PHOTO

Business conditions in Lebanon deteriorated at the end of the second quarter as both output and new orders fell at faster rates, leading to a drop in staffing levels, a business survey showed.

According to firms, poor cash availability, economic instability and a weakening exchange rate were key factors driving the stronger decline in operating conditions.

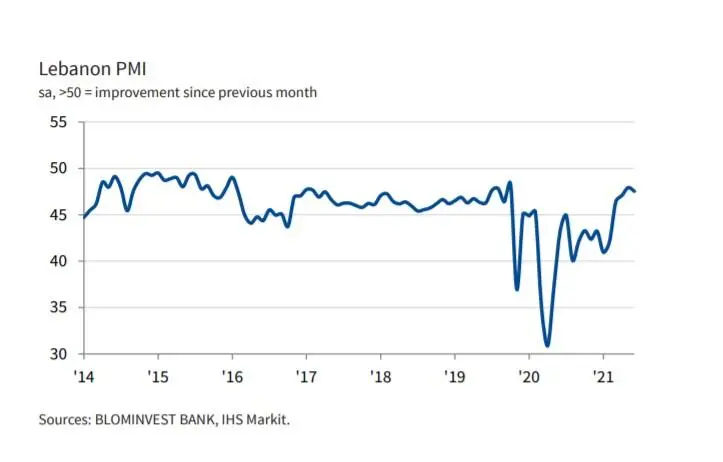

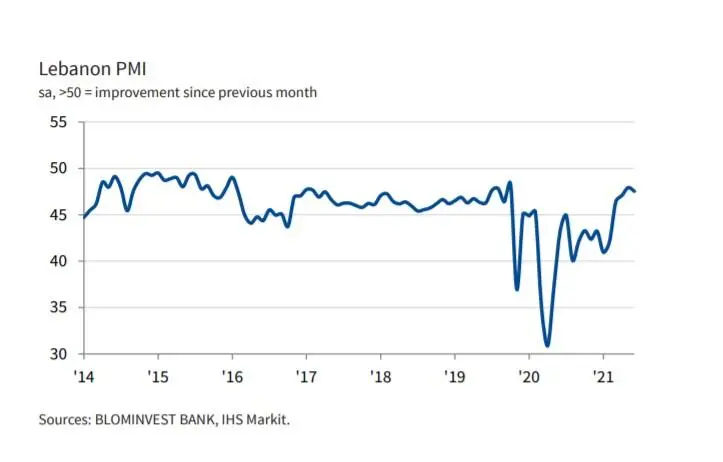

The IHS Markit Purchasing Managers’ Index (PMI), a composite indicator designed to give an overview of operating conditions in the non-oil private sector economy, fell to 47.5 in June, down from May's 19-month high of 47.9, to signal a faster deterioration in the health of Lebanon's private sector economy.

Tala Nasrallah, Senior Research Analyst at BLOM Bank, said: “For the month of June, BLOM Lebanon PMI recorded a decline since last month reaching 47.5, reflecting the deterioration in business conditions and in output demand from international clients. For the second quarter of 2021, the country witnessed a continuous drop in purchasing power; notably a higher cost of imports following the weakening of the Lebanese pound in the parallel market."

"This also resulted in reduced business volumes over the month of June, highest in three months, and a fall in private sector employment rate. As such, many local firms remain discouraged, expecting lower output volumes for the next 12 months as they face shortage in liquidity, difficulty in obtaining credit and a reduction in purchasing activity," he added.

According to survey respondents, weak purchasing power due to the deteriorating value of the local currency adversely impacted sales, leading to reduced business activity.

Meanwhile, volumes of new business from abroad, which stabilised during May, decreased at the fastest pace in four months in June. "Anecdotal evidence indicated that political and economic instability curtailed demand from international clients," the report said.

"The results show the need for bringing back political and economic stability and for forming a new government to expedite growth-enhancing reforms in the near future. But, unfortunately, this does not seem to be likely at present,” Nasrallah said.

(Writing by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021