Driving higher fee income with strong organic growth in assets under management and robust levels of investment and fundraising activity

Results impacted by lower investment returns and fair value adjustments to legacy investments

Bahrain – Investcorp (the “Firm”), a leading global provider and manager of alternative investment products, today announced its semi-annual fiscal year (H1 FY20) results for the six months ended December 31st, 2019. This press release and Investcorp’s full set of financial statements are available on Bahrain Bourse’s website (Symbol: INVCORP).

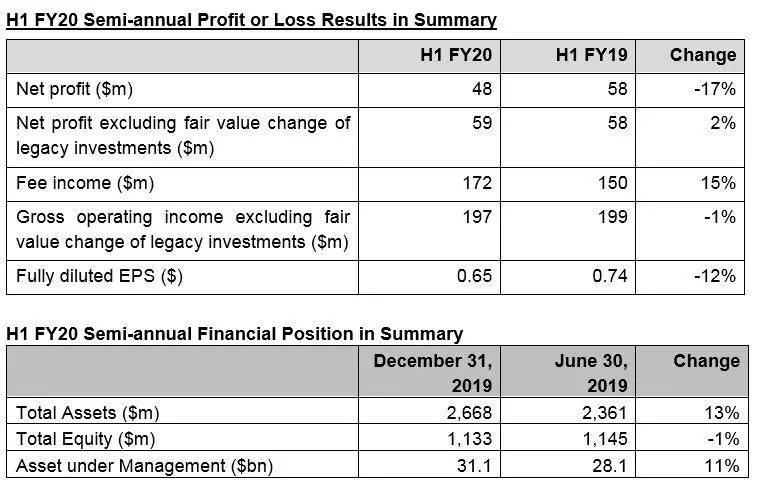

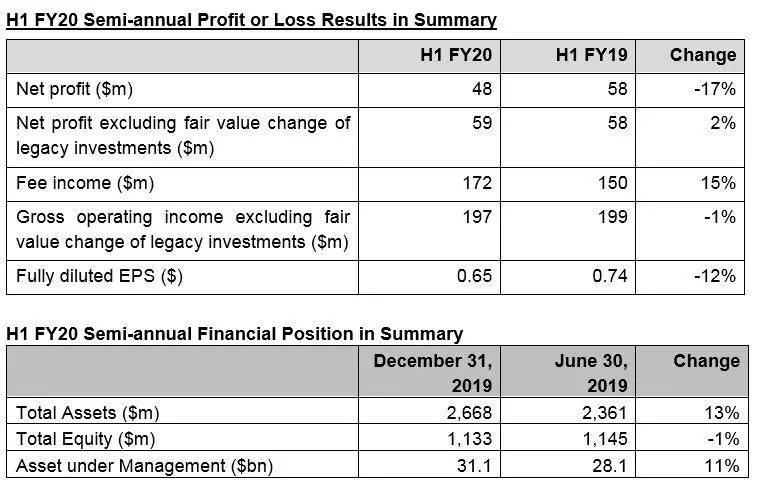

Despite a challenging macroeconomic backdrop and continuous trade and geopolitical tensions, the Firm delivered solid results with net income of $48 million for the period, down 17% compared to $58 million for the six months ended December 31, 2018 (H1 FY19). Net income for the period, excluding fair value change of legacy investments, of $59 million is 2% higher than $58 million for the six months ended December 31, 2018. On a fully diluted basis, earnings per ordinary share were $0.65 for H1 FY20, down 12% from $0.74 for H1 FY19. Total comprehensive income for H1 FY20 was $46 million, down 18% compared to $56 million in H1 FY19. The Firm’s assets under management (AUM) increased by $3.0 billion to $31.1 billion during the period. Investcorp believes its continued progress on its strategic and financial objectives, including reaching AUM of $50 billion over the medium term, are increasingly translating into a more resilient business and financial model.

Financial and operational highlights

- Broad-based growth in assets under management by $3.0 billion to $31.1 billion, as the Firm moves closer to reaching its medium-term target of $50 billion AUM.

- Lower net income of $48 million compared to $58 million for the same period last year is largely attributable to fair value declines of private equity investments in the US retail sector and a write down on a legacy asset.

- Fee income of $172 million is up 15% compared to H1 FY19 driven by increases in both AUM fees and deal fees.

- Strong investment activity of $1.9 billion in H1 FY20, compared to $1.2 billion in H1 FY19, with healthy placement activities and record-breaking deal-by-deal fundraising that was further supported by solid execution on several key strategic initiatives, including:

- Increasing globalization of the distribution platform with fundraising outside of the Gulf comprising more than $1.6 billion out of total fundraising of $2.6 billion;

- Closing the acquisitions of Mercury Capital Advisors and CM Investment Partners, advancing the Firm’s strategic objective to further diversify across products, clients and geographies;

- Completing the first investment within the Firm’s newly formed Strategic Capital line of business;

- Securing $130 million in anchor commitments to focus on direct lending for projects in the affordable and mid-market housing segment, subject to receipt of regulatory approvals and registrations, in India’s top seven cities, which are projected to be among the top 10 fastest-growing cities in the world over the next 15 years;

- Driving continued growth in Asia with the launch of a private equity platform dedicated solely to investing in Asian food brands and the first Indian private equity deal-by-deal investment;

- As previously announced, in August 2019 Investcorp agreed the sale of TPx Communications (‘TPx’) (formerly TelePacific) to affiliates of Siris, a leading private equity firm focused on investing and driving value creation in technology and telecommunications companies. The transaction is expected to close during Q3 FY2020, subject to the satisfaction of regulatory approvals and other customary closing conditions; and

- On September 2, 2019 Investcorp voluntarily relinquished its wholesale banking license to the Central Bank of Bahrain.

