PHOTO

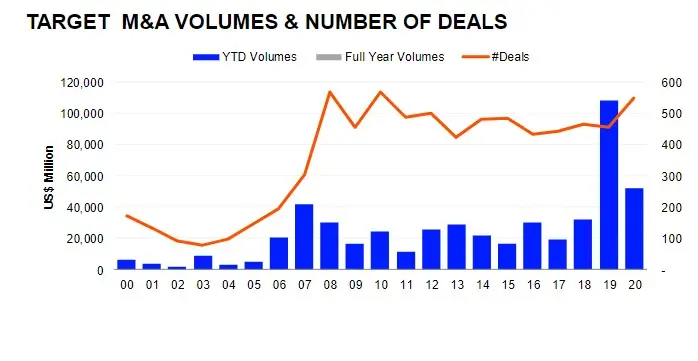

The value of announced M&A transactions with any MENA involvement reached $70.3 billion during 2020, according to global data provider Refinitiv.

This makes 2020 the fourth highest annual total of all time, despite falling 47 percent in value from the record high achieved in 2019 with Saudi Aramco’s agreement to buy a stake in Saudi Basic Industries Corporation (SABIC)

Aramco acquired 70 percent stake in SABIC from the Public Investment Fund (PIF), the sovereign wealth fund of Saudi Arabia, for a total purchase price of SAR 259.125 billion ($ 69.1 billion), equating to SAR 123.39 price per share.

According to Refinitiv data, $52.0 billion worth of target M&A deals were announced from 550 deals, making it the second-highest year in deal value.

Inbound M&A in MENA saw a record year of $24.1 billion in deal volume and 260 deals announced, a 41 percent increase in deal volume and 64 percent increase in number of deals from 2019.

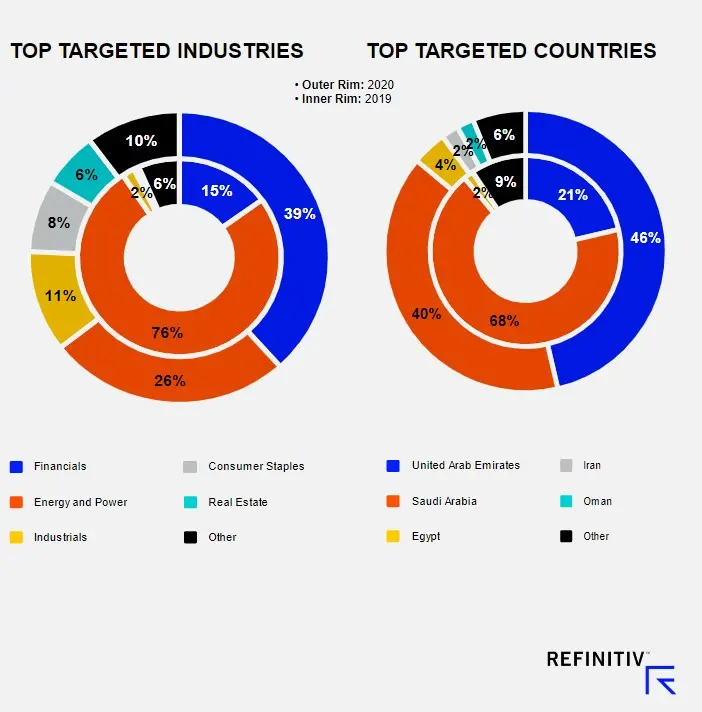

The financial sector was most active in 2020, with deals targeting financial companies accounting for 39 percent of total M&A in MENA, followed by Energy & Power with 26 percent.

The UAE was the most targeted nation, followed by Saudi Arabia and Egypt. Morgan Stanley topped the any MENA involvement announced M&A financial advisor league table with 37 percent market share and MENA Target M&A league table with 49 percent market share in 2020.

(Reporting by Seban Scaria; editing by Anoop Menon)

seban.scaria@refinitiv.com

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021