PHOTO

Global markets

Asian shares surged early on Monday, tracking gains on Wall Street on Friday as government data showed United States job growth accelerated in May and the unemployment rate dropped to an 18-year low of 3.8 percent.

On Wall Street on Friday, U.S. tech shares soared, pushing up the Nasdaq Composite 1.51 percent to 7,554, near its record closing high of 7,588 marked in March.

MSCI’s broadest index of Asia-Pacific shares outside Japan gained 1.0 percent to a high last seen on May 17, while Japan’s Nikkei rose 1.3 percent.

Middle East markets

In the Middle East, the Saudi stock market added 2 percent on Sunday after the weekend appointment of Ahmed bin Suleiman al-Rajhi as labour minister, a move widely welcome by the private sector.

Samba Financial Group and Al Rajhi Bank rose 4.7 percent and 5.2 percent respectively. The best performer was dairy firm Almarai, which jumped 8.5 percent.

In Dubai, the index gained 0.8 percent, lifted by a 2.1 percent surge by blue-chip Emaar Properties and a 2.8 percent gain by Dubai Islamic Bank.

According to a monthly Reuters poll of leading Middle East fund managers published on Thursday, sentiment is shifting in favour of United Arab Emirates equities.

In Abu Dhabi, the index shed 0.9 percent, with TAQA plunging 8 percent in thin trading. The stock has been volatile after soaring earlier this year on rising oil prices.

Real estate firms Aldar Properties and RAK Properties were down 0.5 percent and 1.5 percent respectively.

In Qatar, the index climbed 0.6 percent, lifted by Qatar Gas Transport, which jumped 7.5 percent.

Egypt’s index gained 1.6 percent, Oman’s index lost 0.1 percent, while Kuwait’s index lost 0.4 percent and Bahrain’s index was flat.

Oil prices

Oil prices were mixed early on Monday. Brent crude oil futures dropped as U.S. crude production rose in March to 10.47 million barrels per day (bpd), a monthly record, the Energy Information Administration said on Thursday.

Global benchmark Brent LCOc1 was down 12 cents, or 0.16 percent, at $76.67 a barrel by 0159 GMT.

U.S. West Texas Intermediate (WTI) crude futures gained 6 cents, or 0.09 percent, to $65.87 a barrel. Last week, the market lost around 3 percent, adding to a near-5 percent decline from the prior week.

“We are going into summer, the high demand season, and I think we are going to see a fall in U.S. crude oil inventories, but shale oil output is growing. Which one is going to win is the issue,” Tony Nunan, oil risk manager at Mitsubishi Corp in Tokyo told Reuters.

Currencies

The dollar was supported early on Monday as expectations of a U.S. rate hike this month offset from trade war worries.

The U.S. currency traded at 109.50 yen, having gained 0.6 percent on Friday

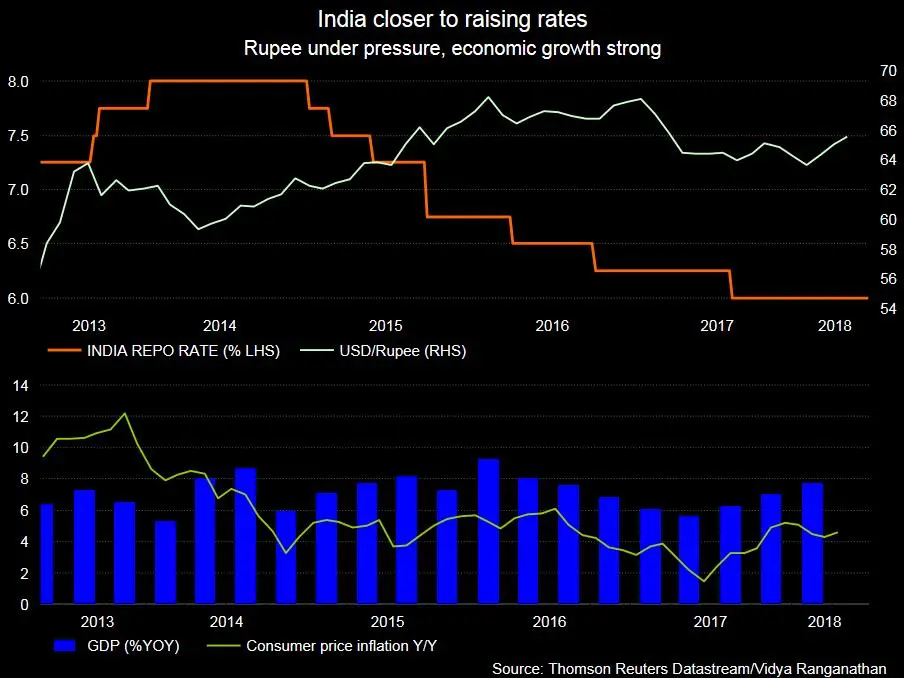

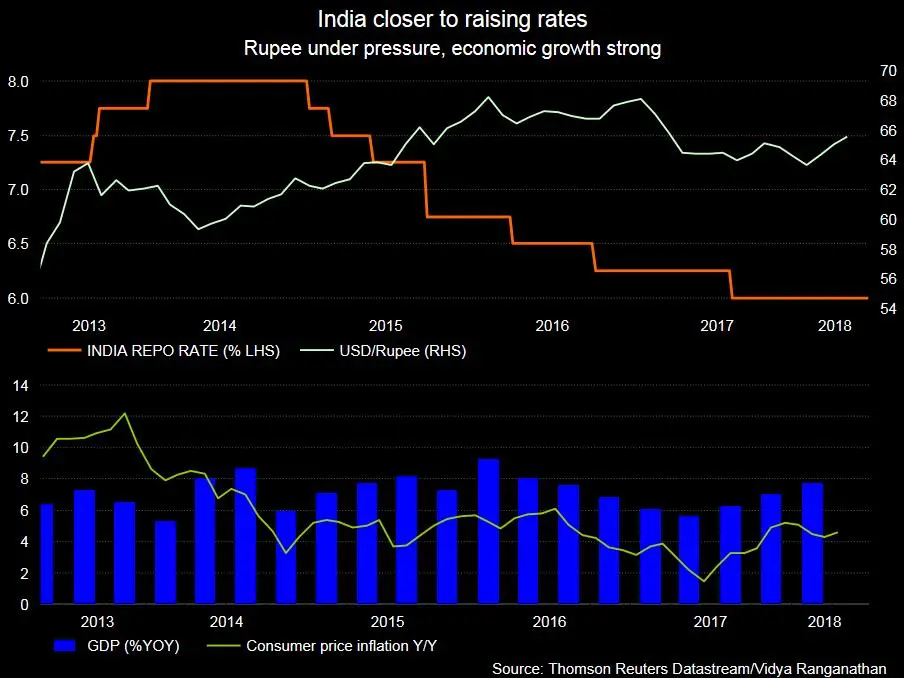

Commentary: The Indian central bank could deliver its first interest rate hike in nearly four-and-a-half years on Wednesday.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Precious metals

Spot gold was nearly unchanged early on Monday at $1,292.96 per ounce by 0340 GMT, after hitting its lowest since May 23 at $1,289.12 in the previous session.

(Writing Gerard Aoun; Editing by Michael Fahy)

(gerard.aoun@thomsonreuters.com)

A new version of the Trading Middle East newsletter is being launched on June 27, 2018. To keep receiving the newsletter after this date, please subscribe using this link.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018