Commenting on the results, Mohammed Alardhi, Executive Chairman, said: “Our solid results reinforce our confidence in Investcorp’s organic and inorganic growth strategy. The increase in AUM during the period was largely attributable to organic initiatives, demonstrating strong global demand for our offerings with investors seeking increased exposure to alternative assets. We remain steadfast in our vision to provide our clients with the best investment solutions and products for their needs across the world, and constantly innovating to deliver new offerings. The successful globalization and institutionalization of our distribution platform is enhancing the resiliency of our business. We enter the second half of our fiscal year facing increasing geopolitical and macro-economic headwinds with a stronger and more diversified business, supported by a robust balance sheet and world-class talent. Our ambitious growth strategy to reach $50 billion in AUM over the medium term is increasingly within reach. Looking ahead, we remain confident in our ability to build upon our long track record of growth and value creation over time.”

Results commentary

Gross operating income (excluding fair value change of a legacy investment) was $197 million in H1 FY20 compared to $199 million in H1 FY19. Fee Income was $172 million, up 15% compared to $150 million for H1 FY19 as AUM fees grew by 5% from $83 million to $87 million and deal fees increased to $85 million, up 27% from $67 million in H1 FY19. This was offset by lower asset-based income of $25 million (excluding fair value change of a legacy investment) down 49% compared to $49 million in H1 FY19, largely attributable to lower private equity returns in the US retail sector.

Operating expenses for H1 FY20 were $116 million, up 5% compared to $111 million in H1 FY19. Cost-to-income ratio was 69%, which was higher than the prior year period, driven by lower asset-based income.

Interest expense for H1 FY20 was $16 million, down 38% from $26 million in H1 FY19 due to a decrease in the cost of funding and a more favorable funding mix.

AUM increased by 11% to $31.1 billion as compared to $28.1 billion at June 30, 2019. AUM increased across all the business lines supported by growth in committed capital. Associate’s AUM, not part of the consolidated AUM figures, stands at $6.0 billion.

Investcorp remains well capitalized with total assets of $2.7 billion as of December 31, 2019, up 13% from $2.4 billion as of June 30, 2019 with an impact of $113 million arising from the adoption of IFRS 16. Total equity of $1,133 million as of December 31, 2019, is down 1% compared to $1,145 million as of June 30, 2019 mainly due to an increase in Treasury shares holdings to $90 million from $74 million. The level of co-investments increased by 8% to $1,097 million from $1,017 million as of June 30, 2019 as a result of higher private equity exposure. Gross and net leverage ratios have slightly increased to 1.3x and 0.6x respectively from 1.1x and 0.4x due to a temporary increase in working capital and underwriting driven by the strong levels of investment and fundraising activity.

The Firm’s return on equity decreased to 9% from 11% in H1 FY19.

Total accessible liquidity dropped to $0.8 billion as of December 31, 2019 from $1.1 billion at June 30, 2019 largely due to increased real estate underwriting driven by high levels of transaction activity in H1 FY20. The debt maturity profile remains favorable with only a revolving credit facility of $250 million due for rollover in December 2020.

Investcorp’s credit rating remains unchanged with Moody’s at Ba2 and Stable Outlook while Fitch has confirmed the BB rating but upgraded the outlook to Positive from Stable.

Good performance across the business lines

Private equity

Investcorp’s private equity business experienced comparable levels of activity over the prior year period.

- Investment activity was $416 million in H1 FY20, in line with H1 FY19

- Placement and fundraising were $571 million, up 4% from $548 million in H1 FY19

- Distributions were $352 million, down 63% from $952 million in H1 FY19

- AUM grew 12% to $6.4 billion from $5.7 billion at June 30, 2019

Real estate

The real estate business line experienced very strong levels of activity driven by US and European portfolios.

- Investment activity was $583 million, up 141% compared to $242 million in H1 FY19

- Placement and fundraising were $484 million, up 72% from $281 million in H1 FY19

- Distributions were $498 million, up 125% from $221 million in H1 FY19

- AUM grew 7% to $6.5 billion from $6.1 billion at June 30, 2019

Absolute return investments

AUM increased by 18% from $3.8 billion as at June 30, 2019 to $4.5 billion.

- Fundraising was $512 million, down 11% from $576 million in H1 FY19

Credit management

Credit spreads were volatile for a good part of H1 FY20 on the back of macroeconomic uncertainties and despite historically low default rates. Investcorp successfully issued two new CLOs, one in the US and one in Europe, further strengthening the franchise with credit investors.

- Investment activity was $790 million, up 36% compared to $579 million in H1 FY19

- Placement and fundraising increased to $967 million from $916 million in H1 FY19

- AUM increased by 8% to $12.8 billion compared to $11.9 billion as of June 30, 2019

-Ends-

© Press Release 2020Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.