PHOTO

- 82% of expats are optimistic life in the UAE will return to normal in the next 12 months

- UAE’s stellar ranking comes as HSBC celebrates 75 years of doing business in the country

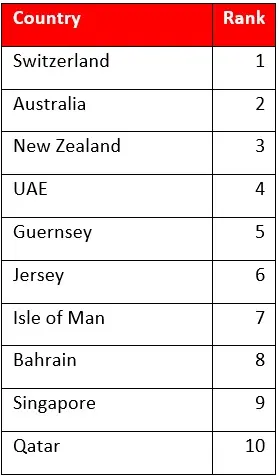

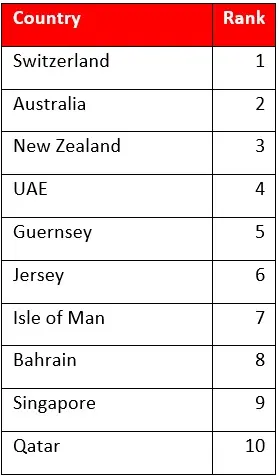

The UAE climbed 10 places to rank 4th best country in the world to live and work according to HSBC’s 14th annual Expat Explorer study - a global survey of over 20,000 people who live and work abroad.

The vast majority of expats surveyed in the UAE (82%) feel optimistic that life will be more stable and normal again in the next 12 months despite the global pandemic, above the 75% global average, with (53%) of UAE respondents also expecting an increase in their income and a better work life balance (57%).

These findings are published the same year that HSBC celebrates 75 years of doing business in the UAE and that the nation celebrates its own Golden Jubilee.

“The UAE being billed among the top five best places to live and work globally is inspiring and a clear indication of the huge potential that drives this country’s economy. We saw that potential as the first and only bank here when we opened our doors for business on 12th October 1946, and we’ve been investing ever since, supporting the country and our customers to open up a world of opportunity,” said Abdulfattah Sharaf, HSBC UAE CEO and Head of International.

“The connectivity of the economy combined with the scale of its vision has transformed it from a small fishing and pearling port in the 1940s into a global trade, logistics, shipping, aviation, business and finance hub today. The country’s focus on innovation, infrastructure, quality of life, diversity and inclusion have made it the destination of choice for businesses and professionals looking to grow and prosper,” Abdulfattah added.

Economics and quality of life

The progress of the UAE has been attractive for many who make the UAE their home. The top three reasons cited by expats for choosing to move to the UAE are: to improve their earnings (56%), to progress their career (49%), and to improve their quality of life (43%).

The quality of life offered in the UAE is what makes expats stay longer than intended. Most expats in the UAE (86%) say their overall quality of life is better than their home country and six out of every 10 intend to stay longer for that reason. Only 11% say the pandemic changed their plans of staying in the UAE.

“The overwhelming sense of optimism from expats in the UAE about the 12 months ahead is reflective of the quick response from authorities to tackle the social and economic impact of the pandemic,” Abdulfattah said.

“The UAE’s clear appeal to entrepreneurs and High Net Worth Individuals, has driven decisions in our own business that will support the recovery. We have committed US$5 billion of lending to support strong companies in the UAE to grow globally with our UAE Growth Initiative, and we have invested in our wealth management business, expanding our private bank in the Abu Dhabi Global Market as part of our plan to double our assets under management over the next three years,” added Abdulfattah.

Culture and safety

In addition to a better quality of life, 80% of respondents said their children are more aware and open to different cultures and experiences in the UAE. The UAE is currently hosting Expo 2020, the festival of internationalism staged in a new city every five years to showcase ideas and innovations that will shape our world, with as many as 25 million visits expected during its six-month run.

“The UAE’s openness to diverse cultures and views is a key attraction for expats looking to make the country their home. Expo 2020, the Arab world’s largest global event with more than 190 countries taking part, is putting this commitment to diversity and openness on the global stage,” Abdulfattah said.

For more information about the findings, and HSBC Expat products, visit www.expat.hsbc.com/expat-explorer-results/

-Ends-

About Expat Explorer

Expat Explorer is a comprehensive and in-depth global survey of expats. The 2021 survey is HSBC’s broadest look at expat living to date, with expats from 46 countries and regions sharing their views. YouGov surveyed 20,460 adults aged 18+ currently living away from their country of origin/home country, in 143 countries, territories and markets, through an online questionnaire between March and May 2021. A minimum sample of 100 respondents was required for a location to qualify for inclusion; this year, 46 locations qualified.

HSBC in the MENAT region

HSBC is the largest and most widely represented international banking organisation in the Middle East, North Africa and Turkey (MENAT), with a presence in nine countries across the region: Algeria, Bahrain, Egypt, Kuwait, Oman, Qatar, Saudi Arabia, Turkey and the United Arab Emirates. In Saudi Arabia, HSBC is a 31% shareholder of Saudi British Bank (SABB), and a 51% shareholder of HSBC Saudi Arabia for investment banking in the Kingdom. Across MENAT, HSBC had assets of US$68.9bn as at 31 December 2020.

Media enquiries to:

Farah Farooq +971 56 686 7337 farah.farooq@hsbc.com

Zahraa Alkhalisi +971 54 994 6181 zahraa.alkhalisi@hsbc.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.