PHOTO

Europe may no longer be a favourite investment destination for the Middle East sovereign wealth funds. Instead, investors are increasingly training their sights on Asia, mainly China.

As the political uncertainty triggered by Brexit continues to plague Europe, some 88 per cent of investors from the Middle East have exposure to China, versus 73 per cent for all investors globally, according to Invesco’s latest Global Sovereign Asset Management Study.

Slowing economic growth and perceptions of rising political risk have led to a decline in the attractiveness of major European economies. The report said that Brexit is now influencing asset allocation decisions for 64 per cent of all sovereigns, and this is higher in the Middle East, at 78 percent.

The result is that Europe has fallen out of favour, with half of sovereign investors in the Middle East decreasing allocations to Europe in 2018 and a similar number planning further decreases in 2019.

This year, only 13 per cent of global sovereigns plan on increasing allocations to Europe, compared to a 40 per cent allocation to Asia and 36 per cent to emerging markets.

“We are observing an interesting shift in terms of both geographic and sector allocation from the Middle East,” Josette Rizk, client director of Institutional Sales, Invesco Middle East and Africa, said.

“The need to balance global exposure is leading many regional investors to explore opportunities in emerging markets and Asia, especially due to the attractive emerging market fundamentals and valuations.”

The annual report is based on interviews with 139 sovereign investors and central bank reserve managers with $20.3 trillion in assets, found bonds had overtaken equities to become the biggest asset class in portfolios, averaging 33 percent. This is up from 30 percent in 2018.

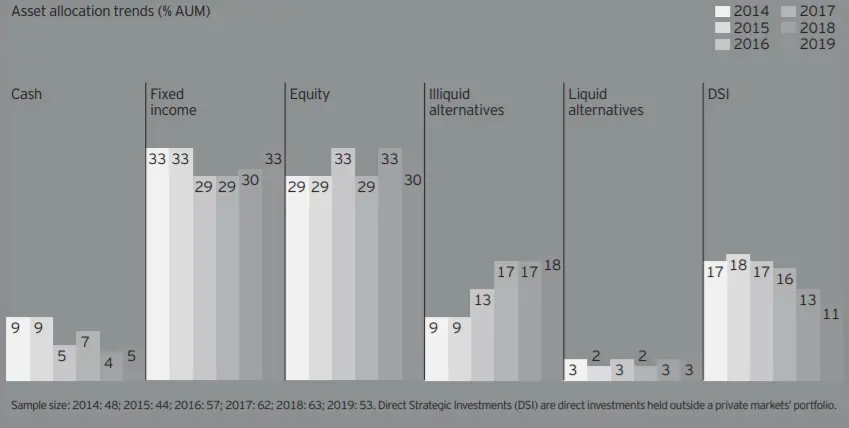

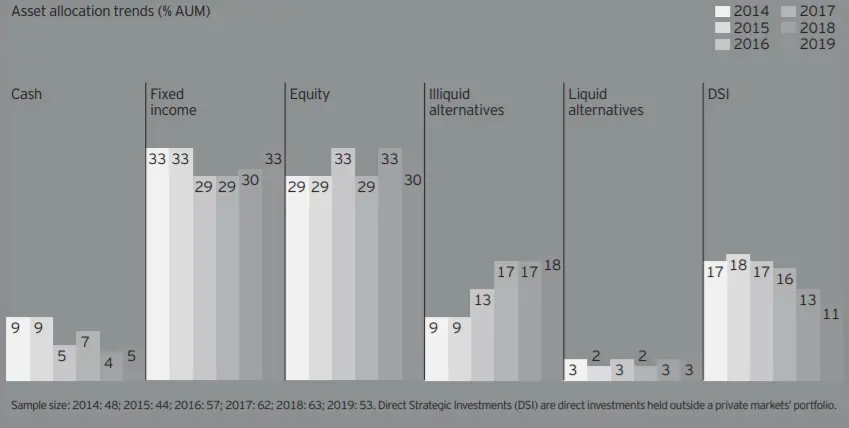

Asset allocation

Allocations to fixed income increased to 33 percent in 2019, becoming sovereigns’ largest asset class.

However, in the Middle East, allocations to illiquid alternatives was particularly prominent with 75 percent increasing allocations to infrastructure, 63 percent to private equity and 38 percent to real estate.

The region is particularly exposed to global economic cycles due to a reliance on oil revenues and therefore has even greater incentive to invest in such assets for diversification.

Leading in tech investments

Sovereigns in the Middle East recognize technology as a large and broad-based investment opportunity, with 89 per cent of Middle East sovereigns having a dedicated technology portfolio or team, compared with 48 percent globally.

