- Earnings before tax (EBT) of SAR 28.5 million, at margin of 38.9%

- Net real estate financing portfolio grew by 9.56% or SAR 305.6 million

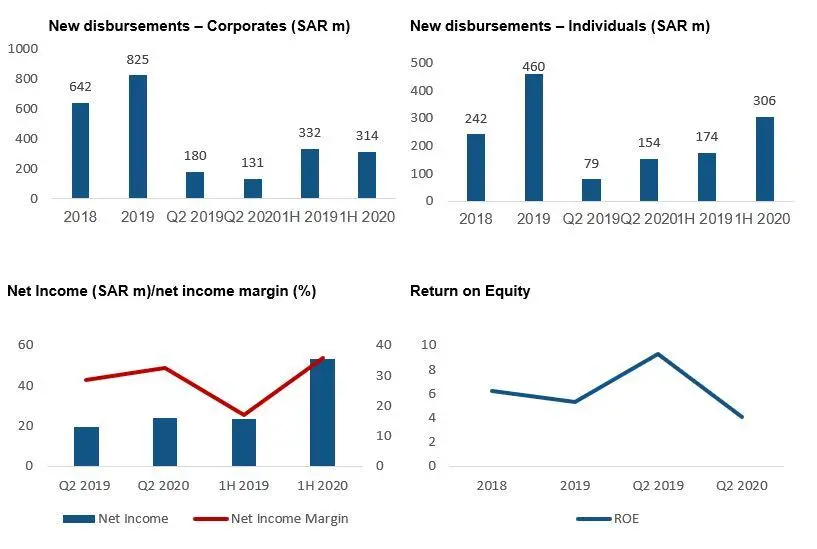

- New disbursements across the lending book increased by 32%

- Amlak completed its listing on Tadawul in July, under ticker symbol 1182

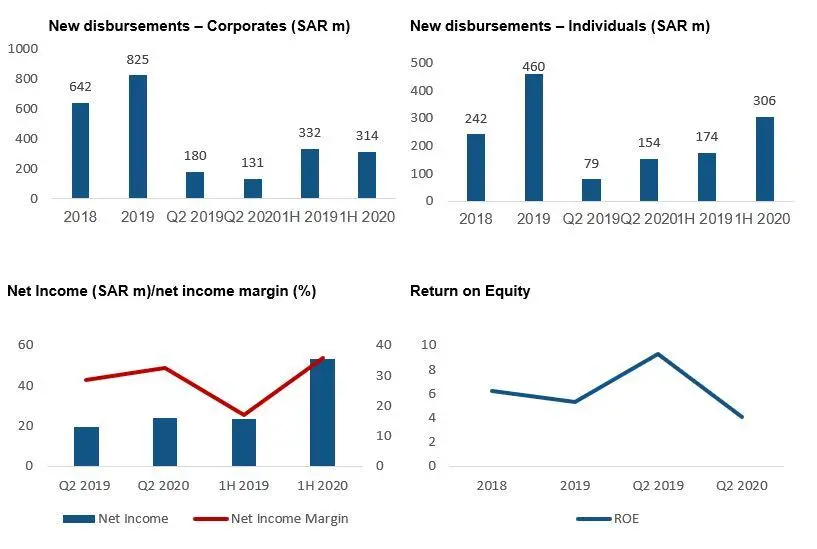

Riyadh, Saudi Arabia: Saudi Arabia’s leading non-bank real estate lender, Amlak International (“Amlak” or the “Company”), has announced its financial results for the period ended 30 June 2020. Net income grew by 20.9% y-o-y to SAR 23.8 million for the Q2 2020 period, and by 129% y-o-y to SAR 53.3 million for 1H 2020, with total revenues increasing by 6.2% y-o-y to reach SAR 73.2 million for Q2 2020 and 7.9% y-o-y to SAR 148.4 million for 1H 2020 . Earnings before tax (EBT) increased by 16% y-o-y to SAR 28.5 million for Q2 2020, at a margin of 38.9%, and by 27% y-o-y to SAR 61.8 million for 1H 2020. The Company recently completed the offering of 30% of its equity on the Saudi Stock Exchange – Tadawul – raising approximately SAR 435 million.

