PHOTO

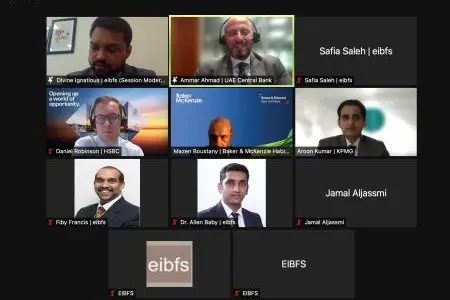

Dubai-UAE: Emirates Institute for Banking and Financial Studies (EIBFS), a regional leader in banking and finance education and training, today hosted a webinar to discuss Consumer Protection Regulation. The webinar is part of the EIBFS Conversational Learning Initiative, which aims to host periodic conferences to cover timely banking and finance related subjects as part of its community outreach initiative.

The webinar drew the participation of 774 participants and an expert panel including Aroon Kumar, Associate Director, Advisory services at KPMG, Ammar Ahmad, Market Conduct Compliance, Financial Consumer Protection Department, UAE Central Bank, Mazen Boustany, Partner-Head of UAE Financial Regulatory at Baker & McKenzie Habib Al Mulla and Daniel Robinson, Head of Wealth & Personal Banking, HSBC UAE. Divine Ignatious, Lecturer at EIBFS moderated the session.

The session examined ways in which financial institutions can strengthen their monitoring framework in order to better track transactions, complaints, and communications, as well as how a more focused approach can be adopted to protect the customer. Additionally, the speakers discussed the importance of financial institutions implementing robust data protection measures to guard against the misuse of consumers' personal and financial information, as well as their assets.

Furthermore, the panelists highlighted how supervision can be more focused on mitigating and protecting the consumer and identifying areas for enhanced enforcement and actions related to institutional conduct. The attendees agreed that strengthening monitoring frameworks to better track transactions, complaints, and communications should be a key priority and that institutions should allot resources to better equip themselves.

Commenting on the webinar, Jamal Al Jassmi, said: “In the banking and finance sphere, customer trust and confidence are key in ensuring long-term stability and growth. While the UAE government has taken crucial steps to ensure that customers are protected, there is much more that needs to be done at an organizational level to improve consumer security. Through this thought-provoking webinar, our aim is to accelerate the customer protection dialogue amongst leading banks and financial institutes in the UAE and find solutions that can have a long-lasting positive impact on the community.

He added: “At EIBFS, discussing topics that are prevalent in the industry is a priority and over the course of the year, we will continue to support the banking sector by providing deep insights that can help in the long-run.”

-Ends-

About EIBFS

The Emirates Institute for Banking and Financial Studies (EIBFS) was founded in 1983. As a leading independent training center, it offers world-class education, training and allied services in the critical areas of banking and finance. Based in the UAE, EIBFS currently has three campuses for education and training services located in Sharjah, Abu Dhabi and Dubai. The Institute has made substantial contributions to the careers of thousands of students and working professionals in the financial services sector. EIBFS is also a strong supporter of Emiratization and has launched various initiatives that have greatly helped to promote the careers of Emiratis. All academic programs offered by EIBFS are accredited by the Commission for Academic Accreditation (CAA), Ministry of Higher Education and Scientific Research. Students who have successfully completed these programs have found productive employment at various levels in banks and financial institutions in the UAE and around the world.

For media enquiries, please contact:

Shady El Gohary

Account Director

APCO Worldwide

Email: selgohary@apcoworldwide.com

Susan Shoury

Senior Account Manager

APCO Worldwide

Email: sshoury@apcoworldwide.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.