PHOTO

MELBOURNE - London copper eased on Monday but held above a one-year low hit last week on mounting concerns escalating trade tariff spats could dent demand, although a weaker dollar cushioned losses.

FUNDAMENTALS

* London Metal Exchange copper eased by 0.2 percent to $6,137 a tonne by 0212 GMT, after prices last week fell for the sixth week in a row, hitting the lowest in a year at $5,988 on Thursday.

* Shanghai Futures Exchange copper was up 0.9 percent at 48,790 yuan ($7,226) a tonne.

* TARIFFS: U.S. President Donald Trump on Friday said he was ready to impose tariffs on all $500 billion of imported goods from China, threatening to escalate a clash over trade policy that has unnerved financial markets.

* TARIFFS: China's Commerce Ministry said on Monday it has launched an anti-dumping probe into imports of stainless steel billet and hot-rolled stainless steel sheet and plate from the European Union, Japan, South Korea and Indonesia.

* TRADE: French Finance Minister Bruno Le Maire said on Saturday the European Union could not consider negotiating a free trade agreement with the United States without Washington first withdrawing its tariffs on steel and aluminium.

* GLOBAL ECONOMY: The International Monetary Fund (IMF) warned world economic leaders on Saturday that a recent wave of trade tariffs would significantly harm global growth, a day after Trump threatened a major escalation in a dispute with China.

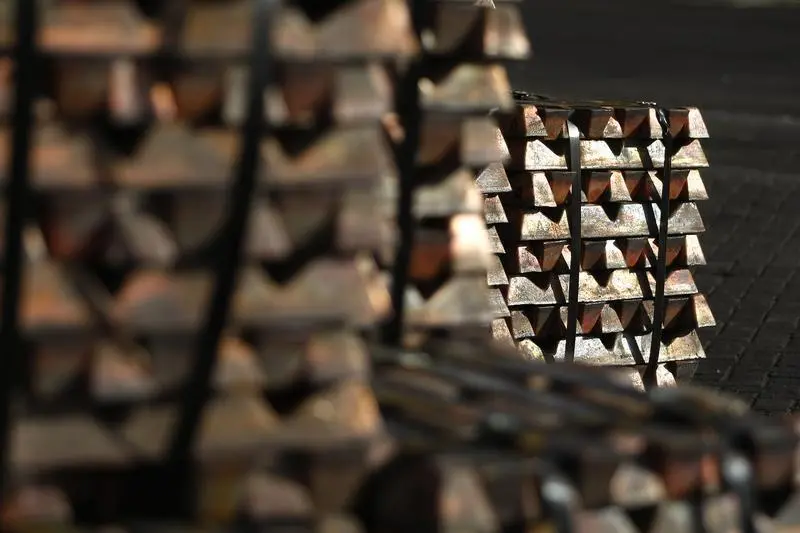

* ALUMINIUM: Big companies in the United States from Amazon.com Inc to Toyota Motor Corp and Alcoa Corp are working to counter the effect of the Trump administration's trade policies and to head off new tariffs.

* COPPER DEFICIT: The global world refined copper market showed a 98,000 tonnes deficit in April, compared with a 66,000 tonnes surplus in March, the International Copper Study Group (ICSG) said in its latest monthly bulletin.

* SPECULATORS: Short holdings in Comex copper surged in the latest week, data from the U.S. regulator showed.

* For the top stories in metals and other news, click or

MARKETS NEWS

* The dollar declined on Monday against major currencies to its lowest in more than two weeks after Trump criticised the Federal Reserve's tightening policy, while stocks slipped on fears of further trade protectionist measures.

PRICES

Three month LME copper

Most active ShFE copper

Three month LME aluminium

Most active ShFE aluminium

Three month LME zinc

Most active ShFE zinc

Three month LME lead

Most active ShFE lead

Three month LME nickel

Most active ShFE nickel

Three month LME tin

Most active ShFE tin

ARBS ($1 = 6.7517 Chinese yuan)

(Reporting by Melanie Burton; Editing by Subhranshu Sahu)

© Reuters News 2018