Dubai, United Arab Emirates: Global economic growth, already at the lowest level since the 2008 financial crisis, is estimated to slow down further in 2019. The Middle East is particularly affected by global growth trends, as domestic financial markets are governed by external factors, especially oil prices, but also international tourism and trade.

As UAE stock markets have been on a rise since the beginning of the year, investors are looking to avoid over-exposure to traditional asset classes. While they are seeking diversification opportunities to put their money to work, a new asset class has appeared on the radar: blockchain assets.

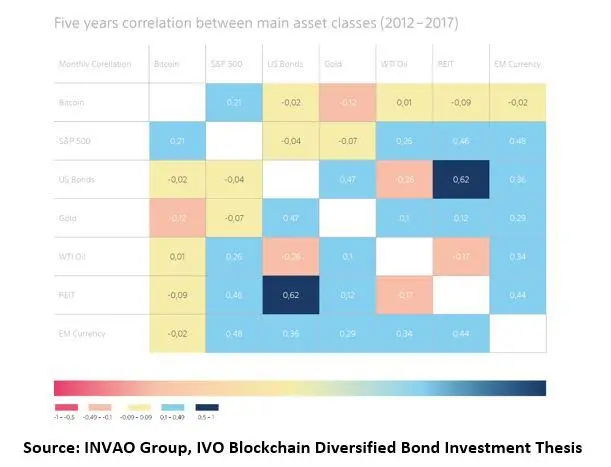

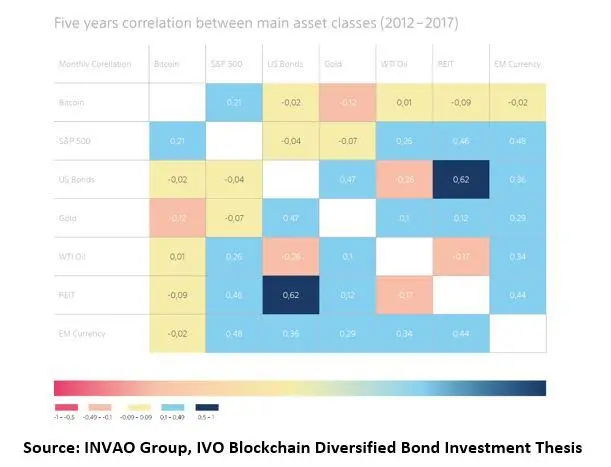

Their non-correlation to traditional asset classes provides investors with a vehicle to diversify their portfolios. Ahmed Jacob, Dubai based Managing Partner and CTO of INVAO Group, said: “In the future, blockchain assets will play an increasingly important role in global financial markets.”

Blockchain assets are exchange-listed and non-correlated to other asset classes

A diversified investment portfolio includes stocks, bonds, cash, and alternative assets. Popular alternative investments in the UAE include real estate, private equity, and commodities such as crude oil or gold.