Given the dominance of tech companies in terms of contribution to equity returns and economic development over the last few years, it is no surprise that 75 percent of the Middle East respondents cited enhancing investment returns as the most important reason for placing emphasis on the sector.

“Another interesting trend we have observed is that technology and innovation is becoming an important part of their overall portfolio," Rizk said, adding, "This is primarily driven by attractive returns that tech companies offer and is also aligned with the agendas of many of the regional governments, particularly of the UAE and Saudi Arabia, who want to ultimately develop a knowledge economy to drive economic development in their countries.”

According to the report, Middle East sovereigns have been leaders in utilizing technology investments for the benefit of domestic society. For instance, in 2015, the UAE announced an $80 billion investment plan in the Emirates Science Technology and Innovation Higher Policy, and Saudi Arabia has made technological innovation central to its Vision 2030.

Hundred percent of the respondents in the Middle East have implemented technology innovation in the investment strategy space in the last 12 months, in areas such as risk management, monitoring and artificial intelligence, the report said.

Spotlight on ESG

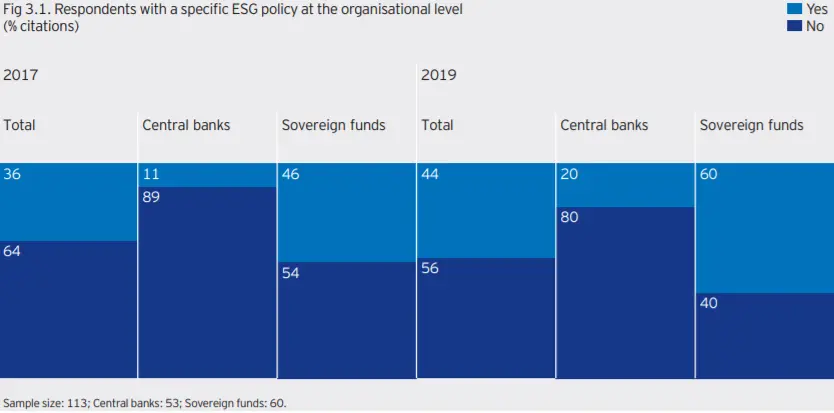

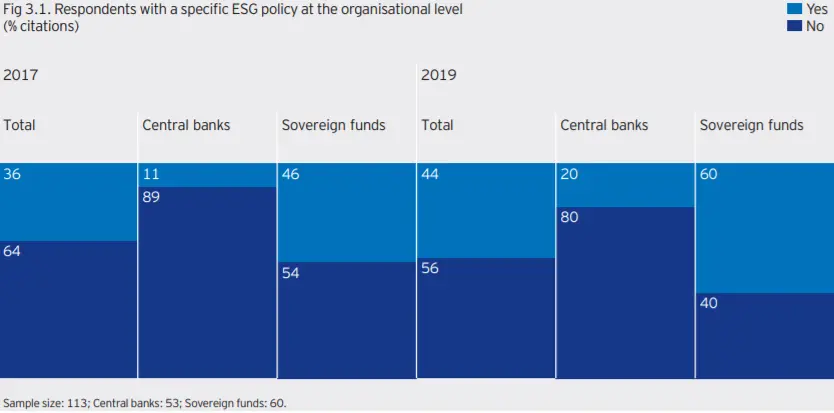

Environmental, Social and Governance (ESG) adoption continues to gain traction amongst both sovereigns and central banks as it becomes clearer how to derive value from its application.

Since 2017, the percentage of sovereigns with a specific ESG policy rose from 46 percent to 60 percent. Twenty percent of Central Banks now have an ESG policy, compared to 11 percent in 2017.

In the Middle East, 67 percent of sovereigns have an ESG policy, ahead of the global average (60 percent) but behind sovereigns based in the West (76 percent).

According to Rizk the conversation around ESG or responsible investing has picked up momentum.

"Much of this has been driven by large institutional investors in the region, and in particular by the sovereign wealth funds, notably on core themes that have an impact on sustainability and the signing of the One Planet Initiative,” she said.

There has also been a shift in focus of the nature of ESG activity.

While asset owners have, in the past, focused on issues of governance due to clearer risk and return benefits, these factors are now often assumed by ESG adopters. For sovereigns, environmental concerns are increasingly becoming the lead focus, with carbon emissions and climate change the single most important ESG issue, the Invesco report said.

(Writing by Seban Scaria; editing by Daniel Luiz)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019