Amlak’s total financing portfolio increased to SAR 3.5 billion across its individual and corporate book. Growth in new financing contracts to individuals saw an increase in value of 75.32%, with the corporate lending book accounting for 69% of Amlak’s total portfolio.

The results for the period included a SAR 6.4 million impairment allowance for expected credit losses (ECL), increasing credit provision from SAR 89.7 million as at December 2019 to SAR 96.1 million as at June 2020. The increase results from the expected impact of the Covid-19 pandemic to the Company’s business.

Commenting on first half performance, Abdullah Al Sudairy, CEO of Amlak International, said:

“The second quarter was a challenging period for businesses across the Kingdom, as measures to contain the Covid-19 pandemic impacted the economy. Despite these headwinds, we have seen growth in our lending portfolio. Top- and bottom-line performance remains healthy. As demonstrated by our own performance, we believe that the current situation is challenging but remains acceptable, and we believe in positive long-term fundamentals. We also saw the roll-out of supportive policies for the sector, including a range of SAMA initiatives, which allow financing companies to postpone financial commitments to bank payments for up to six months. These have been accommodative and have enabled us to relieve some pressure on borrowers.”

Financial and operating highlights: Q2 2020

- Net Real estate financing reached SAR 3.5 billion

- Bank borrowing increased by SAR 286 million from December 2019 to reach SAR 2.37 billion

- Gross revenue reached SAR 148.4 million for 1H 2020 compared to SAR 137.6 million for 1H 2019, driven by growth in the portfolio

- Net profit before Zakat in 1H 2020 increased to SAR 61.8 million y-o-y

- Net profit after Zakat increased to SAR 53.3 million for 1H 2020, compared to SAR 23.3 million for 1H 2019, a result of business growth and Zakat settlement for the previous year

- Amlak has exploited a sound business model, a highly agile digital operating platform (Temenos 24) and robust risk management procedures, allowing it to maintain regular operations and sustained healthy financial results during the pandemic period

- Amlak’s lean and scalable business model continues to allow it to capture new opportunities.

Covid-19: impact and response

The Covid-19 pandemic has had a limited impact on the Company so far, and the reopening of the Saudi economy bodes well for the gradual return of confidence in the market. The Company adapted quickly to new conditions, moving operations online with no disruption to disbursals or collections. Its online operating system – Temenos 24 – and risk management procedures have put it in a strong position to maintain regular operations.

The short-term revenue impact of the pandemic has so far been minimal, as the portfolio is mostly comprised of long-term tenors. Amlak has increased provisions to account for potential risks related to delinquencies that might arise from customers’ cash flow challenges.

Growth strategy

Amlak’s strategy for growth is focused on its home market of Saudi Arabia, and on the core business of secured lending to corporates and individuals. The Company has identified a clear opportunity to cater to an under-served corporate sector – which accounts for around 69% of the total lending book – and remains the cornerstone of its business, supported by Vision 2030’s commitment to diversification and growth in the private sector.

On the individuals side, Amlak has built a fruitful relationship with the Saudi Refinancing Company (SRC), to whom the Company has sold more than SAR 400 million in contracts from the portfolio to date – benefitting from fee based income, an additional competitive source of funding, and off-loading of risk from the individuals lending book. This is an important component in the Company’s program for capitalizing on growing demand for financing among prospective Saudi homeowners and homebuilders.

In July, Amlak completed the offering of 30% of its total equity on the Saudi Stock Exchange – Tadawul – and in the process raised approximately SAR 435 million. The transition to listed company status will be important for raising the profile of Amlak International among a range of important stakeholders and is also intended to lower the future cost of capital. The offer was heavily oversubscribed in both its institutional and retail tranches.

-Ends-

About: Amlak International

Amlak International is Saudi Arabia’s first-established and leading real estate Non-Bank Financial Institution (“NBFI”). Established in 2007 and headquartered in Riyadh, Amlak is licensed by the Saudi Arabian Monetary Authority (“SAMA”) to provide innovative and Shariah-compliant real estate financing solutions, including Murabaha and Ijarah, to businesses and individuals. Amlak is listed on Tadawul under ticker number 1182. To find out more, visit www.amlakint.com.

Media enquiries:

George Allen

+971 4 369 9353

George.Allen@instinctif.com

Khaled Fansa

+971 4 369 9353

Khaled.Fansa@instinctif.com

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.