DUBAI, United Arab Emirates--(BUSINESS WIRE/AETOSWire)-- International General Insurance Holdings Limited today reported earnings for the first half of 2018.

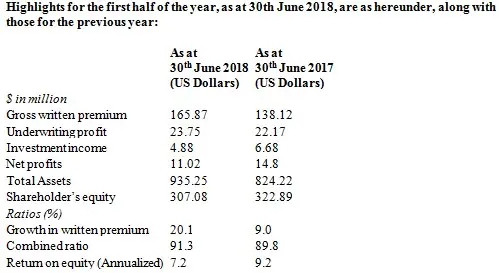

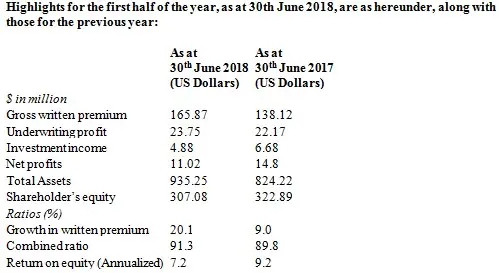

IGI reported a net profit of $11.0 million for the first six months of 2018, against $14.8 million last year and a 20% rise in gross premiums written from $138.12 million in June 2017 to $165.87 million. Growth occurred across all IGI’s major lines of business.

The Company posted a 7% rise in gross underwriting profits of $23.75 million, mainly due to growth in gross earned premium from last year, partially offset by increase in net claims incurred primarily due to strengthening of IBNR.

IGI posted a combined ratio of 91.3%, compared to 89.8% in June 2017.

“We are pleased with the first six months of the year and we continue to remain optimistic that barring major catastrophes as occurred in the third Quarter of 2017, we should be able to deliver our planned results for 2018,” said Mr. Wasef Jabsheh, Vice Chairman and Chief Executive Officer of IGIH.

In July, rating agency Standard & Poor reaffirmed IGI’s financial strength rating of A- stable outlook, citing IGI’s strength in maintaining sound underwriting and operating performance. A.M. Best also reaffirmed IGI’s financial strength rating of A- (Excellent) with a positive outlook in the first week of August.

The Board of Directors of IGIH proposed at its meeting of 16 August an interim dividend of US $0.03 per share for the first half of 2018.

-Ends-

Issued by rein4ce on behalf of International General Insurance Holding Limited.

About IGI:

International General Insurance Holdings Limited is registered in the Dubai International Financial Centre (DIFC) with operations in Bermuda, Jordan, UAE, Malaysia, Morocco and a wholly owned subsidiary in the U.K.

IGI Bermuda is a class 3B (re)insurer regulated by the Bermuda Monetary Authority (BMA). This subsidiary is the principal underwriting entity for the Group. The Group also has a branch in Labuan, Malaysia, registered as a second-tier offshore reinsurer.

Both IGI Bermuda and IGI UK are rated A- with a stable outlook by Standard & Poor’s and A- (Excellent) with a positive outlook by A.M Best Company.

IGI Group of companies underwrites a worldwide portfolio of energy, property, engineering, casualty, legal expenses, directors and officers, financial institutions, general aviation, ports & terminals, marine liability, political violence, forestry and reinsurance treaty business.

International General Insurance Holdings Limited had assets in excess of US$ 900 million as at 30th June 2018.

For more information, please visit www.iginsure.com or email info@iginsure.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180820005197/en/

*Source: AETOSWire

Contacts

REIN4CE for IGI:

Sarah Hills

+44 (0)7718 882011

email sarah.hills@rein4ce.co.uk

or

IGI

Aaida Abu Jaber

PR & Marketing Manager

T: +96265662082 Ext. 311

M: +962770415540

Email: Aaida.AbuJaber@iginsure.com

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.