PHOTO

ROME- The Italian government has given Abu Dhabi's biggest sovereign fund a conditional green light to invest in Telecom Italia's (TIM) last-mile network, three sources close to the matter told Reuters on Monday.

The planned sale would give Abu Dhabi an indirect 10.3% stake in TIM's last-mile grid in a deal worth about 500 million euros ($608 million), a fourth source said.

The Italian government has the power to block unwanted bids in industries deemed of strategic importance, such as telecoms, banking and health.

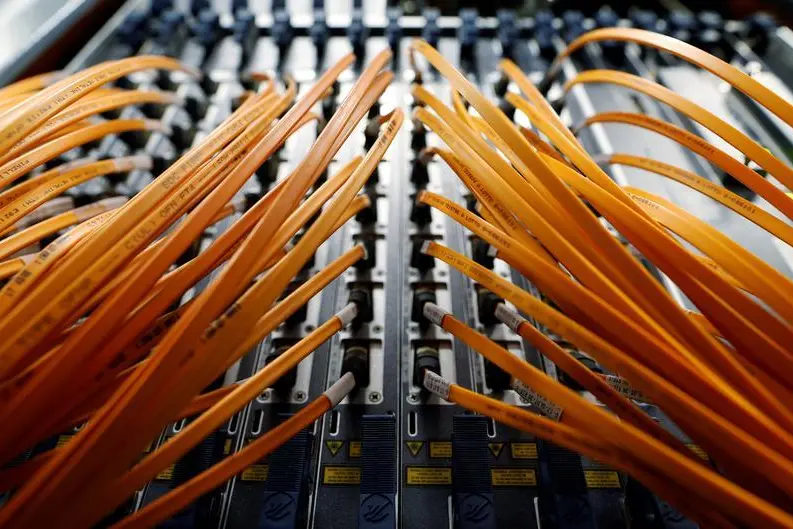

TIM agreed in August to sell to U.S. investment firm KKR 37.5% of a newly created company, FiberCop, into which the telecoms firm is transferring its "last-mile" network, which links so-called street cabinets to individual homes.

Rome gave its green light to the deal in November.

Following the first clearance, KKR informed the government of its intention to sell up to 30% of the unit that will hold its FiberCop stake to Infinity Investments, a subsidiary of the Abu Dhabi Investment Authority (ADIA).

The cabinet approved the deal with conditions on Dec. 10, said the sources, who asked not to be named because of the sensitivity of the matter.

It was not immediately clear what the conditions were.

The Italian prime minister's office, ADIA and KKR all declined to comment. ($1 = 0.8229 euros)

(Reporting by Giuseppe Fonte in Rome and Elvira Pollina in Milan; Additional reporting by Davide Barbuscia in Dubai; Editing by David Clarke) ((giuseppe.fonte@thomsonreuters.com; +390680307711;))