PHOTO

Global markets

Asian shares extended a global sell-off in early trading Wednesday as Italy’s political crisis provoked a heavy retreat on Wall Street, sent the euro to a 10-month low and pushed up borrowing costs for the government in Rome.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 1.1 percent, while Japan’s Nikkei average shed 1.7 percent to hit a six-week low.

On Wall Street on Tuesday, the Dow Jones Industrial Average fell 1.58 percent to 24,361.45, the S&P 500 lost 1.16 percent to 2,689.86 and the Nasdaq Composite dropped 0.5 percent to 7,396.59.

Emerging market stocks lost 0.5 percent, marking a new low point for the year, under continued pressure from a rising United States dollar for countries that often borrow in that currency.

“It’s not surprising that investors fled fragile emerging markets and southern Europe and sought safety in cash,” Yasuo Sakuma, chief investment officer at Libra Investments, told Reuters.

Middle East markets

Dubai shares were sluggish on Tuesday, dragged down by property stocks. Gains were modest amid very thin trading volumes during the holy month of Ramadan, a risk-off sentiment in foreign markets as well as slightly lower oil prices over the past few days.

In Dubai where the index slipped 0.2 percent, property stocks such as Union Properties and blue-chip Emaar Properties lost 1.1 percent and 0.6 percent, respectively.

Building contractor Drake & Scull International shed 1.7 percent, after gains this month after reporting a net profit of 7.3 million dirhams ($1.99 million) for the first quarter of this year, against an 838.8 million loss in the first quarter of 2017.

In Saudi Arabia, the index rose 0.5 percent, lifted by gains in banking and petrochemical shares. Alinma Bank and Bank Aljazira rose 0.4 percent and 1.4 percent, respectively. Blue-chip Saudi Basic Industries Corporation climbed 1.7 percent.

The Qatari index closed flat, after surging earlier this week as a result of its biggest listed companies reported gains and government plans to allow full foreign ownership of companies.

In Abu Dhabi, banking shares such as First Abu Dhabi Bank and Abu Dhabi Commercial Bank gained 1.2 percent and 0.6 percent, respectively. The index rose 0.6 percent.

Kuwait gained 0.4 percent, Bahrain edged up 0.2 percent, Oman climbed 0.2 percent and Egypt was up 1.3 percent.

Oil prices

Oil prices were mixed in early Asian trade on Wednesday, with worries that Saudi Arabia and Russia will pump more crude weighing on the market.

Riyadh officials and their Russian counterparts have discussed raising OPEC and non-OPEC oil production by 1 million barrels per day (bpd) to counter potential supply shortfalls from Venezuela and Iran.

Brent crude LCOc1 was down 1 cent at $75.38 a barrel by 0015 GMT, after settling up 9 cents on Tuesday.

U.S. West Texas Intermediate crude CLc1 was up 13 cents, or 0.2 percent, at $66.86 a barrel, having earlier settled down $1.15.

The Organization of the Petroleum Exporting Countries is due to meet in Vienna on June 22.

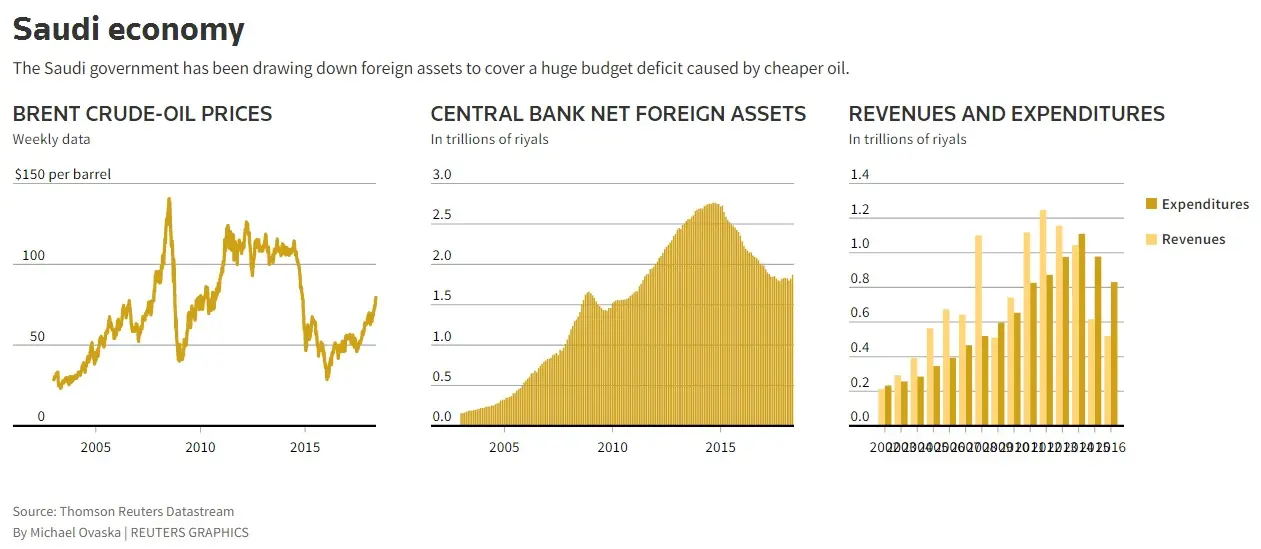

Commentary: The Saudi government has been drawing down foreign assets to cover a huge budget deficit caused by cheaper oil.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Currencies

The euro was buried near multi-month lows against major rivals on Wednesday as Italy’s political crisis deepened.

The euro, which slipped to a 10-month low of $1.1510, on Tuesday, and last stood at $1.1542, moved little in Asian trade. It has fallen 4.5 percent so far this month.

“What the markets are starting to factor-in is not a default per se but an early election leading to a victory of eurosceptics and an exit from the euro,” Makoto Noji, senior strategist at SMBC Nikko Securities, told Reuters of the market's reaction to the situation in Italy.

The dollar slipped 0.3 percent to 108.38 yen, edging towards a five-week low of 108.115 yen hit the previous day as the risk-averse mood boosted the yen.

Precious metals

Gold prices rose in early Asian trade on Wednesday as political turmoil in Italy and concerns over the Sino-U.S. trade conflict spurred safe-haven demand.

Spot gold had risen 0.3 percent to $1,301.98 per ounce by 0125 GMT. U.S. gold futures for June delivery were up 0.2 percent at $1,301.50 per ounce.

In other news…

Saudi Arabia’s inflation edged down 0.2 percent month-on-month in April, recording the lowest rate this year so far, according to the latest official data.

Consumer price inflation increased 2.5 percent in April, compared to the same period last year, driven mainly by the rise in tobacco, transport, food and beverage prices following the kingdom's introduction of several new taxes.

(Writing and editing by Shane McGinley)

(Shane.McGinley@thomsonreuters.com)

For access to market moving insight, subscribe to the Trading Middle East newsletter by clicking here.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018