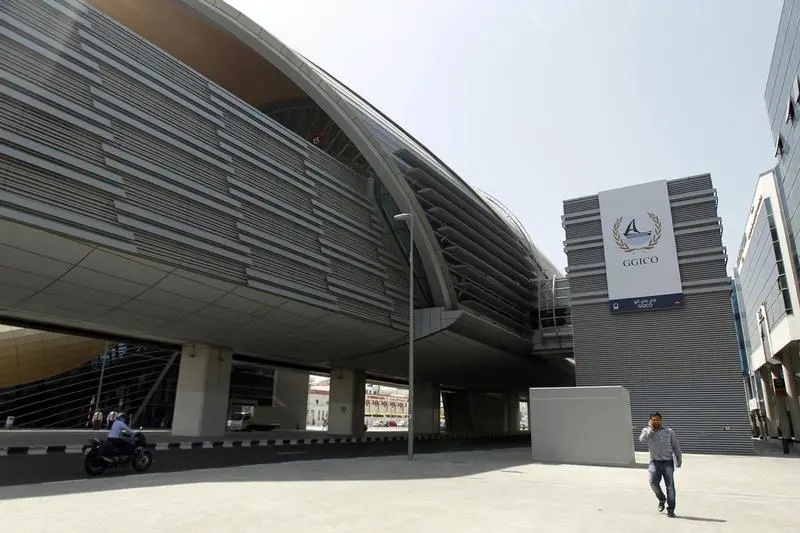

DUBAI, May 15 (Reuters) - Dubai-listed conglomerate Gulf General Investment Co

GGIC.DU

(GGICO) said on Monday it expected to complete a restructuring of around 2.36 billion dirhams ($643 million) in loans by next month.

The firm, which has investments spanning financial services, property, hospitality, manufacturing and retailing, previously renegotiated 2.8 billion dirhams in financial commitments in 2012.

But the subdued local economy prompted the company to revisit that debt restructuring last year.

urn:newsml:reuters.com:*:nL8N1C44AI

urn:newsml:reuters.com:*:nL8N1DF1MG

A new restructuring plan is being discussed with a committee of banks tasked with negotiating on behalf of all creditors on debt totalling 2.1 billion dirhams, it said on Monday in its financial statement.

Payments of interest and principal debt, which had been due last year, will be paid as part of the restructuring plan, it said.

Separately, GGICO is in talks with an unidentified financial institution to restructure credit of 257.04 million dirhams, which had been due to be repaid on Sept. 30, 2016, the statement said.

Several other companies in the United Arab Emirates have sought help on their debt payments in the past year or so against a backdrop of lower government and consumer spending linked to weaker oil prices.

urn:newsml:reuters.com:*:nL5N1HE0TL

urn:newsml:reuters.com:*:nL8N1ID2MN

urn:newsml:reuters.com:*:nL8N1IA1KU

GGICO said that some of its businesses were also in talks with banks to restructure 267.2 million dirhams in debt. It added that as of March 31 one of the group's entities, which it didn't identify, had not complied with certain financial covenants on a 102.2 million loan.

($1 = 3.6724 UAE dirham)

(Reporting by Tom Arnold, editing by Louise Heavens) ((Tom.Arnold@thomsonreuters.com; +97144536265; Reuters Messaging: tom.arnold.thomsonreuters.com@reuters.net))

The firm, which has investments spanning financial services, property, hospitality, manufacturing and retailing, previously renegotiated 2.8 billion dirhams in financial commitments in 2012.

But the subdued local economy prompted the company to revisit that debt restructuring last year.

A new restructuring plan is being discussed with a committee of banks tasked with negotiating on behalf of all creditors on debt totalling 2.1 billion dirhams, it said on Monday in its financial statement.

Payments of interest and principal debt, which had been due last year, will be paid as part of the restructuring plan, it said.

Separately, GGICO is in talks with an unidentified financial institution to restructure credit of 257.04 million dirhams, which had been due to be repaid on Sept. 30, 2016, the statement said.

Several other companies in the United Arab Emirates have sought help on their debt payments in the past year or so against a backdrop of lower government and consumer spending linked to weaker oil prices.

GGICO said that some of its businesses were also in talks with banks to restructure 267.2 million dirhams in debt. It added that as of March 31 one of the group's entities, which it didn't identify, had not complied with certain financial covenants on a 102.2 million loan.

($1 = 3.6724 UAE dirham)

(Reporting by Tom Arnold, editing by Louise Heavens) ((Tom.Arnold@thomsonreuters.com; +97144536265; Reuters Messaging: tom.arnold.thomsonreuters.com@reuters.net))