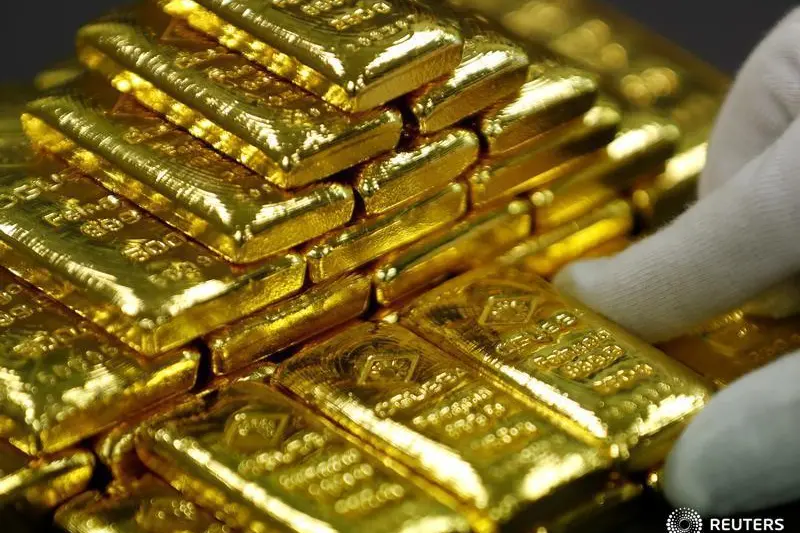

PHOTO

Gold prices climbed to a near six-year high on Friday, surpassing the key $1,400 level on dovish signals from major central banks and rising dispute between the United States and Iran.

Spot gold was up 0.5% at $1,394.26 per ounce at 1240 GMT, after earlier hitting its highest since Sept. 2013 at $1,410.78.

U.S. gold futures rose 0.2% to $1,399.4 per ounce.

"The Iranian tensions provided the catalyst for gold to inch above $1,400, after threatening to break above that level since yesterday's dovish Fed outcome," said Howie Lee, an economist at OCBC Bank.

"There is a perfect mix of ingredients for gold's rush to the top – a weak macroeconomic environment, low bond yields, soft dollar and rising geopolitical tensions."

Iranian officials told Reuters on Friday that Tehran had received a message from U.S. President Donald Trump through Oman overnight warning that a U.S. attack on Iran was imminent.

Earlier this week, in a further boost for gold, the U.S. Federal Reserve joined global peers such as the European Central Bank and the Bank of Japan with plans to cut interest rates to support flagging economic growth, hinting at cuts beginning as early as next month.

This prospect has put government bonds on a bullish footing.

The combination of a weaker dollar, falling yields and the Middle East tensions have lifted gold by nearly 4% so far this week - its biggest rise since the week ended April 29, 2016. Since Wednesday, bullion has risen as much as $70.

"Gold should remain in demand as a safe haven and as a store of value," said Commerzbank analyst Daniel Briesemann.

"However, because the price has also been pushed up by speculative buying, the higher the price, the more attractive it is to take profits so we will see some setbacks in the near future."

Meanwhile, the dollar was set for a weekly loss of more than 1% against major currencies, and U.S. benchmark 10-year Treasury yields dropped below 2% for the first time in more than 2-1/2 years.

Investors will now focus on whether the United States and China can resolve their trade row at a Group of 20 leaders summit in the western Japanese city of Osaka next week.

In the physical market, dealers in India, the second-biggest global gold consumer after China offered the biggest discounts in almost three years this week as local prices soared to record peaks.

Elsewhere, silver fell 0.6% to $15.33 per ounce.

Platinum was up 0.2% at $804.33 per ounce.

Palladium climbed 1.2% to $1,495.56 an ounce and was headed for a third consecutive weekly gain.

(Reporting by Eileen Soreng, Brijesh Patel and Nallur Sethuraman in Bengaluru Editing by Gareth Jones and Louise Heavens)

© Reuters News 2019