PHOTO

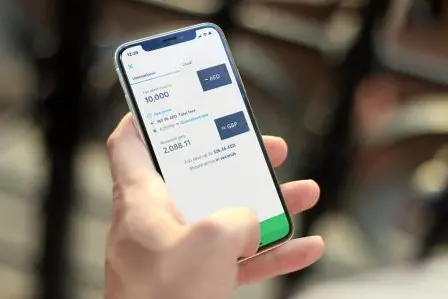

Send money at the real, mid-market exchange rate up to 2 times cheaper* than banks

Abu Dhabi: TransferWise today announced the launch of its low cost, fast money transfers in the United Arab Emirates. TransferWise Nuqud LTD is regulated under the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority, enabling people to send money from AED at the real mid-market exchange rate, using its platform.

TransferWise is a global technology company that’s building a new way to move money around the world, entirely online. This includes online account set-up and verification.

TransferWise’s approach makes sending money abroad faster, cheaper and more convenient as customers are able to compare prices and set-up payments without leaving their homes. Today the company offers over 1600 currency routes and 49 currencies, with from-AED money transfers found to be up to 2 times cheaper than the major banks and exchange houses by independent firm Viva Consulting.

According to World Bank data, outward remittance flows from the UAE reached US$44 billion in 2017, making it one of the biggest outward remitters in the world. After TransferWise announced its UAE licence to operate in 2019, 15,000 people signed up to be notified about the launch of the currency route.

TransferWise has opened an office in the ADGM, operating as a hub for its expansion into the Middle East. TransferWise is licenced as a Money Services Provider.

TransferWise in numbers

- The company serves 7 million customers worldwide

- TransferWise is processing US$5 billion in customer payments every month (domestic & cross-border), saving people $1 billion a year compared to making the same transaction with a bank

- 25% of its international transfers are instant (delivered in less than 20 seconds)

- Over 2,000 people in the team in fourteen global offices

- TransferWise is a rare profitable unicorn, with revenues of £179m in the fiscal year ending March 2019, and net profits of £10.3m

Kristo Käärmann, CEO and co-founder of TransferWise said: ‘The UAE is one of the most important remittance markets in the world, and we’re delighted to be bringing the first fully online money transfers to the country. It’s testament to the forward thinking nature of the FSRA that we’ve been able to bring our product to market so quickly - more competition means more choice for those living and working in the UAE.

‘Sending money abroad should be as easy as sending an email, yet many people are still reliant on expensive, slow legacy services. People can now send money to over 80 countries without leaving their homes, and all at the real, mid-market exchange rate. ’

Steve Barnett, Executive Director of Business Development at Abu Dhabi Global Market, said: “We are pleased to welcome TransferWise to our portfolio of financial services entities. We are confident that coupled with ADGM’s thriving and holistic ecosystem, TransferWise will continue to reinforce its position as a leading financial services provider. As an international financial centre located in the capital of the UAE, ADGM is committed to leveraging Abu Dhabi’s robust business environment to attract the world’s foremost enterprises, in an effort to facilitate further growth and development in the UAE and across the region.”

Simon Penney, Her Majesty’s Trade Commissioner for the Middle East, said: “The launch of TransferWise in the UAE is great news for the financial services offering in the Gulf. This launch is the largest UK FinTech market entry in the region to date, and will pave the way for other UK fintech companies to offer their services in this exciting and dynamic market. FinTech is a priority sector for the Department for International Trade in the UAE and wider region, and builds on the UK’s strong partnership with the Gulf across multiple industries.”

*Research reference

The claim ‘up to 2 times cheaper’ than traditional providers is based on an independent research carried out by Viva Consulting, a UAE based Market research and consulting firm. The study compared the cost of sending money abroad between 1-5 March 2020 among 6 of the top banks and brokers operating in the UAE: Al Ansari Exchange, Al Fardan Exchange, Western Union, Abu Dhabi Commercial Bank, HSBC and Dubai Islamic Bank in comparison with TransferWise. The data points gathered were for transfers from AED to USD, EUR and GBP including upfront fees and exchange rate mark-ups.

About TransferWise

TransferWise is a global technology company that’s building the best way to move money around the world. Whether you’re sending money to another country, spending money abroad, or making and receiving international business payments, TransferWise is on a mission to make your life easier and save you money.

Co-founded by Taavet Hinrikus and Kristo Käärmann, TransferWise launched in 2011. It is one of the world’s fastest growing tech firms having raised $689m in primary and secondary funding from investors such as Lead Edge, Lone Pine, Vitruvian, IVP, Merian Global Investors, Andreessen Horowitz, Sir Richard Branson, Valar Ventures and Max Levchin from PayPal.

Over seven million people use TransferWise, which processes over $5bn in payments every month, saving customers over $1 billion a year.

© Press Release 2020Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.