PHOTO

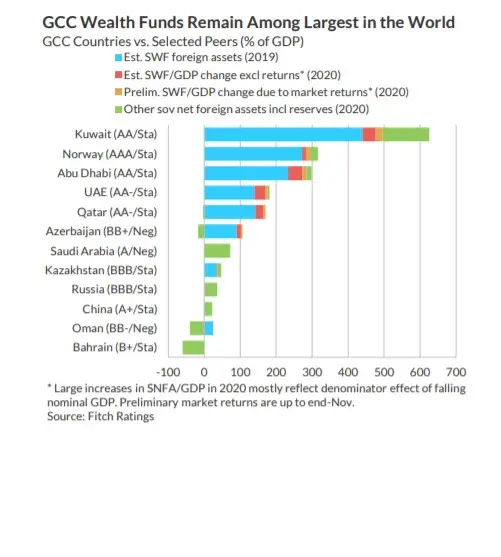

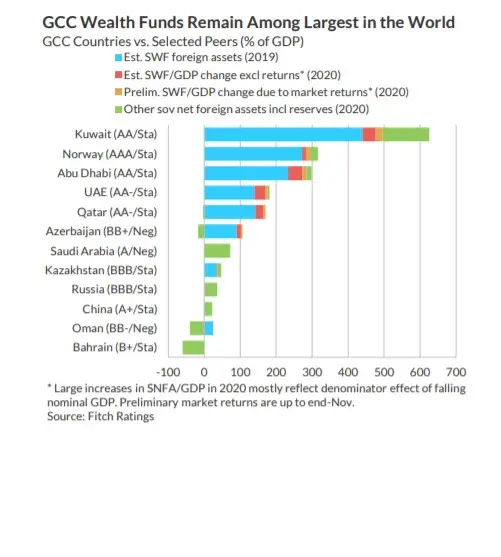

The sovereign wealth funds (SWFs) of Abu Dhabi, Kuwait and Qatar have underpinned the resilience of their sovereign ratings despite lower oil prices and the coronavirus shock, Fitch Ratings said.

The SWF assets of these countries could even increase in 2020 due to supportive market returns, despite governments using SWFs' foreign assets and other deposits to cover government funding needs in 2020.

The uplift to ratings from SWF assets has been stable or increasing despite materially larger fiscal and external deficits in 2020.

According to the global ratings agency, SWF assets in Abu Dhabi, the UAE, Kuwait and Qatar provide two to six notches of uplift to sovereign ratings by boosting sovereign net external asset positions, fiscal balances, and overall financing flexibility.

Estimated gross sovereign external assets of these countries are sufficient to cover five to eight years of total government spending and six to eight years of non-oil deficits.

"We estimate that SWF assets in Kuwait, Abu Dhabi and Qatar would remain sizeable in the medium term even under adverse oil market scenarios. All three countries stand to substantially deplete their SWF assets in the long term without some combination of recovery in oil prices, growth in production, fiscal adjustment and supportive financial market returns," Fitch said.

"Exceptionally strong balance sheets are necessary to support their ratings at current levels, given structural constraints, in particular, a lack of economic diversification. Erosion of fiscal and external balance sheets, for example, due to an inability to adjust to lower-for-longer oil prices, is a negative rating sensitivity for all GCC sovereigns," the ratings agency said.

(Writing by Seban Scaria ; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020