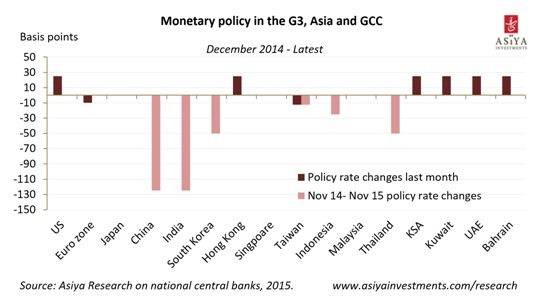

While the GCC will follow the US by increasing rates, Asia's fate is less certain.

After seven years of ultra-loose monetary policy, the United States increased interest rates this month. The easing cycle started in mid-2007 when the benchmark rate was lowered from 5.25% to 4.75% in a context of financial instability and tightening credit conditions until reaching 0.25%. Since then, macroeconomic conditions have improved markedly: real GDP has been growing consistently above 2% YoY in the last year and a half, the unemployment rate fell from 10% in 2010 to 5% this year and wage growth has stabilized at more than 4% YoY in the last two years. Nevertheless, the American economy still faces substantial threats, mainly on the external front as global demand remains fragile and the USD strengthens. These headwinds, together with low inflation and the Federal Reserve's prudent approach towards tightening, suggest that rate increases will be gradual and that policy will remain relatively loose for the time being.

Interest rate changes in the US matter to emerging markets. In Asia, the majority of currencies are under floating regimes, hence not pegged to the USD. These currencies are likely to experience downwards pressure when the Federal Reserve hikes interest rates. USD-denominated assets become more attractive with respect to their equivalents in Asia due to higher returns, resulting in money outflows and depreciation of the currencies. Asian central banks can try to offset the effects of US monetary policy by raising interest rates, but this would squeeze growth and potentially fuel deflationary expectations in a region already facing a deceleration and disinflationary trends. The US hiking cycle under Alan Greenspan in the mid-1990s' caused massive outflows from Asia, but the region's macroeconomic conditions are substantially better: the current account is in surplus (+4% vs. -2% of GDP), external short term debt halved from around 30% of GDP, currencies are not pegged and reserves more than doubled to 140% of GDP. Overall, the effect of the gradual US tightening cycle on Asian monetary policy will not be as considerable as in 1997.

The currency framework in the GCC is radically different than in most Asian countries. Gulf currencies are pegged to the USD, with either a nominal anchor or a softer peg to a basket of currencies such as in Kuwait. A peg implies a loss of policy independence: follow the policy rates of the reference currency or risk capital outflows. In fact, Gulf countries have already adapted to the new situation. For instance, the Saudi Arabian Monetary Agency (SAMA) already hiked its reverse repo rate by 25 basis points to 0.5% and Kuwait, UAE and Bahrain also reacted to the Fed's decision. At the same time, the GCC is highly exposed to the deteriorating energy market, which accounts for half of the economy and 85% of public revenue. The combination of low oil prices and tighter credit conditions could be the perfect storm for the GCC. Apart from the downside risk on growth, the whole currency system could face substantial pressure if current conditions persist as the Gulf continues to spend from its reserves.

Emerging markets are split between two magnetic poles. The first element is the gradual tightening of US monetary policy, which will add pressure on US-pegged countries to raise interest rates. The other element is the ultra-loose policies of the European and Japanese central banks, which are hurting emerging markets' competitiveness. Today, monetary policy trends in main economies diverge. Despite low oil prices, the GCC will maintain its peg with the US and gradually increase interest rates. In Asia, given the current economic dynamics, Asian central banks will attempt to track more closely European and Japanese monetary policy - to the extent it is possible.

- Ends

IMPORTANT DISCLAIMER: The information contained in this report is prepared by the Research Department of the Asiya Capital Investments Company and is believed to be reliable, but its accuracy and completeness are not warranted. Research recommendations do not constitute financial advice nor extend offers to participate in any specific investment on any particular terms. Investors should consider this material as only a single factor in making their decisions.

About Asiya Capital Investments Company:

Asiya Capital Investments Company is an investment company founded by an Emiree Decree with a capital of KD 80 million and a mandate to invest in domestic demand-driven sectors in Asia, namely energy, real estate, healthcare, infrastructure, and financial services. Asiya Capital Investments Company is the Parent Company of a Group that includes Asiya Investments Dubai Limited and Asiya Investments Hong Kong Limited. Asiya Investments Dubai Limited serves as the investment advisory hub for Asiya Capital Investments Company. Asiya Investments Hong Kong Limited is fully equipped with a skillful and experienced investment team which has further demonstrated Asiya Capital Investments Company's commitment to the Asian markets. The publicly-listed Group employs a team of Asia specialists and currently manages assets in excess of a billion. Key shareholders include the Kuwait Investment Authority (Kuwait's Sovereign Wealth Fund), National Investments Company (one of the leading investment banks in the Middle East), and Alghanim Industries (one of the largest conglomerates in the Middle East).

Reporters may contact:

Yasmeen Al Shammeri

Bensirri PR

+965 97274488

y.alshammeri@bensirri.com

© Press Release 2015