The unexpected dovish turn adopted by major Western central banks during the first quarter of 2019 is justifiably leading investors to wonder whether this could be a game-changer for emerging economies.

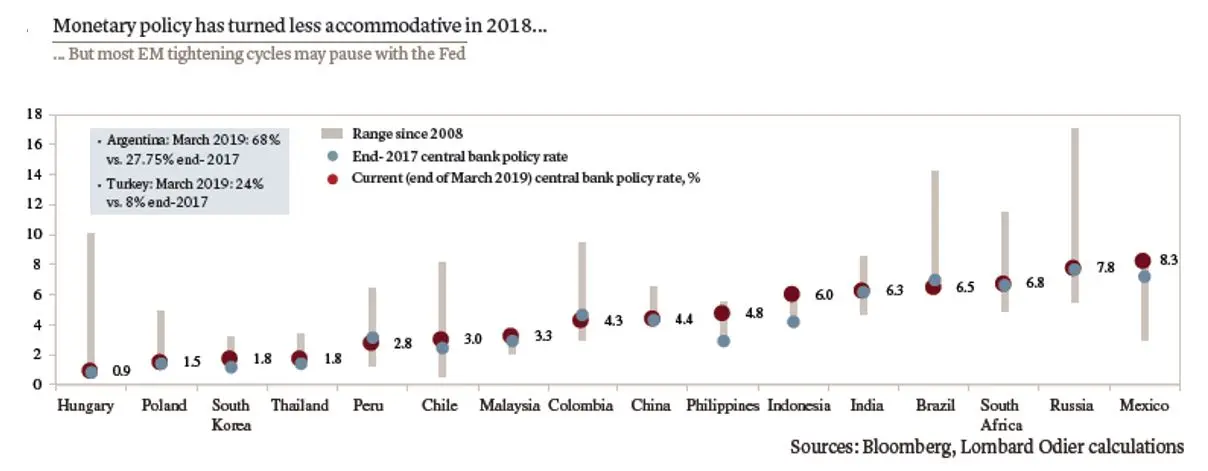

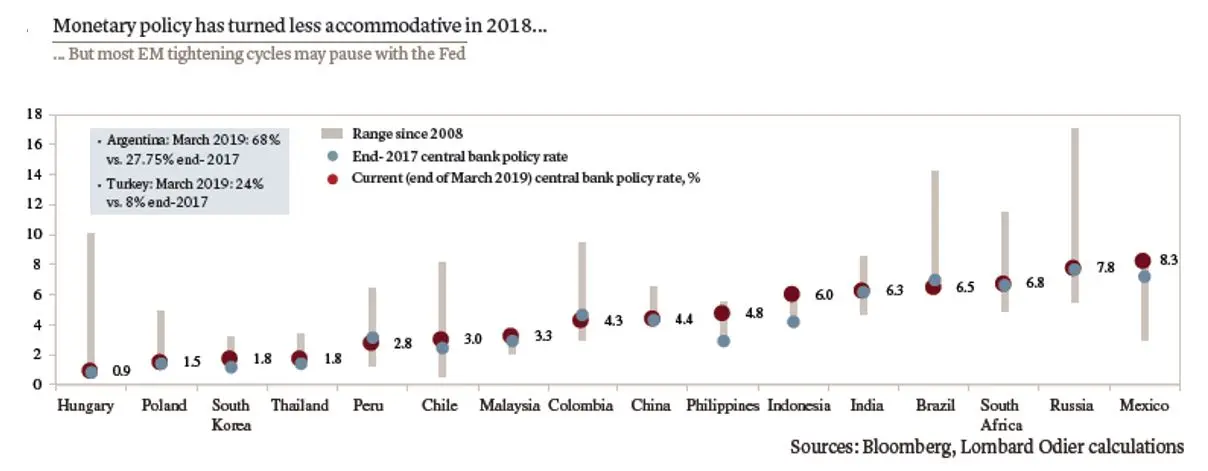

Indeed, last year saw many emerging central banks tighten their monetary policy, more or less in line with the Fed, in order to support their currencies and stem nascent inflation pressures. Half of the 18 countries in our emerging universe thus exhibit higher key rates today than at the end of 2017 (see chart below). With the Fed on hold, emerging currencies stabilising and favourable oil price year on year base effects keeping a lid on inflation, this tightening trend appears likely to pause in 2019.

Click image to enlarge

In addition, emerging fundamentals are broadly sound, with current account balances that have improved over the past five years, higher official reserves and mostly orthodox fiscal and monetary policies. The weakest links among the larger emerging economies – Turkey and Argentina – broke last year. Other large economies do not suffer the same type of vulnerabilities, meaning that a repetition of 2018’s idiosyncratic crises is unlikely. In fact, given still relatively young economic cycles with some upside potential, emerging growth should hold up this year.

This is not to say that we expect a significant acceleration. The lagged effect of past monetary tightening on growth should not be underestimated. Moreover, global economic momentum has softened over the past two quarters and trade growth could well remain subpar worldwide, even in the event of a trade deal between China and the United States. Finally, the political agenda is particularly heavy in the emerging world this year, with key general elections in India (April 11 to May 19), South Africa (May), Argentina (October) and Indonesia (April). And we should not be complacent regarding political developments in other countries such as Brazil (will President Bolsonaro manage to truly reform the social security system?), Mexico (will President AMLO adopt a completely unpredictable style of governance?) or Turkey (will Erdogan again pressure the central bank to support growth at the expense of currency stability?)

Any opinions expressed here are the author’s own.

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.