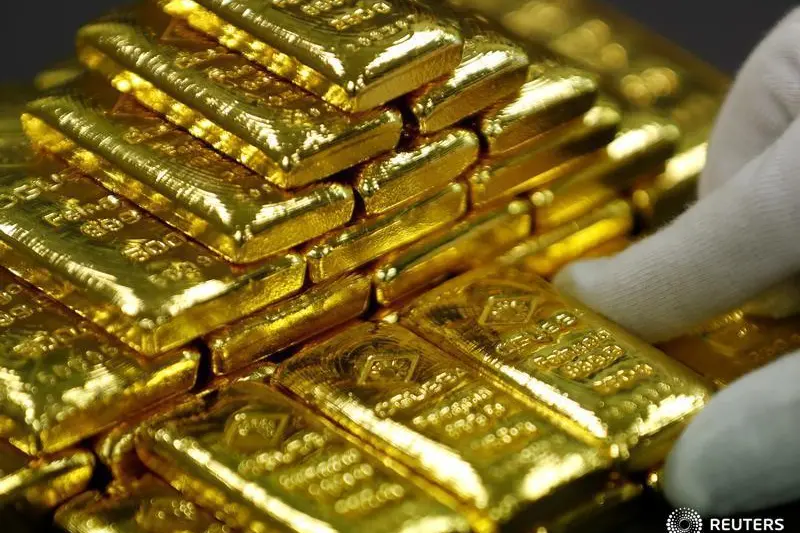

PHOTO

Gold traded in a tight range on Monday as strong U.S. economic data fuelled investors' appetite for riskier assets and dented the metal's safe-haven appeal.

FUNDAMENTALS

Spot gold ticked up 0.1% to $1,558.47 per ounce by 0134 GMT, after a near 0.4% drop last week. U.S. gold futures were down 0.1% to $1,558.10.

Asian stocks surged close to a 20-month high, supported by an extended rally in global stocks on Wall Street and solid U.S. economic data.

U.S. homebuilding surged to a 13-year high last month as activity increased across the board, while production at factories increased for a second straight month, data showed on Friday.

U.S. President Donald Trump sought on Sunday to assure American farmers and ranchers hit by a protracted tariff war with China that a trade agreement he signed with Beijing will lead to major purchases of U.S. agricultural products.

Chinese Vice Premier Liu He said Beijing and Washington signing the Phase 1 deal had created a beneficial condition for future Sino-U.S. relations, according to a state media Xinhua report.

hiladelphia Federal Reserve Bank President Patrick Harker said on Friday that a robust labour market was boosting consumer confidence and lifting the U.S. economy, despite headwinds such as a global slowdown and trade uncertainty.

The Turkish central bank said on Saturday it had decreased the upper limit of holding standard gold to 20% from 30% of lira reserve requirements in a move to support financial stability and bring out gold savings into the economy.

Speculators cut their bullish positions in COMEX gold contracts in the week to Jan. 14, data showed.

Holdings of the world's largest gold-backed exchange-traded fund SPDR Gold Trust rose 2.20% to 898.82 tonnes on Friday.

Physical gold purchases gathered steam ahead of the Lunar New Year celebrations in China and Singapore, while demand in India dwindled last week, encouraging retailers to offer more discounts.

Palladium was flat at $2,479.73 an ounce. The auto-catalyst metal hit a record high of $2,537.06 on Friday.

A squeeze in ready availability of automotive metal palladium has driven up already record-high prices by 25% in just two weeks, accelerating a four-year rally and stoking expectations for further gains, analysts said.

Silver edged higher by 0.2% to $18.03 per ounce, while platinum rose 0.6% to $1,023.55. DATA/EVENTS (GMT) 0700 Germany Producer prices MM, YY Dec -- Japan Bank of Japan holds monetary policy meeting (Reporting by Asha Sistla in Bengaluru; Editing by Subhranshu Sahu)

© Reuters News 2020