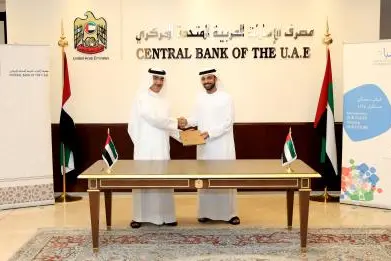

PHOTO

Abu Dhabi: The Central Bank of the UAE (CBUAE) has signed a memorandum of understanding (MoU) with Emirates Foundation to roll out financial literacy programmes through Emirates Foundation’s programme ‘Esref Sah’ which aims to raise financial awareness among youth and educate them on ways of managing their finances.

The MoU was signed by HE Saif Hadef AlShamsi, Deputy Governor of CBUAE and Mr. Ahmed Talib Al Shamsi, Acting CEO of Emirates Foundation at CBUAE HQ.

This partnership comes as part of the Central Bank’s efforts to achieve its vision in promoting monetary and financial stability towards sustainable economic growth, and highlights its importance to the UAE’s overall economic growth and stability as it contributes greatly to the economic wellbeing of the society, and to youth in specific.

His Excellency Saif Al Shamsi, Deputy Governor of CBUAE said: “Our partnership with Emirates Foundation offers financial knowledge-sharing support to help make positive impact in our country and to our people. Educating our youth on how to become financially independent and stable will help us to build a strong nation equipped with the right knowledge and ensure sustainable economy growth.”

He added: “The programme introduces smart ways for the youth to enhance the quality of their life by providing guidance and real life scenarios, which will help them to meet their financial goals, grow their wealth and become financially secure today and tomorrow.”

Mr. Ahmed Talib Al Shamsi, Acting CEO of Emirates Foundation said: “Our partnership with the Central Bank of the UAE is testament to our commitment in promoting financial literacy among our community and supporting youth in managing their finances and debts. Enabling youth to sustain a culture of financial literacy is a vital stepping stone that will create a promising future for our youth, in addition to our nation’s economy.”

He added: “Esref Sah has been at the forefront of addressing financial challenges faced by youth since its inception six years ago, and has been successful in empowering youth to build a financially sustainable career.”

‘Esref Sah’ is one of many successful programmes initiated by the Emirates Foundation, as attested by winning the 2016 Khalifa Award for Education. It deals with challenges faced by youth in managing their financial activities, investments, spending and savings, and provides learning opportunities to support them to become financially independent through customised workshops, training and volunteering activities.

CBUAE is committed to support all initiatives to maintaining financial stability and supporting the UAE’s economic growth objectives as well as encouraging youth to use Esref Sah platforms.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.