PHOTO

Abu Dhabi’s Mubadala Investment Company has joined a group of Asian companies to acquire nearly half of the stake in South Korean botox maker Hugel from Bain Capital.

The sovereign wealth fund is part of a consortium led by Singapore-based healthcare investment firm CBC Group that signed on Wednesday a definitive agreement to own equity interest in the medical aesthetics company.

The transaction is estimated to cost around 1.7 trillion won ($1.5 billion) and will involve the transfer of the 46.9 percent stake held by the US private equity firm, according to media reports.

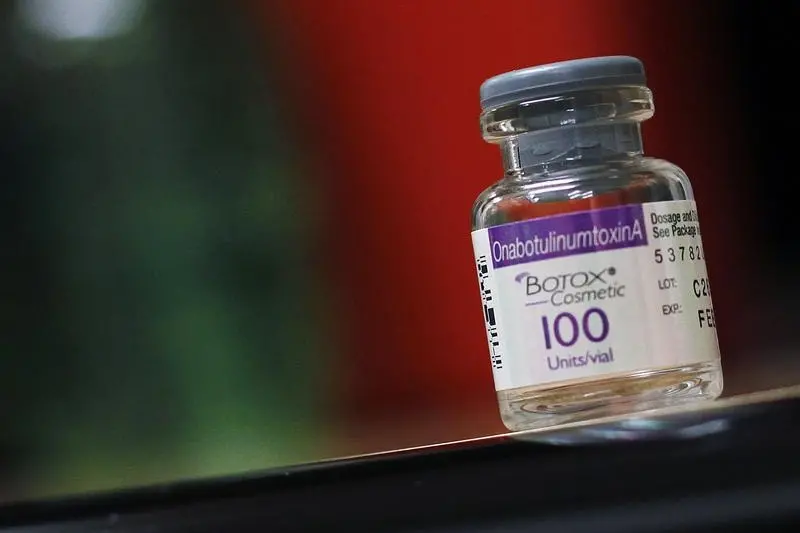

Hugel has a market capitalization of around $2.5 billion. It is a leader in the botulinum toxin and hyaluronic acid fillers space in Korea and also develops, manufactures and distributes cosmeceutical products.

The other firms who are part of the consortium are GS Holdings Corp. (GS), a business group in South Korea and IMM Investment Corp., an investment firm also based in the Asian state with investments across alternative asset classes.

According to Camilla Macapili Languille, head of Life Sciences at Mubadala, the investment cements the company’s entry into the Asian market.

“We are very excited about embarking on Hugel’s growth journey in partnership with CBC, GS and IMM. This opportunity cements Mubadala Life Sciences’ entry into Asia alongside our colleagues from the Mubadala’s China Investment Program team, who already have an established presence in China and a long-standing relationship with CBC,” Languille said in a statement.

“We will work closely with our consortium partners and leverage our network to support Hugel’s vision of becoming a leading global medical aesthetics company.”

(Writing by Cleofe Maceda; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021