PHOTO

Did you ever walk around Emaar Properties’ huge Dubai Mall and wonder why a centre with more than 1,000 retail outlets keeps undergoing expansion?

The reason, according to retail experts, is that despite major challenges faced by the retail sector more widely – such as reduced spending power due to slowing economic growth and rising costs caused by the introduction of value-added tax (VAT) and fuel prices – big malls are continuing to perform well.

Even with the onslaught of greater competition from e-commerce sites, prime centres such as Dubai Mall and Mall of the Emirates remain in demand.

Yet for smaller, secondary malls, it’s a different story.

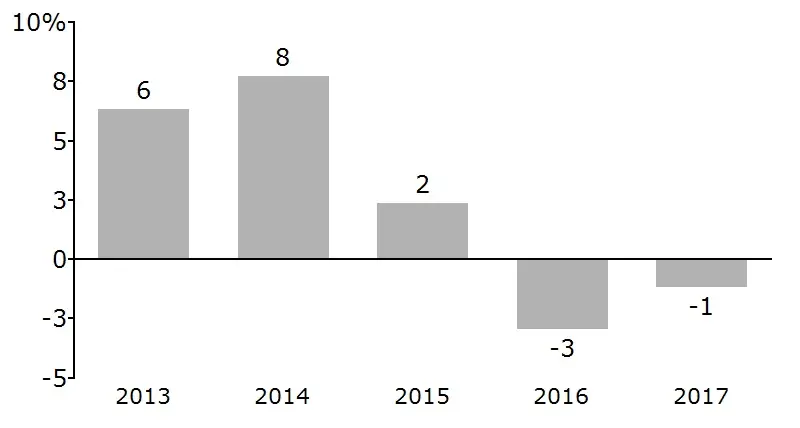

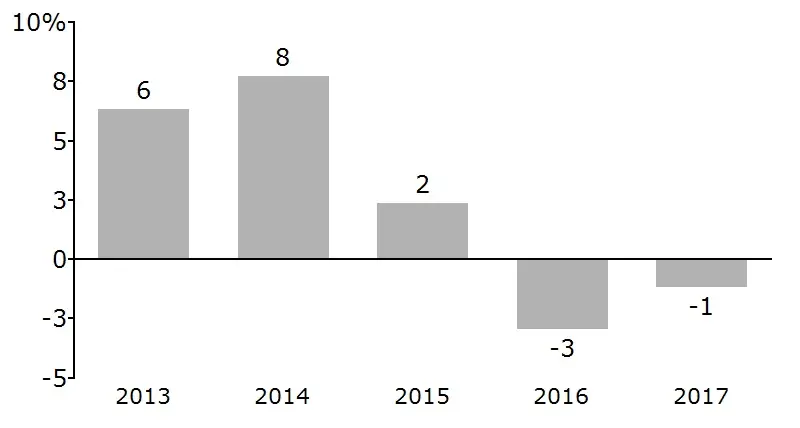

“Across all the big malls here in Dubai and the Northern Emirates, prior to 2014, prior to the oil crisis, sales were growing at 6 to 7 and 8 percent annually. Then, in 2015, it slowed down but (was) still positive by maybe 2 percent. In 2016, it was largely negative - maybe -4 or -5 (percent) and then last year, 2017, it was -1 percent,” Cyrille Fabre, a partner in Bain & Company's Middle East, told Zawya in an interview.

“So it is still negative, but better than 2016,” said Fabre, who heads the firm’s retail and consumer products practice in the region.

Growth rate of tenant sales per square metre across all malls in Dubai and the Northern Emirates

Source: Bain & Company

Fabre said Dubai’s big malls such as Dubai Mall and The Mall of the Emirates continued to experience positive sales in 2017, spurred by an increase in spending by tourists.

“The not very big malls were not doing as well as they were not serving tourists but they are serving the residents who are not spending very much,” he added.

Fabre said that the broader market decline had also fed into the early part of this year, following the introduction of value-added tax in the United Arab Emirates in January, which has been applied to a range of goods including food, clothing and cars.

The number of international overnight tourists rose by 2 percent in the first three months of the year, compared to the same period last year, according to a press release from Dubai Tourism, an official tourism body.

“Mall of the Emirates continued to be successful in this difficult market environment, thanks partly to strong tourism sales. Retail sales per square metre (were) up 6 percent last year versus 2016, which is almost double the performance of the national malls,” Fabre added in a follow-up email interview.

Financial statements for Emaar Malls show that its 'super-regional malls' division containing malls with gross leasable space of over 800,000 sq ft (of which Dubai Mall is currently its only trading asset) generated more than 2.7 billion UAE dirhams of the company’s total sales of 3.3 billion dirhams in 2017.

Matthew Green, UAE head of research and consulting in CBRE consulting firm said Dubai’s Mall of The Emirates and Dubai Mall had both seen high traffic and occupancy rates.

“In the past, Dubai Mall had around 80 million visitors per year and I think Mall of the Emirates is somewhere around 42 million,” Green told Zawya in an interview on Monday.

“That is well reflected in occupancy rates. Within Dubai Mall, the mall is about 98 percent occupied and Mall of the Emirates is similar - up at 98 percent as well. You can certainly see from that aspect of performance that retailers obviously want to be in these big centres and are willing to pay a premium to make sure that that happens.”

However, he said that although smaller malls don't have some of the outlets that make people stay longer and spend more, such as big cinema complexes that can attract family outings, they are still needed to serve customers who don't want to leave their own areasto buy something or get a service done.

"In that respect, they probably struggle a little bit more to attract the same levels (of traffic) and the consumers they do attract are more focused on the domestic demands," Green said.

Further reading:

(Reporting by Yasmine Saleh; Editing by Michael Fahy)

(yasmine.saleh@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018