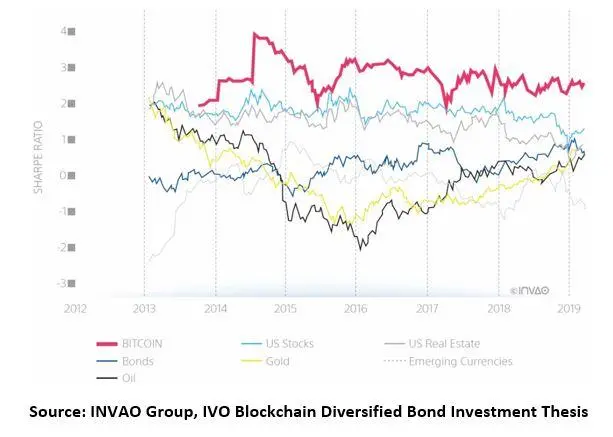

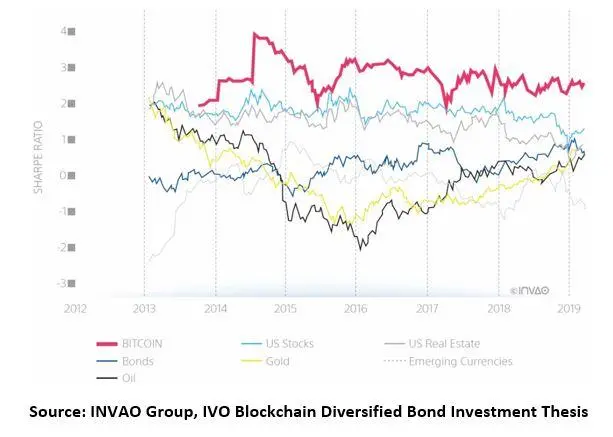

Jacob explains that compared to these asset classes, blockchain assets have three key advantages: “They are exchange-listed, non-correlated to other asset classes, and they have outperformed every other asset class over the past five years.”

As blockchain assets are listed on digital exchanges, investors can determine their current market value in real-time. While that is also possible with assets like gold or crude oil, it is significantly more complex with real estate or private equity assets.

Jacob continues, “Non-correlation means if the price of another asset class moves, blockchain assets remain unaffected. This provides effective downside protection. In case equity or bond markets turn bearish, blockchain assets will lower the negative effect on the overall portfolio return. “

Blockchain assets also have a more attractive risk-return profile than other asset classes. The graph below shows the Sharpe Ratios – a widely used measurement for an asset’s risk-adjusted return – of popular assets over the past five years: Bitcoin outperformed the entire market.

Blockchain assets will likely become increasingly popular in the UAE’s investment landscape

The rising popularity of blockchain assets in the UAE was a hot topic at the Alternative Investment Summit (AIM) in Dubai. During the summit, INVAO Group presented its latest investment product, the IVO Blockchain Diversified Bond (ISIN: LI0471823018) which replicates the returns of a diversified blockchain asset portfolio.

“As blockchain is a relatively new technology and markets are volatile, investors need to continuously keep an eye on their investments,” says Jacob. “But most investors neither have the time nor the technical expertise. That’s why we launched an actively managed investment product that allows investors to participate in the returns of blockchain markets in a more convenient and secure way.”

INVAO’s success speaks for itself: Over the first six months of 2019, the IVO bond has seen returns of more than 108 percent and has outperformed its benchmark index, the CCi30, as well as Bitcoin and all popular traditional indices.

Jacob says, “Blockchain assets will rise in popularity over the next three years and establish themselves as a new asset class in the UAE’s financial investment landscape. They provide an excellent opportunity for UAE investors to put their cash reserves to work while managing their risk and avoiding over-exposure to traditional asset classes.”

For further information and Interview arrangements please contact:

Ayah Mokhalalati

ayah@theprprofessionals.com

Sam Malik

sam@theprprofessionals.com

+971 55 838 0566

INVAO

INVAO Group is a Blockchain Investment Management company with presence in Berlin, Liechtenstein, Dubai, and Singapore. With a team of experienced traders, successful entrepreneurs, and investment professionals, INVAO develops financial securities enabling investors to participate in the growth potential of blockchain technology across various industries.

With its flagship product, the IVO - Blockchain Diversified Bond (ISIN: LI0471823018), INVAO enables investors to access a globally diversified portfolio of blockchain assets represented in one single token. The IVO bond provides a straightforward way to invest in blockchain as an asset class, fully compliant to Liechtenstein law. Deploying AI-based automated trading strategies and active portfolio management, INVAO aims to outperform the market at all times while offering effective downside protection. Trading profits are reinvested in the value of the digital portfolio to ensure sustainable long-term value creation. For more information refer to www.invao.org.

Managing Partner & CTO - Ahmed Jacob

Topics: Middle East focus, advanced technology, entrepreneurship

Entrepreneur and financially focused CTO with a demonstrated history of working in the financial and IT services industry specializing in blockchain and crypto based product investments. Skilled in Project management, negotiation and establishing the customer service. Driven by strong technical knowledge and experience in several programming languages and Frameworks. Ahmed is a software engineer with a proven track record of successfully developing and implementing different products and frameworks for various companies. He holds a Bachelor’s in computer engineering and Master’s in Software Engineering, is an avid web developer and Blockchain enthusiast.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.